| HIGHLIGHTS

Local Market

International Markets

|

HY 2020: Equity Markets Lower but Stable

This week, we at Bourse review the performance of the local and international equity markets for the first half (HY) of 2020. Economies throughout the world have endured a challenging first half of 2020 due to the emergence of the Novel Coronavirus (COVID-19). The virus has wreaked havoc on lives and livelihoods, significantly impacting economic activity and financial markets. Since peak ‘panic-mode’ in March 2020, governments and monetary authorities around the world have responded with unprecedented support and safety measures. International borders were closed, entire states and countries were effectively sent into ‘lock-down’ mode and Central Banks and Governments pledged seemingly limitless financial support to prop up economies and financial markets.

The middle of Q2 2020 saw a reversal of several ‘lock-down’ measures, prompting one of the greatest stock market rallies experienced in the US. Since then, there has been a global resurgence of cases, forcing the reimplementation of partial lockdowns.

With domestic and international economic contraction projected for the year, how will financial markets fare for the rest of 2020? Will the feared ‘second-wave’ renew COVID-19 concerns, or will news of promising vaccine developments allay investor fears? What other factors could influence local and international asset prices? We consider below.

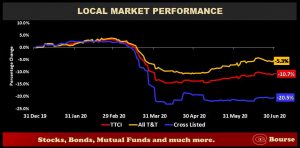

Local Markets Lower

The Trinidad and Tobago Composite Index (TTCI) lost 10.7% of its value at the end of HY 2020, weighed by the performance of cross listed stocks. Despite the All Trinidad and Tobago Index (ALL T&T) being down 5.3% at HY 2020, it has recorded some modest recovery since reporting a 6.9% decline at the end of Q1. The Cross Listed Index (CLX) plunged 20.5% at the end of HY 2020, impacted by the stock price performance of Jamaican financial institutions NCB Financial Group (NCBFG) and JMMB Group Limited (JMMBGL).

TT Composite Index Major Movers

After facing a significant shift in market sentiment due to COVID-19 and its economy-halting impact, the Trinidad and Tobago stock exchange has embarked on a path towards recovery. At the end of the first quarter of 2020, only 3 corporate stocks (RFHL, AMBL, AGL) were in positive territory. As at the close of June however, there has been a slight reversal of fortunes with 7 stocks in the green.

National Flour Mills (NFM) (↑ 38.5%) benefitted from a boost in investor sentiment in HY 2020, making it the best performer on the local market for the period. The closure of restaurants and shortening of operating hours for grocery stores catapulted demand for flour and other consumer staples, leading to an increase in NFM’s earnings per share ($0.03 in Q1 2019 vs $0.06 in Q1 2020). Republic Financial Holdings Limited (RFHL) continued to outperform the market, appreciating 6.3% buoyed by investor sentiment amid the Group’s continued drive to expand its geographical base of operations. Trinidad and Tobago Cement Limited (TCL) was up 5.0%, despite the increasing likelihood of more tepid construction conditions in the months ahead. Rounding out the top five performers for HY 2020 were Ansa Merchant Bank Limited (up 3.2%) and First Citizens Bank Limited, appreciating 3.1% also having recorded a 2.6% YoY increase in its EPS for HY 2020.

Financial and economic conditions would have weighed on investor sentiment across most index constituents. the profitability of the market’s five largest decliners, swaying investor sentiment for those stocks. One Caribbean Media (OCM) registered the largest decline in HY 2020, falling 35.3%. Jamaican Banking Conglomerate NCB Financial Group Limited (NCBFG) declined 27.7% year to date, affected by adverse economic conditions across its operating jurisdictions and concerns about the tourism-dependent Jamaican economy. Trinidad and Tobago NGL Limited (NGL) suffered a 27.0% decline at the end of HY 2020, influenced by downward pressures in the market for energy commodities. Unilever Caribbean Limited (UCL) shed 26.1% of its stock price. Rounding out the list of top 5 largest decliners was JMMB Group Limited, which declined 24.1%.

On the Local Horizon

With the economic ramifications of COVID-19 still filtering into the economy, investors will be keeping a sharp eye out on the next round of quarterly results which may give some more clues about how companies performed in the quarter ended 30th June, 2020.

