Pre-Budget Review: Revenues, Reserves and Growth

As Trinidad & Tobago’s Fiscal Year approaches its end (September 30th), this week we at Bourse present the first of a two-part series reviewing how the economy has fared. Today, we take a closer look at the Revenue side of the budget equation and how it has been impacted by the sharp fallout in the energy sector. We also review some of the extraordinary initiatives announced to address recurrent revenue declines and their progress.

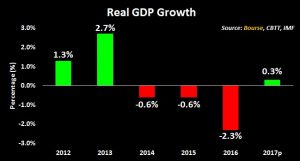

Real GDP Growth set to rebound?

Following three consecutive years of negative Gross Domestic Product (GDP) growth of -0.6% (2014), -0.6% (2015) and -2.3% (2016), the International Monetary Fund (IMF) – in its World Economic Outlook dated April 2017- expects the Trinidad and Tobago economy to improve by 0.3% in calendar 2017. The projection is based on increased production from new natural gas fields, expected to be commissioned throughout the latter half of 2017.

Petroleum Sector Woes

While most other sector contributions to GDP remained constant/improved over the past five years, the Petroleum Sector recorded a significant absolute and relative decline in contribution to GDP. Based on available data from the Central Bank of Trinidad & Tobago (CBTT), this sector accounted for TT $68.5B or 41% of GDP in 2012. In 2016 however, the contribution to GDP was reduced to $27.5B, equating to just 19% of the overall GDP figure of $145.9B. In contrast, all other sectors contributed TT$ 96.7B (59%) of GDP in 2012 and TT$118.5B (81%) in 2016.

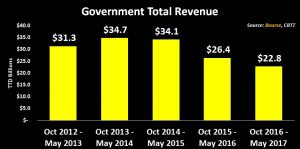

Revenue Lower

For the fiscal period October 2016 to May 2017, Government Total Revenue stood at TT$ 22.8B. This represents a decline of 16% over the comparable period in 2015-2016 and 27% when compared to the same period five years ago.

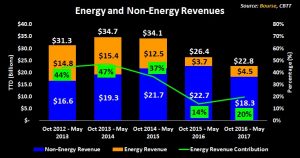

Energy Revenue Slips

Overall, the contribution of Energy revenue to Total revenue has declined over the last five years. From October 2012 to May 2013, Energy revenue stood at $14.8B, representing 44% of total revenue. For the same periods in 2015 – 2016 and 2016 – 2017, however, Energy revenue totalled $3.7B (14% of total revenue) and $4.5B (20% of total revenue) respectively. The Non-Energy component of total revenue has remained relatively stable over the last five years, averaging TT$ 19.7B.

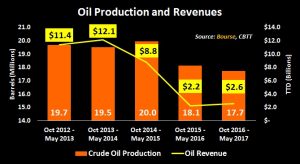

Oil Production, Revenue Lower

The fall in Energy revenue would have been due to a combination of lower crude oil production, coupled with the decline in oil prices during 2016. For the period October 2012 to May 2013, crude oil production totalled 19.7 million barrels. Crude oil production slipped to 18.1 million barrels (-8.1%) for the same period in 2015 – 2016, and stood at 17.7 million barrels (-10.2%) in 2016 – 2017. More importantly, oil prices averaged US$ 91.76/bbl from October 2012 to May 2013. During the same period in 2015 – 2016, oil prices averaged US$ 39.19/bbl (57.3% lower). In 2016 – 2017, there has been improved stability in oil prices, averaging US$ 50.33/bbl, 28.5% higher when compared to 2015 – 2016. Consequently, Oil revenue to the Government, which stood at TT$ 11.4B from October 2012 to May 2013, fell to TT$ 2.2B (-80.7%) for the same period in 2015 – 2016. In 2016 – 2017, the marginal recovery in oil prices would have contributed to improved Oil revenue of 18.2%, totalling TT$ 2.6B.

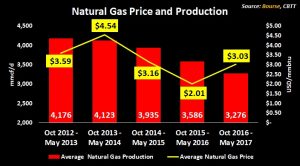

Natural Gas Production Declines

Natural gas production has also fallen over the last five years. From October 2015 to May 2016, Natural gas production averaged 3,586 mmcf/d. For the same period in 2016 – 2017, production averaged 3,276, 8.6% lower when compared to the prior period. On a positive note, the new gas production expected to come on stream should have a positive impact on gas volumes for the remainder of 2017 and into 2018. Natural gas prices have also improved over comparable periods, from an average US$ 2.01/mmbtu in October 2015 – May 2016 to US$ 3.03/mmbtu in the 2016 – 2017 period.

Falling Reserves

With lower energy revenues – the major earner of foreign exchange – T&T’s Net Official Foreign reserves have expectedly come under some strain. Net Official Reserves stood at US$ 8.7B at the end of July 2017. This is 14.8% lower than a year ago, or a decline of US$ 1.5B. Prior to this, Net Official Reserves have remained relatively stable, averaging US$ 10.1B from October 2012 to June 2016. Currently, Net Official Reserves equate to an import cover of 9.6 months at the end of July 2017, a drop from 11.5 months a year ago. Similarly, import cover has been stable from October 2012 to June 2016, averaging 11.6 months.

Divestment Initiatives

In an attempt to address the sharp decline in recurrent revenues, the Honourable Minister of Finance would have outlined various divestment initiatives in the 2016/2017 fiscal Budget and 2017 Mid-year Budget, which the Government set out to undertake throughout FY 2017. Among the successful initiatives was the 26% sale of Trinidad and Tobago NGL Limited (TTNGL) through the Additional Public Offering (APO). During the 2016/2017 fiscal Budget, it was announced that 51% of TTNGL would be sold. This was later revised to 26% in the 2017 Mid-year Budget. The APO would have raised approximately $845M, equal to the amount intended. The Government also offered 20% of its holdings in First Citizens Bank Limited for sale through an APO. However, only 13% was sold, raising $1.03B out of the proposed $1.55B.

Other divestment initiatives such as the sale of TGU (20%), eTeck (50%), CLF Group Assets and Lake Asphalt are yet to materialize, with understandably longer more complicated routes to execution.

In next week’s review, we take a closer look at Government’s expenditure and borrowing trends.

For more information on these and other investment themes, please contact Bourse Securities Limited, at 628-9100 or email us at invest@boursefinancial.com.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”