| HIGHLIGHTS Local Market

International Markets

|

HY 2020: Bond Markets Subdued

In similar fashion to stocks, bond markets endured a roller coaster ride during the first half of 2020, largely as a result of COVID-19. This week, we at Bourse review the performance of local and international bond markets year-to-date, considering the impact of the pandemic thus far and what could lie ahead for bond investors. With uncertainty still prevalent across all financial markets, we offer some perspectives to refining the fixed income portion of investors’ portfolios in the prevailing bond environment.

Local Bond Market Stable

Local bond markets remain relatively stable despite several significant developments brought about by COVID-19. With the expected significant contraction in T&T’s economy, the Central Bank of Trinidad & Tobago (CBTT) in collaboration with the Ministry of Finance moved swiftly to utilize several monetary policy tools to insulate the financial system. The Monetary Policy Committee (MPC) of the Central Bank of Trinidad and Tobago cut its repo rate by 150 basis points from 5.00% to 3.50%, setting the stage for lower lending rates at commercial banks. With the economy gradually restarting, the MPC maintained its rate in June 2020 with the expectation of a stronger effect on lending and credit conditions in the coming months.

In perhaps an overdue move, the MPC also reduced the Primary Reserve Requirement (PRR) from 17% to 14%. A lower PRR effectively means there are more funds available for banks to lend/invest, promoting higher levels of liquidity in the banking system and creating a more supportive lending environment. Commercial Banks Excess Reserves reached a high of TT$8.34 billion in May 2020, a 53% increase from TT$5.45 billion in December 2019.

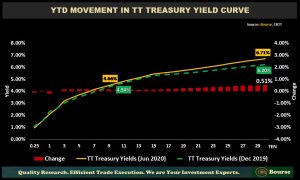

Despite a substantial increase in financial system liquidity (which should ordinarily pressure bond yields lower), the Trinidad and Tobago (TT) Treasury Yield Curve remained relatively stable. The longer-end of the curve (20-30 years) shifted marginally upwards, while short-term yields remained muted. The TT 30-year Treasury yield climbed 0.51% to 6.71% in June 2020 from 6.20% in December 2019, while the TT 10-year Treasury yield inched-up 0.12% to 4.66% over the same period.

This movement of the yield curve –against a backdrop of elevated liquidity and lower lending rates- is likely being driven by several factors, including:

- Expectations of higher inflation, given that headline inflation fell to 0.4% in March 2020. With the disruption of global supply chains and some uncertainty regarding the potential devaluation of the TT dollar, inflation could tick upwards in the coming months.

- Increasing TT-dollar bond issuances. The significantly wider fiscal gap has resulted in an increase in (private) TTD bond issuances at the government and state-owned enterprise level. With more securities becoming available, investors may need to be incentivized by higher yields to participate.

While there has been increased ‘private’ issuance of bonds, investors will likely be hoping for more publicly available bond offerings. The last major public bond auction would have been the TT$4 billion National Investment Fund (NIF) offering in 2018.

CariCRIS revised outlook to negative

Locally based credit rating agency Caribbean Information and Credit Rating Services Limited (CarCRIS) has maintained the credit rating of T&T at CariAA+. The agency, however, revised their outlook for the country from stable to negative. CariCRIS affirmed the credit rating of T&T based on (i) relative diversification of the economy, (ii) stable monetary and exchange rate performance and (iii) the country’s debt levels in comparison to Caribbean peers. Similar to international credit rating agencies, CariCRIS believes that the country’s credit rating is constrained by (i) increasing debt levels and (ii) lack of reliable macroeconomic data, limiting attempts to strengthen the economy and collection of revenue by the government. The negative outlook of the firm reflects the agency’s view that the country could be impacted by the lower energy prices and reduced demand, amplifying the need for government borrowing and the uncertainty of the recovery of the economy by 2021.

Low Yield Environment helps US Bond Markets Recover

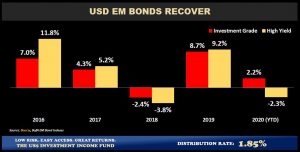

USD Emerging Market (EM) bonds have thus far been unable to match the stellar gains provided to investors in 2019. COVID-19’s stalling of economic activity globally led to heightened fears of financial market collapse. Bond markets fell as much at -8.3% in March 2020. While almost every segment of the bond markets has been affected, issuers with (i) high exposure to commodity prices, (ii) lower credit quality and (iii) operations in regions with high numbers of Covid-19 cases have been hardest hit.

Widespread concerns triggered a flight to higher quality bonds, in addition to several extraordinary measures by major Governments and Central Banks across the globe. Payroll support programs, stimulus spending packages and social grants were just some examples of the fiscal support provided by governments.

With respect to monetary policy action, the US Federal Reserve has perhaps acted in the most aggressive and proactive manner to promote financial system stability and mitigate credit risk. In doing so, the US Federal Open Market Committee (FOMC) maintained its Fed Fund Rate in the range of 0.00% to 0.25% in June 2020, after slashing rates in March of 2020 to the lowest levels since the 2008 Financial Crisis. The Fed indicated that low US interest rates would persist until it is confident that the US economy has weathered recent challenging times.

