HIGHLIGHTS

Local Market

- FY 2022 Projected Performance:

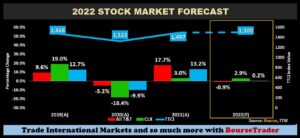

- TTCI: base case↑ 0.2%

- ALL T&T: base case ↓0.9%

- CLX: base case ↑2.9%

- Market Drivers:

- Acquisition Activity ↑

- Geographic Diversification Initiatives↑

- Inflationary Pressures ↓

- Stabilizing Energy Prices ↑

- Energy Production Recovery?

US Market

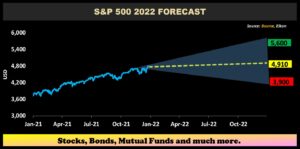

- FY 2022 Performance:

- S&P 500 +17.5% to -18.2%, base case 3.0%

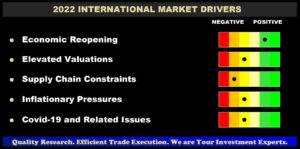

- Market Drivers:

- Economic Reopening ↑

- Elevated Valuations ↑

- Supply Chain Constraints ↓

- Inflationary Pressures ↓

- Covid-19 and Related Issues

With 2021 now firmly in the rear view mirror of investors, this week we at Bourse consider the potential direction of equity markets in the year ahead. This outlook is provided against a backdrop of elevated valuations and still-considerable uncertainty linked to the Coronavirus and associated effects. How should investors position their portfolios? We discuss below.

Local Stocks Could Trade Flat

Aggregating individual company earnings and valuation forecasts for most major publicly-listed stocks by market capitalization, the Bourse view for local equities in 2022 is muted price growth. The All T&T Index – comprising stocks domiciled in Trinidad & Tobago – is forecast to modestly retreat 0.9% in the year ahead after advancing aggressively 17.7% in 2021. The T&T Composite Index is projected to appreciate just 0.2% (2021 up 13.2%), while the Cross-Listed Index, which includes Jamaican and Barbados-based companies listed on the TTSE, is forecast to advance 2.9% (2021 up 3.0%).

Local Market Drivers Mixed

- With operating conditions expected to generally improve in 2022, drivers of local equity market performance could include:

- Continued acquisition activity, which is likely to positively impact investor sentiment for companies seeking to (i) build market share, (ii) capture synergies/economies of scale and/or (iii) diversify by business activity.

- Geographic Diversification Initiatives. Related to acquisition activities, companies aiming to achieve growth by expanding externally out of primary jurisdictions are more likely to be viewed favourably by investors. Acquisitions with regional diversification benefits were among the characteristics of some of the top stock performers in 2021.

- Inflationary Pressures have the potential to affect stocks differently, depending on the nature of the business. Higher prices for consumer staples such as food, transport, utilities etc. are likely to be passed through to a large extent by suppliers of the same. Already, suppliers of flour, basic goods and most recently certain alcoholic beverages have announced price increases. With basic items increasing in cost, lower disposable income could mean a combination of (i) lower discretionary spending and/or (ii) lower savings rates. The effect of this could lead to lower ‘big-ticket’ item purchases (vehicles, appliances, housing and consumer durables etc.), which could adversely impact consumer-oriented financial services and other related businesses.

- Domestic energy production is- based on estimates provided in the FY2022 budget – expected to recover in the coming months. Combined with forecast robust energy prices throughout 2022, this could prove a welcome benefit to public finances and the related economic activity generated from continued government spending.

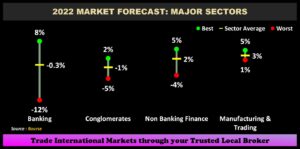

Sector Outlook Broadly Positive

Banking: The Banking sector, the local market’s largest sector by market capitalisation accounting for roughly 56% of total market value, is forecast to slip 0.3% in 2022. Drivers include a weaker net interest income outlook, largely offset by improving efficiency ratios (better cost management). While sector earnings are projected to modestly increase, already stretched valuations from fairly rapid price advances in 2021 are not likely to justify prevailing stock Price-to-Earnings (P/E) and other trading multiples. Stocks within the sector are forecast to range from -12% to +8% in individual price changes.

