HIGHLIGHTS

Local Markets

- 2021 Performance:

- TTCI ↑ 13.2%

- All T&T ↑17.7%

- CLX ↑ 3.0%

- Performance Drivers:

- Gradual Sector Reopening

- Outlook:

- Inflation Challenges

- Economic Normalization

International Markets

- 2021 Performance:

- US Markets – S&P 500 ↑ 27.2%

- European Markets- Euro Stoxx 50 ↑12.3%

- Asian Markets – MXASJ ↓ 5.7%

- Latin American Markets – MSCI EM ↓ 13.7%

- Performance Drivers:

- Continuing Fiscal/Monetary Support

- Outlook:

- Economic Normalization

- Global Supply Constraints

We take this opportunity to wish you a very Happy New Year from the team at Bourse! This week, we recap the performance of local and international stock markets for 2021. Investors in equities largely rejoiced in 2021, despite soaring energy prices, supply chain challenges and the continuing impact of COVID-19 on the global economy. With value becoming harder to find, could the resilience of and optimism in stocks carry into 2022, or could markets be set for a breather? We discuss below.

Local Markets Advance

Local equities recovered ground lost in 2020, posting significant gains in 2021. The Trinidad and Tobago Composite Index (TTCI) advanced 13.2%, propelled by a rally in domestic equities. The All Trinidad and Tobago Index (All T&T) expanded 17.7% during the period, with investors appearing to view local stocks favourably. The Cross Listed Index (CLX) increased just 3.0%, with a 60.5% gain in GKC and 17.7% gain in JMMB offset by the movements of index heavy weights FCI (down 12.6%) and NCBFG (down 1.6%).

While the TTCI has marginally advanced to 1,497.6 as at December 30th 2021 relative to its 2019 closing level of 1,468.4 driven by major price increases of its component stocks, company earnings have not kept pace. As a result, valuations have been stretched across most sectors. This could signal investor confidence in the future growth prospects of these companies, as they anticipate corporate earnings catching up to valuations in the medium to long term.

Major Movers

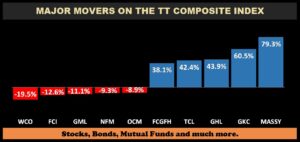

Two conglomerate sector members, Massy Holdings Limited (MASSY) and GraceKennedy Limited (GKC), led market gains in 2021. MASSY advanced 79.3%, supported by good results and catalyzed by excitement surrounding its proposed 20-for-1 stock split carded for March 11th, 2022 and pending cross-listing onto the Jamaican Stock Exchange (JSE) on January 27th, 2022. Cross-Listed Conglomerate GKC appreciated 60.5%, boosted by positive earnings momentum and investor sentiment.

Guardian Holdings Limited’s (GHL) increased 43.9%, fuelled primarily by investor sentiment around its cross-listing on the JSE during the year. Trinidad and Tobago Cement Limited (TCL) was up 42.4%, following reported revenue growth and improved margins mainly due to higher cement sales volumes across the region and stronger market demand in Jamaica.

Rounding out the top 5 major advancers, First Citizens Group Financial Holdings (FCGFH) increased 38.1%, as investors anticipate the Additional Public Offering (APO) in Fiscal 2022, the acquisition of Scotiabank’s operation in Guyana (subject to regulatory approval) and its recent investments in Barita Investments in Jamaica.

Major decliners for 2021 included, West Indian Tobacco Company Limited (WCO, down 19.5%), FirstCaribbean International Bank Limited (FCI, down 12.6%), Guardian Media Limited (GML, down 11.1%), followed by National Flour Mills (NFM, down 9.3%) and One Caribbean Media Limited (OCM, down 8.9%)

Some notable transactions by publicly listed companies in 2021 included:

- In August 2021, Republic Financial Holdings Limited (RFHL) branched into the Insurance sector under the wholly owned subsidiary, Republic Evolve Limited. Effective September 15th, 2021, the company’s name was changed to Republic Life Insurance Limited.

