BOURSE SECURITIES LIMITED

22nd July, 2019

T&T’s Credit Rating: Better Days Ahead?

This week we at Bourse take a closer look at recent credit rating actions taken by international rating agencies, including the downgrade by international credit rating agency Standard and Poor’s (S&P). We examine some of the factors which influenced the various ratings and consider the impact on investors in Trinidad & Tobago international bonds.

Rating actions

S&P rating Downgraded

S&P downgraded the credit rating of the Government of Trinidad and Tobago by one ‘notch’ to BBB from BBB+ (July 9th, 2019), on account of lower-than-expected energy production and economic growth, slow implementation of institutional reforms and lack of improvements in timely data collection. While the downgrade will like dent investor confidence, S&P’s rating of T&T still remains in Investment Grade territory. S&P’s Outlook for T&T was changed from negative to stable, based on the country’s liquid financial assets in the Heritage and Stabilization Fund (HSF) and the expectation of a small increase in energy production, which could support an increase in economic growth.

Moody’s rating Affirmed

Moody’s Investor Services (Moody’s) affirmed the credit rating of T&T as Ba1 (June 26th, 2019), on account of T&T’s sovereign wealth fund (HSF), projected economic recovery of between 1.5% to 2.5% in 2019-2020 and a low susceptibility to external financing risk based on the country’s high foreign reserves. Despite being affirmed at Ba1, Moody’s rating places T&T in the non-investment grade or ‘junk’ category of bonds. The outlook for T&T by Moody’s was maintained at stable.

Ratings Drivers mixed

Credit Ratings drivers can be split into four broad categories; Savings, Borrowings, Earnings and Spending. In T&T’s case, the country got good reviews for its Savings and mixed reviews for its Borrowings, Earnings and Spending.

Savings remain healthy, for now

Both S&P and Moody’s made mention of the very comfortable level of international reserves and the value of the HSF in the rating reviews. Indeed, the HSF and International Reserves were supportive factors to T&T’s credit ratings.

With respect to the HSF, the most recent value of the Fund was US$6.2 billion at July 2019 according to the Ministry of Finance. This was an increase of US$0.23 billion (3.8%) from September 2018 to date and US$0.54 billion (9.5%) higher since September 2015. The growth of the HSF has been attributable in large part to the benefits of investing in international markets, which have experienced multi-year rallies in recent times.

The positions of T&T’s international reserves and import cover paint a less positive story. On the one hand, T&T’s import cover of 7.9 months (as at June 2019) remains well above the international standard of 3 months. However, there have been consistent declines in the level of international net official reserves, declining by 35% from US$10.74 billion in June 2015 to US$6.99 billion in June 2019.

Borrowings manageable

The reduction in energy production and price volatility, resulting in lower energy revenues, has led to increased borrowing over time. S&P has stated that they expect the country’s budget deficit to grow, as revenue fails to match pace with expenditure growth. In 2019, however, the deficit is expected to narrow, based on higher revenue from energy sector and one-off sources according to S&P. Notably, the majority of T&T’s borrowing has been in the local currency, with TT$66.5 billion (72.0%) of T&T’s outstanding debt being borrowed from the domestic market, while TT$25.8 billion (38.0%) equivalent of outstanding debt has been sourced from external markets as at May 2019.

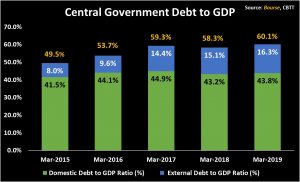

Total Debt to GDP (Gross Domestic Product) of T&T rose from 49.5% in March 2015 to 60.1% in March 2019, made of Domestic Debt to GDP, which increased by 2.3% from 41.5% to 43.8% and External Debt to GDP, which increased from 8.0% in March 2015 to 16.3% in March 2019, a jump of 8.3%.

Earnings under pressure

Economic growth is forecast to remain muted, with Moody’s citing a 1.5% growth in 2019 and between 1.5%-2.5% in the subsequent 2-3 years. The country remains highly dependent on the energy sector, with an added reliance on asset sales and dividends from state-owned enterprises. The good news is that Natural Gas production – T&T’s main hydrocarbon resource – is expected to increase from its current 3.8 bcf/d to 4.14 bcf/d in 2021.

One of the concerns raised by both credit rating agencies was the slow implementation of a single Revenue Authority to curb the high level of tax leakages and enhance revenue.

Spending contained, adjustments still needed?

S&P has stated that it does not expect the government to meet its previous target of a balanced budget by 2020-2021. However, government expenditure has reduced by 20% in the last four years. This has been mainly due to a reduction in capital expenditure by the government from TT$8.4 billion in the 2013/2014 fiscal year to TT$3.4 billion in the 2017/2018 fiscal year.

Impact on investors

The overall impact of a lower credit rating – all else equal – is typically an increase in borrowing costs for the borrower. This is as a result of investors/lenders requiring a higher rate of return for bearing increased risk. While there has not yet been any significant reaction by investors holding T&T US-dollar international bonds, continued downgrades and/or loss in investor confidence could lead to yields on T&T bonds heading higher. Trinidad & Tobago (TRITOB) US dollar bonds due in 2024 and 2026 were offering a yield of 3.53% and 4.14% respectively, before the rating actions by both Moody’s and S&P. After the downgrade, yields have remained fairly stable at 3.52% and 4.36% for TRITOB 2024 and TRITOB 2026 respectively.

Similar Caribbean US-dollar bond issues of similar tenor and credit rating, such as Government of the Bahamas (rated BB+ by S&P) due 2028 and the Government of Bermuda (rated A+ by S&P) due 2027 offer yields of 4.6% and 3.0%, while TRITOB bonds due 2026 bonds offer a yield of just under 4.4%.

Comparing the US-dollar bond issues of countries in the region whose economies are also energy-reliant such as Mexican USD Government bonds (rated BBB+ by S&P) due 2027 and Colombian USD Government bonds (rated BBB- by S&P) due 2027 offer yields of 3.5% and 3.2% respectively.

For more information on these and other investment themes, please contact Bourse Securities Limited, at 226-8773 or email us at invest@boursefinancial.com.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”