HIGHLIGHTS

Local Markets

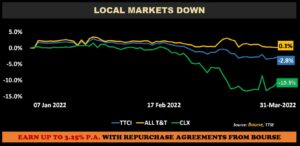

- Q1 2022 Performance:

- TTCI ↓ 2.8%

- All T&T ↑ 0.1%

- CLX ↓ 10.3%

- Performance Drivers:

- Inflationary Pressures

- Volatile Financial Markets

- Outlook:

- Economic Normalization

International Markets

- Q1 2022 Performance:

- US Markets – S&P 500 ↓ 4.9 %

- European Markets- Euro Stoxx 50 ↓ 5.4%

- Asian Markets – MXASJ ↓ 6.1%

- Latin American Markets – MSCI EM ↑ 26.1%

- Performance Drivers:

- Geopolitical Tensions

- Inflationary Pressures

- Outlook:

- Economic Normalization

- Global Supply Constraints

This week, we at Bourse recap the performance of local and international stock markets for the first quarter of 2022. Equity markets confronted a turbulent few months with rising geopolitical tensions, surging energy prices and climbing inflation all weighing on investor confidence. What might investors face in the months ahead? We discuss below.

Local Markets Lower

The Cross Listed Index (CLX), comprising some of the largest publicly-listed regional companies, led the declines among the three major indices, slipping 10.3%, as movements of index heavy weight NCBFG (↓20.0%) and GHL ( ↓8.7%) dragged market performance down. The All Trinidad and Tobago Index (All T&T) was up marginally by 0.1% for Q1 2022. Resultantly, the Trinidad and Tobago Composite Index (TTCI) fell 2.8% to close at 1,455.18. JMMB Group Limited and GraceKennedy Limited were the volume leaders on the First Tier Market for Q1 2022, with 17.9M and 6.4M shares being traded respectively.

Major Movers

Agostini’s Limited (AGL) advanced 42.2%, boosted by positive earnings momentum, improving margins and acquisition activity. The Group captured synergies with its recent acquisitions of Smith Robinson, Oscar Francois and Intersol Limited. Canadian-owned Banking giant, Scotiabank Trinidad and Tobago Limited (SBTT), was up 17.1% for the first-quarter on account of higher revenues, lower impairment losses and Non-Interest Expenses. The Bank continues to attract investor interest with consistent dividend payments.

MASSY Holdings Limited (MASSY) appreciated 10.9% during the quarter, fuelled by excitement around its cross-listing onto the Jamaican Stock Exchange (JSE) on January 27th, 2022 and a 20-for-one stock split which was effective on March 11th, 2022. Angostura Holdings Limited (AHL) increased 12.3% for Q1 2022, as demand for its branded products in international markets strengthened coupled with new product launches and marketing campaigns. Rounding out the top 5 major advancers, Point Lisas Industrial Port Development Corporation (PLD) gained 11.1% for the first-quarter of 2022.

Major decliners for Q1 2022 included NCB Financial Group Limited (NCBFG ↓ 20.0%), West Indian Tobacco Company Limited (WCO, ↓ 15.8%), First Citizens Group Financial Holdings (FCGFH ↓14.9%), National Enterprises Limited (NEL↓10.4%) and Guardian Holdings Limited (GHL ↓ 8.7%).

US Markets Lower

US stocks, as gauged by the S&P 500 Index, contracted 4.9% at the end of Q1 2022. After keeping its benchmark interest rates anchored near zero since the onset of the pandemic, the Federal Reserve increased the target federal funds rate by 0.25% in an effort to combat inflation while allowing the economy to continue to expand. Fed officials have indicated an aggressive path ahead for interest rates, with possible rate increases coming at each of the remaining six meetings in 2022. With inflationary pressures of an already challenged global supply chain compounded by the fallout between the US, Western Europe and Russia over the Ukraine invasion, it is increasingly likely that the communicated path of rate hikes will be maintained to curb rising price pressures.

The Energy Select Sector SPDR Fund (XLE) advanced 37.7% in Q1 2022 and continues to be the strongest performing sector (2021: up 46.1%), driven by higher oil prices and energy supply shocks spurred by the Ukraine war. The Communication Services Select Sector SPDR Fund (XLC) rounded out Q1 2022 as the worst-performing sector, down 11.5%.

