BOURSE SECURITIES LIMITED

28th January 2019

GHL takeover nears close

This week, we at Bourse review National Commercial Bank Financial Group Limited’s (NCBFG) revised offer to acquire a majority stake (62%) in Guardian Holdings Limited (GHL). We provide some information on key dates, as well as other important investor considerations.

About the offer

On December 8th 2017, NCBFG announced an offer and take-over bid to acquire up to an additional 74,230,750 ordinary shares at an offer price of US$2.35 or TT$15.90 per share (32% of GHL outstanding shares). Several concerns from a group of minority shareholders, however, led to intervention from the Trinidad and Tobago Securities and Exchange Commission (TTSEC). Since then, the concerns of these investors appear to have been assuaged, resulting in a revised Offer being put forward. On December 18th 2018, NCBFG announced that the terms of the take-over bid would be revised again. The second revision proposes an offer price of US$2.79 (TT$18.88) per share, with a maximum holding of 62% of the outstanding GHL shares (considering the current 29.99% ownership). The offer is expected to close on 7th February 2019 (unless extended by NCBFG). Importantly for investors, any GHL shares to be tendered in the offer must be acquired by January 31st 2019 (the record date). Accordingly, the last day to purchase GHL shares on the market to participate in the offer is January 28th, 2019.

Will the Offer be successful?

NCBFG has stated that the Offer is conditional upon GHL shareholders tendering shares which would result in NCBFG’s ultimate total ownership of at least 50.01% of GHL. In other words, the Offer must be accepted by shareholders with at least 20.02% holdings in GHL.

GHL’s most recent Directors’ Circular stated that at least 2 key shareholders – holding 21.83% of GHL’s outstanding shares – have indicated their intention to accept the Offer. If accurate, the Offer will be successful.

Is the Offer price fair?

One of the primary concerns of investors related to the initial Offer was pricing. The revised Offer is at a price of US$2.79 per share, being paid in US to shareholders whose shares have been successfully tendered.

Investors should note that:

- The price paid to Key Shareholders, by NCBFG, in May 2016 to acquire a 29.99% stake in GHL was US$3.24. This arrangement was not extended to all shareholders of GHL.

- Ernst & Young Services Limited (EY) was engaged by NCBFG in November 2017 to value GHL’s shares. EY suggested a valuation in the range of US$2.53 to US$2.90 per share

- After being engaged by GHL, a valuation exercise was conducted by BroadSpan Capital LLC and presented in January 2019, which placed the value of GHL shares within a range of US$2.76 to US$3.35 per share

Based on this information, it would appear that the revised Offer falls (i) within, but on the lower end of the latest valuation range and (ii) below the US$3.24 per share received by key shareholders in May 2016.

Should Investors accept the Offer?

An investor’s decision on whether or not to accept the Offer will depend on his/her individual circumstances. Nonetheless, here are some options GHL shareholders could consider and conditions under which they may lean toward a particular course of action, within the context that the Offer should already have the minimum shares required to be successful. Importantly, in the latest Director’s Circular published by GHL, the Board would have recommended the acceptance of the Offer to all shareholders.

Investors considering to Accept the Offer might (i) be uncertain of the benefits of the takeover to GHL, (ii) harbour concerns about the direction of GHL’s share price after the Offer closes, (iii) be interested in at least partially reducing their investment in GHL and/or (iv) be willing to accept US dollar proceeds for a TT dollar asset.

On the other hand, investors who Do Not Accept the Offer might (i) believe that future growth prospects of GHL are brighter with the takeover, (ii) believe the shares are undervalued and/or (iii) do not particularly need to receive US dollars for a TT dollar asset.

How many of my shares will be accepted?

The number of shares successfully tendered will depend on the overall acceptance of the Offer by shareholders.

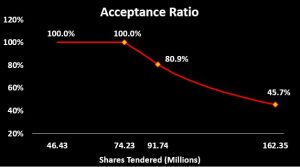

In a case where the total number of shares tendered takes NCBFG’s holding of GHL to between 50.01% and 62%, all shares tendered by investors will be accepted. Under such circumstances, investors would receive US dollars for 100% of their tendered shares.

On the other end of the spectrum, there is the (remote) possibility that all remaining shareholders tender their shares under the revised Offer. In this scenario, it is estimated that 45.7 out of every 100 shares (45.7%) tendered by investors would be accepted.

Under the terms of the initial Offer (US$2.35 per share in December 2017), approximately 91,743,975 GHL shares were tendered. With the revised Offer price some 18.7% higher, it could be the case that more GHL shares are tendered than in the previous Offer.

What could happen to GHL’s share price post-offer?

If the Offer is oversubscribed, that is, NCBFG receives more shares than needed to ensure a maximum 62% ownership of GHL, there is the chance that investors may attempt to sell ‘excess’ GHL shares on the open market. Following the lapse of the previous Offer on February 23rd 2018, GHL’s share price fell 11.8% from $17.00 to a low of $15.00 on April 18th 2018.

For more information on these and other investment themes, please contact Bourse Securities Limited, at 226-8773 or email us at invest@boursefinancial.com.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”