BOURSE SECURITIES LIMITED

5th June, 2017

JMMGL advances, UCL retreats

This week, we at Bourse review the performance of JMMB Group (JMMBGL) over the twelve months period ended on 31st March 2017 and the first quarter results for Unilever (UCL) ended on March 31st 2017. JMMBGL reported considerable increases in its earnings while UCL struggled under the difficult economic conditions facing its main market Trinidad and Tobago. We provide some perspectives on the varying fortunes of both companies below.

JMMB Group (JMMBGL)

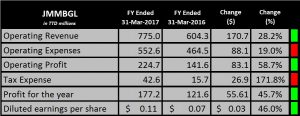

JMMBGL reported Earnings per Share of TT$0.11 for the year ended on March 31st 2017, an improvement of 46 percent over the prior year.

Operating Revenue grew to TT$775M, an increase of 28.2 percent from the previous year. This was mainly attributed to increases in Gains on Securities Trading which advanced by TT$71.8M, followed by Net Interest Income which rose by TT$66.8M and Foreign exchange margins from Cambio trading which increased by TT$15M. Operating Expenses increased to TT$552.6M while Operating Profit jumped to TT$224.7M, an improvement of 58.7 percent compared to Operating Profit generated in 2016. Tax Expense grew by TT$26.9M, an increase of 171.8% due in part to a deferred tax credit in 2016 which resulted in a lower tax expense that year. This credit did not reoccur in 2017, consequently higher taxes were paid. Nevertheless, Profit for the year advanced by 45.7% or TT$55.6M.

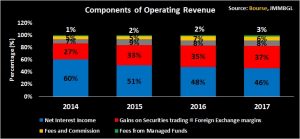

Outlook

The Group has been able to generate improvements in every revenue stream over the last four years. Net Interest Income, the largest contributor to total Operating Revenue, advanced by 23% mainly due to growth in loan and investment portfolios, which grew by 26 percent and 9.3 percent respectively. Operating Profit margin for 2017 stood at 28.9%, higher than the margins generated in the two previous years. Lower interest rates, higher business confidence and a faster pace of economic growth in Jamaica likely contributed to improvements in the Group’s Net Interest Income. This segment should continue to improve once inflation remains tempered and economic conditions continue to improve. Revenues from Gains on Securities Trading grew from TT$123M in 2014 to TT$284 in 2017. This performance highlighted this revenue stream’s growing share of total Operating Revenue in recent years. In 2013 this revenue stream accounted for 27 percent of Operating Revenue, by 2016 it grew to 37 percent. The favourable economic conditions in Jamaica and opportunities in the global economy have contributed to the performance of this revenue stream.

The Bourse View

At a current price of TT$1.28, JMMBGL trades at a trailing P/E of 11.92x above the Non-Banking Finance sector average of 10.87x (excluding NEL). The trailing dividend yield is 1.86%, below the sector average of 3.31% (excluding NEL). The market to book ratio is 1.52x above the sector average of 1.21x (excluding NEL). Based on improving performance but tempered by high valuations and a relatively low dividend yield, BOURSE maintains a NEUTRAL on JMMBGL.

Unilever Caribbean Limited (UCL)

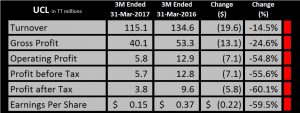

UCL reported Earnings per Share of $0.15 for the first quarter ended 31st March 2017, down 59.5 percent from the corresponding period in 2016.

Turnover fell $19.6M to $115.1M, a decline of 14.5 percent. Gross Profit for the first quarter fell to $40.1M, down 24.6 percent from the prior period. With relatively high Selling and Distribution costs, Operating Profit was recorded at $5.8M, down 54.8% from the same period in 2016. Consequently, Profit before Tax declined 55.6 percent to $5.7M and Profit after Tax decreased 60.1% to $3.8M.

Outlook

While Gross Profits have remained relatively stable, Profit before Tax has declined 52% since 2013. Selling and Distribution expenses are relatively high and have risen consistently since 2013, resulting in a considerably lower Operating Profit margins. In 2013, Operating Profit margin was 57.5%, this has since fallen to 36.9% by 2016. Recent capital expenditure under the Capex program is intended to boost efficiencies and enhance profit delivery. This expense should result in greater cost efficiencies and improved profit margins moving forward.

UCL generated 57% of total revenue in the Trinidad and Tobago market in 2016 , this market continues to see a deterioration in economic performance, compounded by difficulty accessing foreign exchange and higher tax rates. The economic challenges facing the domestic economy and other operating territories have impacted UCL’s first quarter performance and this should continue in coming quarters.

The Bourse View

At a current price of $52.60, UCL trades at a trailing P/E of 37.57x, above the Manufacturing I average of 22.57x. UCL offers investors a trailing dividend yield of 2.38% below the sector average of 3.39%. On the basis of high valuations, below average dividend yield and challenges facing its main main market, BOURSE maintains a SELL on UCL.

For the detailed report and access to our previous articles, please visit our website at: http://www.remotestores.com

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”