BOURSE SECURITIES LIMITED

3rd June, 2019

Insurer Acquisitions yield USD for Investors

This week, we at Bourse focus on recent and pending transactions in the non-banking finance sector of the Trinidad & Tobago Stock Exchange. Specifically, we refer to (i) the acquisition of majority control of Guardian Holdings Limited (GHL) by the National Commercial Bank Financial Group (NCBFG) and (ii) the pending business combination transaction of Sagicor Financial Corporation (SFC) by Alignvest II Corporation (AQY).

In both cases, shareholders would have been offered a considerable premium over the traded price of GHL (13%) and SFC (69%) shares pre-announcement of their respective offers. Shareholders of GHL have already received precious US dollars in exchange for their GHL shares. In the case of SFC (with a successful vote on June 4th 2019), shareholders will effectively receive USD cash and/or shares which can be ultimately used to receive USD.

With the dust having settled on the GHL transaction and a major step about to be taken with the SFC/AQY deal, what might shareholders be looking forward to? We consider some of the value propositions for both GHL and SFC, as well as provide some options for investors who may wish to utilize their USD proceeds.

USD Inflows present opportunity

With the take-over bid of GHL by NCBFG having been successfully completed, the consolidated entity will now benefit from an improved regional footprint of more than fifteen territories and expansion of the range of products and services offered to customers. Through further synergies and the integration of best practices, expertise and high quality technology, the group’s overall financial performance is forecasted to improve going forward. Therefore, considering the growth potential, investors may opt to ‘hold’ their current GHL shares.

Upon settlement of the transaction on 13th May 2019, more than US$207.1M was effectively placed into the hands of GHL investors. Despite the oversubscription of the transaction, shareholders would have received USD cash for a significant portion (62.6%) of their validly tendered shares.

Also pending is the Alignvest (AQY) acquisition of Sagicor Financial Corporation Limited (SFC) which, if successful, will result in the delisting of SFC from the Trinidad and Tobago Stock Exchange (TTSE), and immediate listing of ‘New Sagicor’ on the Toronto Stock Exchange (TSX). AQY’s proposed capital structure for the new entity is expected to materially reduce its cost of capital and promote improved profitability. SFC will have better access to capital funding to execute its organic and inorganic growth initiatives, such as the acquisition of ScotiaBank’s insurance operations in Trinidad and Tobago. Hence, investors seeking to take advantage of this potential for capital appreciation may decide to hold on to their SFC shares.

If given SFC shareholder approval on June 4th, 2019, this transaction would also provide an avenue for investors accepting the offer to obtain valuable US Dollars. As at December 31st 2018, SFC common shareholders residing in Trinidad and Tobago collectively owned over 151.4M or 49.4% of the 306.6M outstanding SFC shares. If the transaction is successful, this translates to a maximum inflow of US$265.1M through a combination of cash and ‘New Sagicor’ shares to local investors.

For the investors who opted to tender their GHL shares and have received USD cash, as well as the SFC shareholders who wish to accept the AQY offer or eventually sell their ‘New Sagicor’ shares on the TSX, the opportunity for further diversification now presents itself. Individuals can now expand the asset allocation of their portfolios to include international alternatives which can provide returns that may be superior to local instruments.

Local vs International Historical Returns

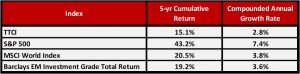

Historically, the performance of the TTCI has been relatively muted in comparison to international equity markets such as the Standard and Poor’s 500 Index (S&P 500). Over the last five years, the TTCI recorded a cumulative return of 15.1%, meaning that an investor’s equity holdings would have grown at a rate of 2.8% annually. In contrast, the S&P 500 advanced 43.2%, or 7.4% annually, providing substantially higher rewards while offering the benefit of higher liquidity. The MSCI World Index also outperformed the TTCI, rallying 20.5% over the past five years, or 3.8% compounded annually. For investors looking at fixed income securities, USD Emerging Market Investment Grade Bonds have provided a five-year return of 19.2% or 3.6% compounded annually.

USD Investment Instruments

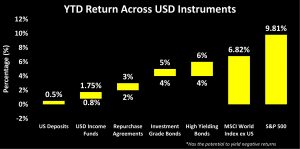

For the more conservative investor seeking high liquidity and capital preservation, options such as USD Income Funds can offer annual returns between 0.8% and 1.75%. Repurchase agreements are similar to traditional fixed deposits but are fully collateralised, and yield between 2-3%, depending on the tenor of the investment. Moving up the scale to longer term instruments, the range of US Dollar-denominated bonds is more extensive and can allow for more competitive returns (between 4-6%) in comparison to their local counterparts without undertaking significantly more credit risk.

For those with a higher risk appetite, who are more tolerant of market volatility and are seeking capital appreciation, US Equity investments or Exchange Traded Funds (ETFs) can result in more rewarding gains. While these investors are exposed to the risk of incurring negative returns, recent performance has been encouraging. Over the past five years, the S&P 500 provided a total return of 43.2%, or 7.4% compounded annually. Investors would have benefitted from not only substantially higher yields but also improved liquidity when compared to its local counterpart, the TTCI.

How can I start investing?

Consulting with a trusted and experienced financial advisor, such as Bourse, can provide you with all the necessary tools to ladder your investment to cater to your specific wealth targets. For those interested in extending from shorter term to longer term instruments, the mechanisms are readily available to get the advice and relevant research in order to make the most informed decision. Furthermore, through a platform such as the BourseTrader, investors now have the ability to easily execute trades on the international markets.

For more information on these and other investment themes, please contact Bourse Securities Limited, at 226-8773 or email us at invest@boursefinancial.com.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”