BOURSE SECURITIES LIMITED

10th July, 2017

TSTT Drives NEL Higher

This week, we at Bourse review the latest financial results of two stocks within the Non-Banking Finance Sector, National Enterprises Limited (NEL) and Scotia Investments Jamaica Limited (SIJL). NEL experienced an upswing in earnings mainly due to an improvement in its TSTT joint venture while SIJL saw a fall in profits. We discuss the performances and provide a brief outlook.

National Enterprises Limited (NEL)

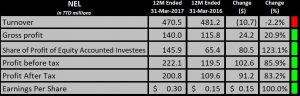

NEL reported Earnings per Share (EPS) of $0.30 for the year ended March 2017, an improvement of 100% when compared to the $0.15 EPS reported in March 2016. NEL’s Share of Profit of Equity Accounted Investees, which usually accounts for the majority of overall profits, increased by $80.5M. NEL, through its consolidated holding of National Flour Mills Ltd. (NFM), recorded a decrease in revenue of $10.7M (2.2%). Gross profit climbed to $140.0M, $24.2M higher when compared to the same period in 2016. Overall, profit for the year moved from $109.6M to $200.8M, an increase of $91.2M or 83.2%.

Outlook

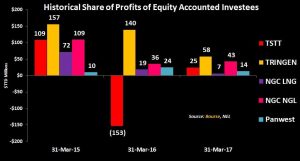

NEL’s Share of Profit of Equity Accounted Investees improved by $80.5M or 123.1% for the year. Of noteworthy was the improved performance of TSTT, which moved from a loss of $153.4M in 2016 to a profit of $24.7M in 2017. Conversely, Share of Profit from TRINGEN declined from $139.6M in 2016 to $58.46M in 2017, a fall of $81.14M.

Dividends received from Investee Companies totalled $60.07M in FY2017, a considerable decline of $301.9M or 83.4% when compared to FY2016. Unlike FY2016, no dividends were received from TSTT or NGC LNG in 2017. Dividends received from TRINGEN, NGC NGL and Panwest fell by 83%, 75% and 45% respectively in 2017.

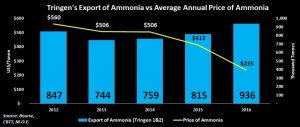

While ammonia exports (for Tringen 1 & 2) have been relatively stable in previous years, ammonia prices remain subdued. In 2016, average annual ammonia prices stood at US$235 /Tonne, 58% lower when compared to 2012 levels of US$560 /Tonne. Ammonia prices averaged US$265 /Tonne in the first quarter of 2017, still some way off the previous levels. Sustained lower ammonia prices could continue to weigh on Tringen’s contribution to NEL’s Share of Profit of Equity Accounted Investees.

Exports and prices of NGLs have reversed the downward trend for the first quarter of 2017. The price of NGLs, based on a weighted basket of propane, butane and natural gasoline, averaged US$90.34 cents per gallon during the first quarter in 2017, 62.1% higher when compared to the same period in 2016. Exports also saw an increase of 14.8%. Improved energy prices may help to stabilize the price of NGLs going forward.

Both NGC NGL and NGC LNG could see an improvement in revenue on account of an expected increase in gas production in the coming months. The performance of TSTT will also have a significant impact on NEL’s earnings going forward.

The Bourse View

At a current price of $10.50, NEL trades at a trailing P/E of 35.0 times, higher than the Non-Banking Finance sector average of 10.2 times. NEL offers investors a trailing dividend yield of 3.33%. Total dividends paid for the financial year amounted to $0.35 per share. As at March 2017, NEL’s cash and cash equivalents stood at $348.1M or $0.58 per share. As such, NEL appears capable of maintaining its dividend payments in the near term. On the basis of expected improvements in LNG and NGL production, coupled with improvements in the performance of TSTT, Bourse maintains a NEUTRAL rating on NEL.

Scotia Investments Jamaica Limited (SIJL)

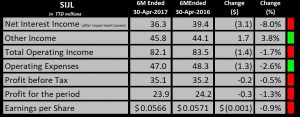

SIJL reported Earnings per Share (EPS) of TT$0.0566 for the six month ended April 2017, a decrease of 0.9% over the EPS of TT$0.0571 reported for the same period in 2016.

Net Interest Income after impairment losses on loans declined 8.0%, to TT$36.3M for the period. Other Income increased 3.8% to $TT45.8M. As a result, Total Operating Income was TT$82.1M, a decrease of 1.7%. Operating Expenses declined TT$1.3M to TT$47.0M. Nevertheless, Profit before Tax declined to TT$35.1M. Profit after Tax also declined, to TT$23.9M from TT$24.2M reported a year earlier.

Outlook

SIJL derived 87% of its Total Operating Income from Net Interest Income after impairment losses and Fees and Commissions for the six months ended April 2017. Revenue from Net Interest Income after impairment losses fell 43.4% compared to revenue generated in the second quarter 2014. Currently, Net Interest Income after impairment losses account for 44.2% of Total Operating Income, down from 58.9% in mid-year 2014. This is in part with SIJL’s long term of strategy of reducing its reliance of Net Interest Income. Consequently, SIJL has grown its revenue from its Asset Management business line by 18%, when compared to same period last year, according to the CEO of Scotia Investments. This is highlighted by the increase in revenues from Fees and Commissions from TT$31.7M at the end of the second quarter 2016 to TT$35.1M at the end of the second quarter 2017. While revenue from Fees and Commission has grown and accounts for a larger share of Total Operating Income in recent years, it has not been sufficient to compensate for the decline in revenue from Net Interest Income (after impairment losses). Greater inflows of non-interest income would increase SIJI’s Total Operating Income. Furthermore, improving economic conditions and accommodative monetary policy also provide a platform for SIJL to increase Total Operating Income.

Total Operating Income has fallen 25% since the second quarter of 2014. Moreover, SIJL’s Operating expenses have remained flat despite declining revenues. As a result, SIJL’s productivity ratio has deteriorated from 41.97% to 57.37% from the second quarter 2014 to the second quarter 2017. Even though there has been a 3% reduction in Total Operating Expenses compared to the same period in 2016, greater efforts must be made in improving operating efficiency given declining revenues.

Scotia Group Jamaica Limited, the parent company of SIJL (77% ownership), has proposed to take SIJL private by cancellation of the shares held by minority shareholders at a price of J$38.00 per share. For shares listed on the Trinidad and Tobago Stock Exchange, shareholders will receive payment in United Sates dollars based on the weighted average selling rate for United States dollars published by the Bank of Jamaica three (3) business before settlement.

The Bourse View

At a current price of TT$2.05, SIJL currently trades at a trailing P/E of 12.2 times, above the Non-Banking Sector average of 10.2 times (excluding NEL). This is also above SIJL’s three-year average P/E of 9.7 times. SIJL’s trailing dividend yield is 4.64%. SIJL pays dividends in USD, thus providing investors with a hedge against a depreciating Trinidad and Tobago dollar. On the basis of an attractive dividend yield and USD dividend payments, but tempered by a high P/E ratio and declining earnings, Bourse maintains a NEUTRAL rating on SIJL.

For the detailed report and access to our previous articles, please visit our website at: http://www.remotestores.com

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”