International Markets Contract

European equities also contracted in Q1 2022, reflecting the widening pullback across global equity markets. Despite an accommodative stance by the European Central Bank; persistent inflation, worsening supply chains and geopolitical tensions placed downward pressure on the benchmark as European markets as measured by the Euro Stoxx 50 fell 5.4%. The UK’s FTSE 100 recorded the ‘best’ performance (down 1.2%), followed by Spain’s IBEX 35 (down 5.7%). Italy and Germany were among the worst-performing markets in the region, falling 10.9% and 12.0% respectively when compared to the prior period.

Asian Equities dipped this quarter as the Russia-Ukraine war enters its second month and markets continue to weigh economic downturn from policy tightening.

China’s market led the losses for the quarter, down 10.4%, as global investors’ funds have exited largely on account of regulatory actions by the US on US-listed Chinese stocks. Sentiment would have been further dampened by a hawkish US Federal Reserve and the impact of Russia’s invasion of Ukraine on global supply chains. China has also been affected by the resurgence of Covid-19 cases (Omicron BA.2 sub-variant), as the city of Shanghai, the country’s financial hub imposed a two-stage lockdown on Monday 28th March, 2022 for a Covid-19 testing blitz over nine days. The announcement placed a dent on the global demand for energy which sent global crude prices down. China is a major net energy importer- 11M barrels of oil per day.

Asian Equity markets (excluding Japan) declined 6.1% in Q1 2022 compared to a gain of 2.3% in Q1 2021. South Korea equities declined 9.4% in Q1 2022, while the Hang Seng Index in Hong Kong tumbled 6.4%. The fragil’ geopolitical environment has slowed trading volumes and initial public offerings on the Hong Kong stock exchange and created challenges for its commodities business, especially Nickel. Other headwinds faced were the tightening regulatory environment for tech and platform companies and concerns about persistent global inflation.

India equities dropped 1.4% in the quarter under review relative to a 3.5% gain in Q1 2021, as inflationary woes over elevated commodity prices weighed markets down and placed pressure on the Indian Rupee. Annual inflation rate in India accelerated for a 5th straight month to 6.1% in February 2022, the highest since June 2021, and above market forecasts of 5.9%. Taiwan markets decelerated 6.0% compared to an appreciation of 10.1% in the year-ago quarter.

Latin American Markets stood out in Q1 2022, rebounding 26.1% (Q1 2021: down 6.1%) while every other regional sub index of developed and emerging markets declined. Brazil, Latin America’s largest economy, advanced 34.6% (Q1 2021: down 9.6%) as the country was well-positioned to benefit from soaring commodity prices which led to an 11.0% appreciation of the Brazilian Real. Chile, Peru and Colombia all showed resilience with double digit gains while Mexico recorded the smallest market gain across the region, up 9.7% relative to 4.3% in the prior comparable period.

Outlook

Russia’s invasion of Ukraine has brought renewed economic uncertainty; roiling global supply chains and providing a fresh driver for already soaring energy costs. Select domestic companies have already responded to accelerating price pressures, passing on higher input costs to consumers to keep margins stable. According to the Central Bank of Trinidad and Tobago, headline inflation rose to 3.8% in January 2022 from 3.6% in November 2021.

The announcement of the removal of safe zone operations and limits on public gatherings from April 4th is expected to bode well for a stronger economic recovery for Trinidad and Tobago in 2022. The impending removal of travel restrictions for foreigners should also aid the recovery of the tourism and hospitality sector, once implemented.

In its most recent country report for Trinidad and Tobago, the IMF expects real GDP growth of 5.5%, reinforced by continued policy support and a recovery in oil and gas production. Shell’s announcement of first gas at its Colibri project was welcomed news, as the project is expected to add approximately 174 mmscf/d of natural gas production, with peak production expected to be 250 mmscf/d.

International Markets are expected to remain volatile heading into the second quarter of 2022 as concerns linger about slowing economic growth, elevated commodity prices and increased fears of a looming recession. There appears to be no near-term conclusion of geopolitical tensions, which could prolong disruptions to commodity markets and keep investor sentiment muted.

Notwithstanding the tenuous macroeconomic environment, investors should still be able to find pockets of opportunity locally and internationally and should consider mutual funds and/or equity index exchange trade funds (ETFs) to gain broader market exposure while diversifying risk. Investors should also review their portfolio periodically and consult a trusted and experienced advisor, such as Bourse, to make better informed decisions.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”