HIGHLIGHTS

AMBL FY 2021

- Earnings: EPS up 89.4% from $1.89 to TT$ 3.58

- Performance Drivers:

- Robust Financial Markets

- Strong Segment Performance

- Outlook:

- Acquisition activity to drive growth

- Volatile Financial Markets

- Rating: Assigned at MARKETWEIGHT.

SFC FY 2021

- Earnings: EPS up 3,879.2% from a Loss of US$0.02 to Earnings Per Share of US$0.91

- Performance Drivers:

- Higher Net Premium Revenue

- Outlook:

- Volatile Financial Markets

- Rating: Assigned at MARKETWEIGHT.

This week, we at Bourse review the financial performance of ANSA Merchant Bank Limited (AMBL) and now Canadian-listed Sagicor Financial Company Limited (SFC) for the financial year ended December 31st, 2021. Both entities would have benefitted from a robust recovery in financial markets in FY2021. Could positive earnings momentum continue for both groups in the year ahead? We discuss below.

ANSA Merchant Bank Limited (AMBL)

AMBL reported an Earnings per Share (EPS) of $3.58 for the financial year ended 31st December 2021 (FY2021), up 89.4% relative to $1.89 in the prior year. Net Insurance Revenue increased 2.2% to $427.5M in FY2021. Finance Charges, Loan Fees and Other Interest Income advanced 20.6% to stand at $184.5M. Investment Income expanded a noteworthy 132.2%, attributable to favourable investment valuation movements from the recovery in local and international equity markets. Revenue from contracts with customers amounted to $11.9M (79.6% higher), while Other Income contracted 5.1% to $155.4M. Total Operating Expenses increased 9.2%, leading to a Net Operating Income of $691.3M, 44.5% higher year-on-year. AMBL’s Total Selling and Administrative Expenses increased 21.0% in FY2021, taking it to $331.2M from a previous $273.7M. Overall, AMBL recorded an 89.0% increase in Profit Attributable to Shareholders, from $162.0M to $306.2M in FY2021.

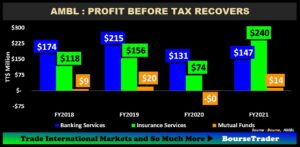

PBT Recovers

AMBL’s Insurance Services segment emerged as the largest profit generating segment in FY2021 (40.7% towards PBT), advancing 224.3% YoY on account of robust financial markets. Life Insurance Operations, which contributed $157.6M ($1.8M, FY2020), showed strong recovery amid increased demand for the AMBL’s offerings. General Insurance Operations, which accounted for $82.5M ($71.7M, FY2020) improved 15.1% over the period. The agreement to acquire 94.2% of Colonial Fire & General Insurance Company Limited (Colfire), pending final approval, should be accretive to earnings for this segment in subsequent periods.

The Banking Services segment (36.6% of PBT) increased 12.2% from $130.8M to $146.6M. According to AMBL, the Bank’s recent acquisition of Bank of Baroda, now rebranded as Ansa Bank has already delivered ‘significant loan growth’ and is expected to yield further growth for the company going forward.

The Mutual Funds segment reported PBT during the period of $14.0M compared to a loss of $0.1M in FY2020. Operating Income in the segment increased 57.5% from $27.7M to $43.6M, likely driven by increased investment income and improved unrealized gains on investments designated at fair value through its statement of income. Operating Expenses remained relatively unchanged.

AMBL posted an EPS of $3.58 in FY 2021, up 89.4% from $1.89 in the previous year, reflecting improved profitability and favorable markets. The fall in the EPS in FY 2020 was primarily linked to the market fallout from the Pandemic. With the recovery in earnings, the Group’s Price-to-Earnings (P/E) multiple has adjusted from a lofty 21.1 times in FY 2020 to 11.5 times in FY 2021.

Acquisitions Drive Growth

AMBL continues to grow profitability through organic and acquisition activity, reflected by the 17.9% increase year-on-year in its asset base. In 2021, its subsidiary T&T Insurance Ltd (TATIL) entered into an agreement to acquire 94.2% of Colonial Fire & General Insurance Company Limited (COLFIRE), subject to regulatory approvals in 2022. In March 2021, AMBL made the move into commercial banking with its acquisition of the Bank of Baroda and rebranded as Ansa Bank Ltd. The group continues to better position itself as an even more well-rounded financial services provider.

The Bourse View

AMBL is currently priced at $41.00 and trades at a price to earnings ratio of 11.5 times relative to the Non-Banking sector average of 7.7 times. The stock currently offers investors a trailing dividend yield of 2.9%, above the sector average of 2.0%. The Bank Group recommended a final dividend of $1.00 per share with a record date of 9th May, 2022 and payment date on 26th May, 2022. The recent and ongoing acquisitions provide credible avenues for growth going forward. On the basis of acquisition activity, but tempered by currently volatile financial markets, Bourse assigns a MARKETWEIGHT rating to AMBL.

