BOURSE SECURITIES LIMITED

2nd October 2017

SBTT Improves, FCI Lower

This week, we at Bourse review the third quarter performance of two stocks withing the Banking sector, Scotiabank of Trinidad and Tobago Limited (SBTT) and FirstCaribbean International Bank Limited (FCI). Despite an increasingly difficult local economic environment and continuing low credit demand, the Banking sector has, thus far, proven resilient. SBTT has delivered strong earnings growth for the nine-month fiscal period, while FCI’s results were negatively impacted by higher costs. We take a closer look at their respective performances and provide some perspective on future performance.

Scotiabank of Trinidad and Tobago Limtied (SBTT)

SBTT delivered Earnings per Share (EPS) of $2.87 for the nine month period ended July 2017, 8.5% higher when compared to the same period in 2016. Net Interest Income, which accounted for 71% of total revenue, increased by 10.8%, from $839.1M to $929.4M. This can be accredited to a 3.6% growth in the loan portfolio. Other Income posted a 7.1% ($25.2M) increase, moving from $356.5M to $386.1M in the comparable period in 2016. Non-Interest Expense remained relatively flat, while Loan Loss Expense increased by 48.6% from $53.8M to $79.9M. Despite being faced with a higher effective tax rate of 30% in 2017 (compared with 26% in 2016), Profit after Tax improved 8.5% ($39.7M) from $466.8M to $506.5M.

Outlook

Desptie weakening economic activity and slower credit growth, SBTT continues to improve its performance. SBTT showed improvement in operational efficiency with a lower productivity ratio of 39% for the third quarter ended July 2017, as compared to 43% in the comparable period last year. The company’s efficiency ratio continues to be stronger than its locally-listed competitors First Citizens Bank Limited (FIRST)and Republic Financial Holdings Limited (RFHL).

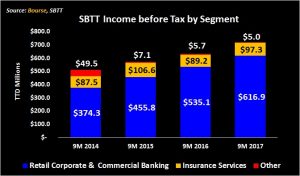

From a segment perspective, core banking remains the major income generator. Retail Corporate & Commercial Banking represents 86% of Income before Tax. This continues to be SBTT’s best performing segment, increasing 64% over a four year period from $374.3M in for the nine-month period in 2014 to $616.9M in the comparable period 2017. The Insurance Services segment remains a distant second, with 11% growth from $87.5M in third quarter 2014 to $97.3M in the comparable period 2017.

The Bourse View

At a current price of $58.05, SBTT trades at a trailing P/E of 15.4 times, above the Banking sector average of 14.0 times. The trailing dividend yield stands at 3.96%, in line with the sector average of 3.91%. On the basis of improving performance and an attractive dividend yield, but mitigated by a subdued economic environment and fair valuation, Bourse maintains a NEUTRAL rating on SBTT.

FirstCaribbean International Bank Limited (FCI)

FCI reported EPS of TT$ 0.435 for the nine month period ended July 2017, a decline of 7.25% from the previous year (TT$0.469). Total Revenue remained relatively flat at TT$ 2.73B. Net Interest Income increased 1.04%, while Operating Income fell 3.23%.

Loan Loss Expense climbed to TT$ 88.8M, an increase of 20.9%. As a result, Income before Taxation fell 8.7%. Overall, Income after Taxation moved from TT$ 753.8M to TT$ 708.1M, a decline of 6.06%.

Outlook

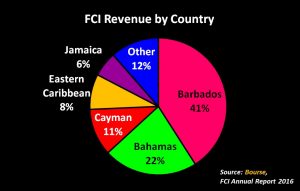

FCI remains geographically diversified with operations throughout the Caribbean. The Group’s siginificant exposure to Barbados (41% of revenue) remains a concern, given negative economic environment of the country.

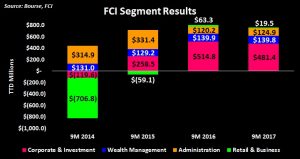

From a segment perspective, Corporate and Investment Banking has been FCI’s main contributor to Income before Tax, averaging 62% for the last two years. This segment amounted to TT$ 481.4M for the nine month period ended July 2017, a decline of 6.5% over the comparable period in 2016. The second largest segment, Wealth Management, remained relatively flat year on year. The Retail and Business segment contributed TT$ 19.5M for the period, which was 69.2% lower than 2016. However, this represents a significant improvement from 2014, where this segment experienced losses of TT$ 706.8M.

The Bourse View

At a current price of $8.10, FCI trades at a trailing P/E of 14.2 times, marginally above the Banking sector average of 14.0 times. The stock offers investors a trailing dividend yield of 4.18%, which is above the sector average of 3.91%. Investors may recall that FCI offers investors the added benefit of investing in TTD and receiving dividends in USD. As such, investors are provided with a hedge against further depreciation of the TTD. Looking ahead, FCI will face headwinds with some of the territories it operates in, which could weigh on results. Bourse maintains a NEUTRAL rating on FCI.

For the detailed report and access to our previous articles, please visit our website at: http://www.remotestores.com

For more information on these and other investment themes, please contact Bourse Securities Limited, at 226-8773 or email us at invest@boursefinancial.com.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”