With most banks having recognized sizable impairments in their Q1 2020 results, second calendar quarter results for the Banking sector should provide a good gauge of credit conditions and a general reflection of economic activity. Lower interest rates and loan demand could test the resilience of banking profitability over the remainder of 2020. Economic pressures stemming from COVID-19 over this period are also likely to extend to Conglomerates and Manufacturing entities, as production activities were halted and consumer spending shifted away from consumer discretionary products to staples. The Non-Banking Finance Sector, meanwhile, is likely to show some recovery in terms of Investment Income, as US markets recovered nearly all of the value lost during the COVID-19 market rout. The Energy Sector (comprising the sole stock Trinidad and Tobago NGL Limited) will be subject to the vagaries of energy markets, whose prices would have improved modestly toward the end of the second quarter.

International Markets Rebound

At the half-year point, all major investment regions were in negative territory. The Latin American market whipsawed in Q1 2020 ending the month of March 46.2% lower as gauged by the iShares S&P Latin America 40 Index (ILF). However, sentiments recovered in Q2 bolstering the market 18.1%, ending HY 2020 down 36.5% YTD. Similar patterns were observed in the European and Asian Markets (as measured by the iShares Core MSCI Europe ETF (IEUR) and the iShares MSCI All Country Asia ex Japan ETF (AAXJ), ending the half period down 14.3% and 5.9% respectively after recording improvements of 15.3% and 15.8% respectively in Q2.

US Markets Report Recovery

At the end of HY 2020, US financial markets (as measured by the SPDR S&P 500 ETF Trust (SPY)) were down 4.2%, an improvement from a 19.9% decline recorded at the end of the first quarter of the year. Despite a spike in COVID-19 cases and recent delays on economic reopening in certain states, investor sentiment appears to be recovering. The rebound in market perception is likely on account of the broad based policy measures implemented by both the US Federal Reserve and the US government, in efforts to provide extraordinary support to an ailing economy.

The Federal Reserve reduced the Federal Fund Rate to a range between 0.00% and 0.25%, expanded securities purchases (Quantitative Easing) and the scope of its repurchase agreement window. It also reinstated its commercial paper lending facility, its International Swap lines and eased banking regulations that were established post 2008 financial crisis.

The US Government employed various Fiscal measures in addition to the aforementioned Monetary Policies to provide support to citizens impacted given the surge in unemployment levels and widespread business closures. In April, more than 80 million Americans received one-time payments of $1,200, as part of a US$2T economic stimulus package called the CARES Act. The US recorded an unemployment rate of 11.1% unemployment rate in the month of June, greater than the unemployment peak of 10% recorded during the economic downturn of 2007 to 2009. A second round of US stimulus package worth approximately US$3T is now being proposed it aims to provide mortgage support, rent relief, coronavirus testing relief and assistance to write off some students’ loans. Already passed in the Democrat-controlled House, it must still be successfully passed through the Republican controlled Senate.

The close of Q2 2020 delivered the US stock market’s best quarterly performance in more than two decades, with the Dow Jones Industrial Average, S&P 500 and the Nasdaq Composite reported upticks of 17.8%, 20.0% and 30.6% respectively.

The health crisis dealt an unprecedented blow to the European economy at the end of HY 2020, disrupting supply chains and curbing domestic and external demand which was reflected in the region’s financial markets. The Euro Stoxx 50 plunged 12.0% YTD, with the UK, Spain and Italy ranking among the top 10 countries with the most COVID-19 cases. The UK’s FTSE 100 has declined 23.5% YTD as the economy grapples with the economic fallout from COVID-19 and its departure from the European Union. The German Dax was down 7.5% YTD, at the end of HY 2020, taking a blow from contractions in economic demand. The German Government announced on the 4th of June a new stimulus package of €130B (US$146.9B) to rekindle economic activity, which brings the total fiscal stimulus for the economy to €1.2T (US$1.356T), an equivalent of 35% of Germany’s 2019 GDP.

At the end of Q1 2020, the Eurozone’s GDP fell by 3.8%, with France recording the sharpest economic decline since 1949 of 5.8%. Economies on the continent have started reopening their economies but the resurgence of cases continues to hinder moves to quick economic recovery, specifically in the UK. Tourism, which contributes a significant proportion of Europe’s economic activity is projected to face a decline of 45% to 70%. The IMF in its June outlook revised its GDP growth outlook, forecasting both Europe and the UK to contract by 10.2% in 2020.