Sagicor Financial Company Limited

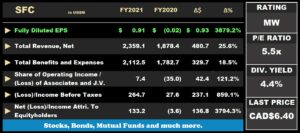

Sagicor Financial Company Limited (SFC) reported a Fully Diluted Earnings Per Share in FY2021 of US$0.91 relative to a Loss Per Share of US$0.024 in FY2020.

The Group expanded its Net Premium Revenue by 22.1% to US$1.7B in FY2021. Income generated by investments and assets gained 7.2% year-on-year, attributable to improvements in regional equity markets. SFC’s performance benefitted from reversals of credit impairment losses for the year ended December 31, 2021, totaling US$4.3M, compared to impairment losses of US$24.0 million, for the corresponding FY 2020 period. Ultimately, Total Revenue stood at US $2.35B for FY 2021, an increase of US$480.7M (25.6%) from US$1.88B reported for the same period in 2020. Total Benefits in the year grew 25.4%, propelled by increases in annuity and life insurance benefits. Total Expenses, increased 3.6% in FY 2021, as the re-opening of the tourism sector and consequent increases in occupancy levels drove hotel expenses and the implementation of IFRS 17, contributed to higher costs as well. Share of Operating Income of Associates and Joint Ventures stood at US$7.4M in the current period. Overall, Income Before Taxes moved to US$264.7M relative to US$27.6M in the prior year. Income Taxes for the year equated to a cost of US$68.3M, leading to a Net Income for the Year of US$196.5M compared to a Net Loss of US$15.1M reported in the prior year. Net Income Attributable to Equity Holders expanded by US$136.8M from a Loss of US$3.6M to US$133.2 in FY 2021.

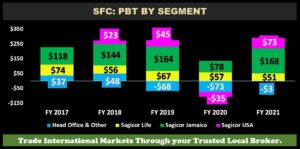

Operational Segments Advance

Sagicor Group Jamaica (SGJ), the largest contributor of the Group’s Income Before Tax, advanced 116.2% from US$78M in FY 2020 to US$168M in FY 2021, attributable to improved investment performance and strong new business growth. This segment generated total revenue of US$719 million for FY 2021, up 37.3% compared to US$632M for in the prior year. SGJ was aided by higher unrealized foreign exchange gains on assets denominated in foreign currency, coupled with increased fee income on its banking business.

Sagicor Life USA reported a Profit before Tax of US$73M relative to a loss of US$35M in the prior year, as the segment continued to grow its market share in the United States. Revenue was impacted positively, up 104.0%, driven by higher Multi-Year Guaranteed Annuity (MYGA) policy sales for the period.

Sagicor Life recorded a 11.3% decline in Income Before Tax moving to US$51M from a prior US$57M. Comprising of operations primarily in the Southern Caribbean region, Total Revenue generated by this segment was down 3.6% year-on-year. The segment’s annuity business declined by US$54.9M resulting in an overall decline in net premium revenue. Head Office and Other contributed a Net Loss from Continuing Operations of US$5M compared to a loss of US$73M in FY 2020.

Regional Revenue Mixed

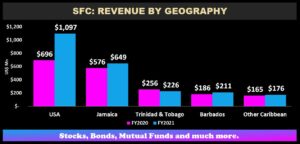

USA, SFC’s largest geographical segment by revenue (46.5%), advanced 57.6% YoY from US$696M to $1.1B attributable to increased annuity sales. SFC’s USA operations experienced a 65.3% increase in Net Assets, underpinned by strong business generation and a capital injection of US$125.0M. Despite economic headwinds. SFC USA plans to continue to optimize its investment portfolio and expand the breath of asset classes utilized to increase risk-adjusted returns.

Similarly, Jamaica, SFC’s second largest geographical segment (27.5% of revenue) expanded 12.7% from US$576M to US$649M. Strong business growth, recoveries in securities markets and substantially lower expected credit losses all served as tailwinds for the segment’s impressive performance.

Barbados and Other Caribbean territories showed resilience during the period, improving 13.4% and 6.7% respectively. Trinidad and Tobago stood out as the only geographical segment to record a contraction in revenue, down 11.7% YoY.

The Bourse View

Sagicor Financial Company Limited is currently priced at CAD$6.40 and trades at a Price to Earnings ratio of 5.5 times. The stock offers investors a trailing dividend yield of 4.4%. SFC’s largest operational markets, the United States and Jamaica, are expect to grow 4.0% and 4.3% in 2022 according to the latest IMF report. Additionally, performance in its other operating jurisdictions are expected to recover amid a broad-based recovery in economic activity. From a trading perspective, the intended price discovery of SFC’s stock by moving to a more developed market, like the Toronto Stock Exchange, has not yet borne fruit. On the basis of healthy dividends but tempered by volatile financial markets and generally muted investor interest, Bourse assigns a MARKETWEIGHT rating to SFC.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”