- Ansa Merchant Bank Limited (AMBL) made the move into commercial banking with its acquisition of the Bank of Baroda, approved by the Central Bank in November 2020 and operationalized in March 2021.

- GKC completed the acquisition of Scotia Insurance Eastern Caribbean Limited on August 3rd 2021 and rebranded under the name GraceKennedy Life Insurance Eastern Caribbean Limited (GK Life).

US Markets Resilient

US equity markets powered ahead in 2021 against a backdrop of rising earnings expectations, expansive monetary and fiscal policy, economic reopening and vaccine rollouts. The Energy Select Sector SPDR Fund (XLE) was the best performing sector during 2021, up 46.1% boosted by a surge in energy prices and a rebound in investor sentiment surrounding energy stocks previously pummelled in 2020. The Consumer Staples Select Sector SPDR Fund (XLP) rounded out 2021 as the ‘worst’ performing sector, up 13.6%.

Although indicators of economic recovery continue to strengthen, supply and demand mismatches contributed to elevated inflation levels. The term ‘transitory’ -previously used by Fed Chairman Jerome Powel was retired, acknowledging ‘stickier’ inflation that is likely to persist throughout 2022. The Federal Open Market Committee (FOMC) recently changed its policy stance, announcing accelerate interest rate hikes in 2022 and 2023 as well as the tapering of asset purchases.

Wall Street analysts have begun rolling out predictions for US equity markets in 2022, with some degree of variation. Morgan Stanley for example, projects an S&P 500 target of 4,400 representing a drop of 8.3%, whereas Credit Suisse predicted another year of double-digit gains with a target of 5,200 (+8.3%). The market closed at 4,778 on Thursday.

European markets as gauged by the Euro Stoxx 50 index advanced 12.3% after recovering from the deleterious effects of the pandemic in early 2020. Improving economic conditions and stronger-than-expected earnings pushed the benchmark, along with improved investor sentiment caused by a shift in the European Central Bank to an accommodative, more dovish stance on monetary policy. The UK’s FTSE 100 rebounded strongly (up 12.1%), supported by re-opening optimism. France and Italy were among the best performing markets in the region, increasing 17.1% and 14.3% respectfully. Spain’s IBEX remained in negative territory despite improving 7.5% whereas the German Dax stood out as the only European market to record lower growth during 2021.

India recorded the strongest major Asian market performance for the period, increasing 18.6% year-on-year, underpinned by strong fiscal support and economic reforms. Taiwan equity increased 25.5%. Asian Equity markets (excluding Japan) declined 5.7% in 2021 compared to a gain of 19.8% in 2020. South Korea equities declined 3.9% in 2021, while the Hang Seng Index in Hong Kong tumbled 15.0%. The index led losses in 2021, affected by the fallout of embattled Chinese property developer China Evergrande Group, weak retail spending and Beijing’s corporate crackdowns which continued to weigh on investor sentiment. China’s market, as measured by the Shanghai Composite Index grew 7.1% in 2021, lagging behind projections. China’s growth momentum has been slowing notably and is facing a painful fallout from real estate weakness and shocks from surging energy prices.

Latin American Equity markets declined 13.7% in 2021, following a drop of 16.0% in 2020. Mexico was the best performing market, rebounding 17.2% during the period given its close association to US economic fortunes.

Brazil was the worst performing Latin American market in 2021, retreating 18.9%, following a 20.4% decline in 2020, mainly attributable to higher inflation and concerns about fiscal discipline. Peru dropped 8.2%, while Chilean equities slipped 14.9% amid political uncertainty, higher price pressures and tighter monetary policy.

With the broadly positive sentiment pervading local equity markets and (mostly) positive movements of international stocks, what could be in store in the coming months? Next week, we consider some possible major drivers of fortunes for stock markets in 2022.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”