BOURSE SECURITIES LIMITED

13th May, 2019

Investing Your US Dollars

This week, we at Bourse seek to provide some insight into US dollar investment opportunities available through Bourse and within the local financial landscape. “How can I invest my US dollars?” is a question on the mind of many investors lately, particularly those who have been or will be involved in market transactions – such as NCB Financial Group’s recently concluded offer to Guardian Holdings Limited shareholders – where US dollars will be received.

In an environment where US dollar availability is somewhat constrained, investors with access to US dollars should ensure that this precious financial resource is gainfully employed. Fortunately, there are investment solutions that cater to the risk and return preferences of almost every investor.

Invest within your comfort zone

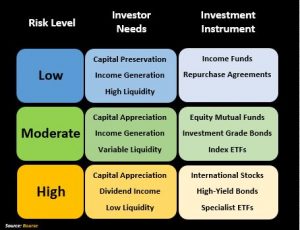

The US dollar investment menu is vast, ranging from very low risk income funds to higher risk investments across various stock markets. Importantly, you should invest in markets and instruments which you feel comfortable with. It is always useful to remember that higher returns are accompanied by higher risks.

Consideration should also be given to your liquidity needs (how quickly do I need access to my funds?) and investment horizon (how long can I stay invested for?), factors which are often unique to each investor.

Lower Risk Opportunities

USD Income Funds

For the conservative investor, USD Money Market Funds are a viable option. These provide the investor with higher returns as opposed to “parking” holdings in a US Savings account at the bank, while still allowing for ease of access to funds and principal security. Local USD Income Funds, including the Savinvest Investment Income Fund (managed by Bourse), offer annual returns of between 0.8% to 1.75% on average, whereas the interest rate on traditional foreign currency deposits has remained at just over 0.5% annually. Investors are offered the benefit of a steady stream of payments derived from a well-diversified portfolio.

USD Repos

USD Repurchase Agreements (Repos) are fully collateralized investment instruments that are customizable to suit the investor’s liquidity needs. Repos generally offer more attractive rates of return (between 2.0% to 3.0%) and are typically secured by financial assets such as bonds. The rate of return and the tenor are agreed upon at the beginning of the investment between you and the Repo seller. Repos cater to investors requiring short to medium term investments ranging from three months to three years, with higher returns corresponding to longer tenors.

‘Medium’ Risk Opportunities

Index Exchange Traded Funds (ETFs) and Mutual Funds

Investors with a relatively higher risk tolerance seeking growth of capital over time may consider Index Exchange Trade Funds (ETFs) and/or US Dollar Equity Mutual Funds.

Equity Mutual funds limit their exposure to any one particular asset class, geographical location or currency. As a result, this instrument offers the benefit of investing in a diversified portfolio along with the high level of expertise of fund managers.

In similar fashion, Index ETFs aim to achieve a rate of return similar to a particular stock index. For example, the SPDR S&P 500 ETF (Symbol: SPY, +13.4% as at May 10 2019) seeks to provide a return which matches that of the S&P500 Index. Like Equity Mutual Funds, Index ETFs offer a considerable degree of ‘built-in’ diversification. ETFs, however, can be readily traded on the international markets, an attractive feature to many investors. Index ETFs are not just limited to US stock markets, with many popular ETFs focused on countries and regions across the globe. Investors can access Index ETFs and other internationally traded securities through our BourseTrader service.

Investment Grade Bonds

For investors who prefer income generation with a limited risk appetite, there is a world of opportunities available with investment grade bonds. US Dollar-denominated bonds can provide rewarding return through semi-annual coupons or interest payments. Upon maturity, the issuer returns the principal amount to the bond-holder. At present, investment grade bonds offer annual returns ranging from 4%-5% and will vary based on the time to maturity of the bond (among other factors).

Higher Risk Opportunities

International Stocks and Specialist ETFs

At the higher-risk, higher-return end of the spectrum are international stocks. Indeed, many investors associate US dollar investments with the US stock market, with popular names such as Facebook (+41.9% YTD), Amazon (+24.4% YTD) and Apple (+22.9% YTD) often being the topic of discussion amongst investment enthusiasts. While the recent performances of these stocks have been commendable, it is important to remember that individual share prices can fluctuate widely. For investors who wish to invest on a thematic basis (Energy, Technology etc.), but still want to achieve some measure of diversification, Sector ETFs may be worth considering. For example, the Energy Select Sector SPDR Fund (Symbol: XLE, +10.0% YTD) seeks to provide returns which broadly mirror the Energy Sector of the S&P 500 Index.

High-Yield Bonds

For more aggressive investors seeking income generation, high-yield bonds are a possible solution. Like investment grade bonds, high-yield bonds pay semi-annual coupon or interest payments, with principal repaid at maturity. As the name suggests, high-yield bonds offer higher annual returns ranging from 5%-8% (based on the time to maturity of the bond and other factors). As would be expected, higher returns are accompanied by higher risks, which an investor should be willing and able to bear.

Building Your US Portfolio

Risk, Return, Liquidity Needs and Investment Horizon are all important considerations in building your US dollar portfolio. Factors which will also influence the type of instruments which form your portfolio include:

- Your level of expertise in financial markets

- Your expected level of involvement on a daily basis

Whether trying to make your US dollars work harder for you or any other investment goal, you should consult a trusted and experienced advisor, such as Bourse, to help make more informed decisions.

For more information on these and other investment themes, please contact Bourse Securities Limited, at 226-8773 or email us at invest@boursefinancial.com.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”