Moreover, the Fed has signalled its commitment to utilizing its full range of tools to provide extraordinary support to the economy, promoting maximum employment and price stability. This includes an almost unlimited bond buying program which reaches into the corporate issuer segment of US company issuers.

With interest rates pushed to near-zero levels and significant liquidity injected into financial markets, US-dollar bonds of both US and non-US issuers have effectively been revived. EM Investment Grade (IG) bonds have generated a total return of 2.2% year-to-date, while non-investment grade of High Yield (HY) bonds have recovered to produce a total return of -2.3%.

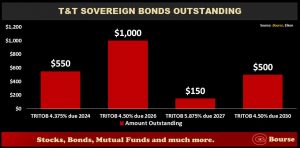

T&T issues new US bond

Taking advantage of the low-interest rate environment, improved sentiment and yield-hungry international bond investors, the Government of T&T issued a new US$500 million 4.5% coupon due 2030 on 26th June 2020. The bond was oversubscribed by over 200% within a few hours and joins three other US dollar-denominated sovereign bonds outstanding by the T&T Government, due in 2024, 2026 and 2027 for a total of US$2.2 billion. Proceeds from the new 2030 bond issuance were utilized for repayment of a US$250 million sovereign bond due June 2020, with the balance allocated for budgetary purposes.

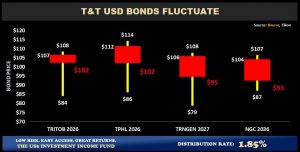

T&T USD Bonds Fluctuate

Similarly to the global markets, Trinidad & Tobago’s US Dollar Issued Bonds have all collapsed year to date with vast fluctuations before somewhat stabalising at current prices. Trinidad Generation Unlimited bond’s due 2027 (TRNGEN 2027) opened the year at a price of $106.63, with the price rising as high as $107.80 in March and plunged as low as $78.75 at the beginning of April. TRNGEN now offers investers a Yield to Maturity of 6.04% at current price of $95.38.

International Rating Agency Action

As has been widely reported, S&P downgraded the T&T’s credit rating in March 2020 from BBB to BBB-, while Moody’s changed the rating agency’s outlook for the country from stable to negative in May 2020, maintaining the country’s non-investment grade rating at Ba1. The change in the credit rating of the sovereign has not significantly affected investor appetite for US dollar-denominated debt issued by T&T, particularly in the prevailing low-interest rate environment. This has been broadly consistent with the experience of emerging market debt, largely built on the expectation of a recovery of the global economy from the damage caused by the coronavirus.

Could T&T get downgraded?

The likelihood of further negative credit rating action for T&T has increased, on account of (i) widened budget deficits, (ii) drawdowns from the Heritage and Stabilization Fund, (iii) increasing Debt:GDP levels and (iv) the prospect of prolonged lower energy prices.

The estimated budgetary deficit of TT$14.5 billion is being financed by withdrawals from T&T’s sovereign wealth fund, the Heritage and Stabilization Fund (HSF) of US$600 million thus far year-to-date and also US$250 million of the US$500 million bond issued in June 2020. Loans from multinational organizations have also been utilized to fund the increased expenditure required because of the pandemic, including:

- US$20 million from the International Bank for Reconstruction and Development (World Bank) was granted to support the country’s National Covid-19 Preparedness and Response Plan

- US$50 million loan from the Inter-American Development bank (IDB) to improve living conditions of low-income households as part of the government’s Urban Upgrading and Revitalization Program

- US$150 million in loans from CAF-Development Bank of Latin America for social and healthcare resources to combat Covid-19.

It is expected that the country’s Debt to Gross Domestic Product (GDP) will increase above 70% in 2020.

Investor Considerations

Locally, it is likely that additional government borrowing will be pursued within the next 12-24 months to meet projected fiscal deficits. It also remains likely that, barring any significant recovery in energy markets, additional drawdowns from the Heritage and Stabilization Fund would be required. In the context of increased indebtedness and deteriorating savings, investors would naturally be expected to require higher rates of return to hold T&T TT-dollar or US-dollar bonds.

However, this requirement may be partially offset by low interest rate environments and lack of suitable investing alternatives both internationally and in the domestic market.

Internationally, bond investors will continue to confront the dichotomy of lower bond yields in an environment of deteriorating credit quality/rising probabilities of default. Regardless of the timing of announcement of a successful vaccine to cure COVID-19, consumer spending behavioural patterns will take some time to resume to normal. Several industries have already had bankruptcy casualties, including well-known companies like Hertz Global Holdings (HTZ), retailer JC Penney and Oil and Gas fracking pioneer Chesapeake Energy Corp (CHKAQ). Airline and Cruise industry stalwarts remain delicately positioned, managing growing losses while waiting for a resumption of ‘normalized’ business activity.

In the environment, security selection remains key. Investors should favour bond issuers with (i) higher credit ratings, (ii) recession-resilient cash flows/business models and (iii) access to credit lines/capital markets. For lower-risk investors, rotating out of bond holdings and into low-risk income funds, repurchase agreements and/or fixed deposits might be worthwhile to consider as uncertainty remains elevated.

For more information on these and other investment themes, please contact Bourse Securities Limited, at 226-8773 or email us at invest@boursefinancial.com.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”