Conglomerates: Accounting for roughly 14% of total market value, the Conglomerate sector is forecast to modestly decline 1.1% in 2022. Positive earnings drivers for the sector include modest revenue growth and a higher likelihood of defending/improving profitability margins given strong ‘pass-through’ pricing power in an inflationary environment. Stocks in the sector are forecast to move between -5% to +2% in price. Despite these drivers, valuations based on current relative to historic trading multiples remain elevated, suggesting that earnings may need to catch up to current traded prices. A possible wildcard in the sector forecast is Massy Holdings Limited (MASSY), whose price significantly appreciated over 2021. This was in no small part attributable to positive sentiment around its Jamaican Stock Exchange (JSE) cross-listing announcement and subsequent intention to execute a 20-for-1 stock split.

Non-Banking Finance: The Non-Banking Finance sector is forecast to advance 1.7%, with member individual performance ranging from -4% to +5%. Underpinning performance in the sector is the prospect of improvements in international investment markets, continued acquisition activity and lower credit loss impairment provisions.

Manufacturing and Trading: The Manufacturing I sector declined 11.1% in 2021, with pandemic pressures posing challenges for most entities within the sector. Notably, the Manufacturing II sector had an exceptional year delivering a 43.2% increase in 2021, through improved sentiment for Trinidad Cement Limited (TCL) attributable to favourable developments for the cement producer in the competitive landscape. Heading into 2022, the Manufacturing and Trading Sectors are expected to modestly appreciate by 2.8% as economic activity increases and the threat of further shutdowns is reduced. Member performance is estimated to range from +1.3% to +4.6%.

Energy: Lone energy sector member Trinidad and Tobago NGL Limited (TTNGL) advanced 22.9% in 2021. Marginal forecast contractions in crude oil prices (expected to average $66.42/barrel in 2022) and an average forecast US natural gas price of $3.98/mmbtu, combined with (i) the prospect of increasing domestic energy production and (ii) potential volume growth in TTNGL’s investee company’s international operations create a rosier outlook for TTNGL. For 2022, TTNGL (and by extension the energy sector is forecast to improve +2.0% over 2021.

International Markets Looking Up

The US market was resurgent in 2021, advancing a notable 26.9% despite the prevalence of COVID-19. Entering 2022, a number of factors could set US markets up for more modest gains including:

- Sustained economic growth and stronger corporate earnings may need to exceed expectations to keep positive market sentiment intact.

- As benchmark indices rise to record levels, US stock price advances have peeled away from corporate earnings, stretching valuations. With elevated valuations and the reversal of ‘easy money’ policies by global central banks, investors may think twice before pouring into international equity markets.

- Despite broader global economic reopening, supply-chain challenges persist. The continuous strain on freight and logistics could contribute to prolonged inflationary pressures, compounded by higher energy, industrial and agricultural commodity prices.

- While vaccination rates haves increased, COVID-19 and new strains remain likely to cause short-term concerns across markets in 2022, as evidenced by market reactions to the Omicron variant uncertainties in late 2021.

The median forecast for the S&P 500 Index is 4,910, a 3.0% appreciation in 2022 from its December 2021 closing level of 4,766.18. The highest 2022 target by US analysts is currently 5,600 (or 17.5% up), while the gloomiest forecast is a level of 3,900 (or 18.2% lower).

Investor Considerations

On the backdrop of a terrific year for equities, the overarching theme for investors heading into 2022 is likely to be diversification. As we enter into a new year of above-average volatility, wide-ranging forecasts and generally elevated valuations, diversification remains one of the most effective ways of enhancing risk-adjusted investment performance. Investors should maintain some level of diversification of their portfolio not only by stock selection but by asset classes as well.

In an ever-changing investment environment, be prepared to make adjustments if and when necessary, i.e., should your portfolio (and its components) move out of line with investment goals. Investors are able to access international and local markets with an array of providers, including Bourse. 2022 could turn out to be an eventful next few months, as investors react to a rapidly evolving investment landscape.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”