At the end of HY 2020, the Asian region (exclusive of Japan) recovered some lost ground with its equity markets (as measured by the AAXJ declining 5.9% YTD in comparison to the 18.7% fall at the end of Q1 2020. Nonetheless, weakness in consumer spending and investor confidence continued to affect in the region, stemming from the health and financial impact of COVID-19. Indian equities (measured by the BSE 100) fell 19.6% YTD. At the end of May 2020, The Reserve Bank of India (RBI) eased policy rates by 40 basis points with the repo rate and the reverse repo now standing at 4% and 3.35% respectively, and extended its enhanced borrowing facility provided to meet liquidity shortages. In addition, the Finance Ministry has extended measures including loan moratoria, credit support to SMEs and benefits under interest subvention and prompt repayment incentive schemes for short-term agricultural loans, to boost economic activities. Meanwhile, unemployment rates in India fell from 23.5% to 11% in June as businesses resumed operations. However, the resurgence of coronavirus cases in the region may continue to stifle operations in the upcoming periods.

The Chinese economy recorded 6.8% YoY economic contraction (its 1st decline in 28 years), after the economy was one of the first to be faced with the economic fallout from the global pandemic. Equity markets seem to be rebounding at the end of HY 2020, with the Chinese CSI 300 recording a 0.2% YTD increase. On June 30th, China passed the National Security legislation for Hong Kong which is likely to threaten the city’s trade deals and ability to effectively function as a financial centre if tensions intensify. This may adversely affect the profitability of companies operating in the jurisdictions. The IMF revised GDP projections for Asian economies downwards with the Indian economy expected to contract 4.5% and China expected to record a marginal 1% growth at the end of 2020.

Latin American Equity markets ended HY 2020 with a 36.5% decline as gauged by the ILF. Currently, 4 Latin American countries rank among the top 11 nations with the highest number of COVID-19 cases with Brazil holding the number 2 position worldwide, recording over 1.4 million cases and 59,000 deaths. Brazil’s equity markets, measured by the performance of the Brazilian Ibovespa declined 39.5% YTD. Brazil’s Central Bank slashed the country’s 2020 economic growth forecast to minus 6.4% from a previous zero, owing to the economic consequences brought forward by COVID-19. The Central Bank also predicted a 13.8% contraction in capital investment for businesses and a 5.3% reduction in services activities, which accounts for two thirds of all activity in the Brazilian Economy.

Latin America’s second largest economy, Mexico, saw a 56.7% YoY drop in exports in May 2020 reflecting the global plunge in oil demand and tumbling manufacturing sales and its GDP contracted 1.4% at the end of Q1 2020. Mexico’s Mexbol plunged 28.6% YTD. On June 25th, the Bank of Mexico reduced its Interest rates by 50 basis points to 5.0% to facilitate the economic ramifications the economy has been experiencing from the global pandemic and as the IMF forecasted a contraction of 10.5%.

Investor Considerations

With the economic uncertainty persisting in the domestic market, investors wanting to enter the market at current prices should consider the operational strength of potential investee companies, their valuation and their dividend yields. It is also increasingly important to consider how the company may perform under current economic conditions and conditions directly following the sustained mitigation of the COVID-19 pandemic.

The accommodative stance of both the Central Bank of Trinidad and Tobago and the Government, coupled with a containment in the domestic spread of COVID-19 and consequent relaxation of measures implemented due to the virus, have acted to improve the sentiments of investors in the domestic market. However, the effects of the virus are lasting with altered consumer spending and slumps in economic activity being expected to leave an impact on the financial performance of some domestic entities. These factors combined with the fall in global energy prices have negatively influenced the sentiments of some market participants.

The US market has recorded a significant uptick in performance over the course of Q2 2020. With this recovery being primarily driven by extraordinary stimulus, phased economic reopening and consequent improvements to economic data. Continuing progress made towards the development of a COVID-19 vaccine has also contributed to bullish sentiments amongst some investors. However, the more conservative of investors are still weighing the risk and returns of entering the market under current conditions. More specifically, the potential for a second wave and altered consumer spending amid greater economic uncertainty have weighed on decisions of many market participants.

On the international front, current global economic climate poses both an opportunity and a threat to investors. With some economies seemingly embarking on a path toward economic normalisation, lower prices will pose a buying opportunity for some. However, with the threat of a second wave of the COVID-19 virus continuing to mount, volatility is likely to persist within financial market, potentially posing a threat to value of shareholdings. For investors keen on entering the international market, while minimizing their exposure to market cyclicality a useful approach to bear in mind is the “averaging in” method. In doing so, an investor will be purchasing incremental lots of share over time. In this way the value of their overall holding of a share would be based on an average, making the investor less exposed to shifts in market value.

For more information on these and other investment themes, please contact Bourse Securities Limited, at 226-8773 or email us at invest@boursefinancial.com.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”