BOURSE SECURITIES LIMITED

24th April, 2017

Q1 2017 Local Market Review

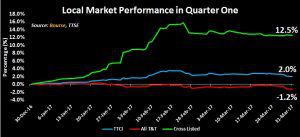

This week, we at Bourse review the performance of the local equity market for the first quarter of 2017. Q1 2017 could be described as a period of resilience for Trinidad & Tobago stocks, while cross-listed stocks strongly advanced. We examine the three stock indices, namely the Trinidad and Tobago Composite Index (TTCI), the All T&T Index (All T&T) and the Cross Listed Index (CLX), as well as highlight the major movers of the various indices. Finally, we highlight some important factors investors should consider for positioning their portfolio.

Local Market Review

The Trinidad and Tobago Composite Index (TTCI) – which comprises locally listed and cross listed stocks – appreciated 2.0% at the end of the first quarter. On the heels of a 57.9% improvement in 2016, the Cross Listed Index (CLX) advanced 12.5% in the first quarter, continuing to outperform local equities. The All T&T Index (All T&T) declined 1.2%. By market capitalization, cross-listed securities account for approximately 26% of the TTCI while the remainder is attributable to local securities. At the end of the first quarter, 19 stocks advanced, 13 declined (inclusive of the Clico Investment Fund or CIF) and 2 traded firm. Trading activity on the TTCI for the first quarter amounted to TT$ 184.2 million (inclusive of mutual funds – TT$ 252.9 million). This represents a decline of 21.4% or TT$ 50.2 million when compared to the first quarter in 2016. With respect to trading volume, 19.6 million shares were traded on the TTCI, down 31.5% when compared to the comparible period in 2016.

Cross-Listed stocks outperform, All T&T Down

Four out of the top five advancers on the TTCI were cross-listed securities. JMMBGL was the top performer during the first quarter, advancing 33.3%. The steepest declines were realized amongst T&T companies, with the lowest being OCM, down 14.8%.

Takeovers and Additional Public Offerings

During the quarter, CEMEX S.A.B. made an offer and take-over bid for TCL. The offer was for up to a maximum of 132,616,942 ordinary shares, at a price of TT$ 5.07 (US$ 0.76) per share. At the close of the offer, CEMEX indicated that approximately 114,313,299 shares were accepted, thereby taking CEMEX’s ownership in TCL to approximately 70.01%.

The second significant market event was the Additional Public Offering of First Citizens Bank’ shares. In the 2016 Budget Statement, the Honourable Minister of Finance indicated GORTT’s intention to sell 25% of its 77.17% shareholding in in First Citizens. That is, the government offered 48,495,665 ordinary shares for sale, at a price of $32.00 per share. The total expected proceeds of $1.55 billion is expected to be used to partly fund the government’s fiscal gap. If all the shares offered were accepted, GORRT’s ownership in First Citizens would now stand at 57.88%. The final notification of allotment of shares is expected to be given by May 8th, 2017.

Sector Review

Banking

The three locally-based banks, FIRST, RFHL and SBTT, delivered improvements in Net Interest Income and Other Income during the first fiscal quarter of 2017, when compared to the same period in 2016. This drove positive EPS growth across the board. In terms of price movements for the quarter, FIRST and RFHL declined 9.5% and 5.9% respectively, while SBTT remained flat. The share price of FIRST fell to $32.00 prior to the Additional Public Offering.

The Cross-listed banks were the best sector performers for the period. Jamaican-based NCBFG continued to be the star performer in the Banking sector, advancing 26%. FCI’s stock price advanced 4.1%

Conglomerates

Price movements in the Conglomerates sector was relatively muted. Locally based AMCL recorded negative revenue growth and operating income growth during FY2016, largely due to one-off events combined with higher taxation. The Group’s share price remained relatively flat during the quarter (down 0.2%). The other locally-based conglomerate, MASSY, saw it price creep up 1.9% during the quarter. GKC continued to demonstrate growth across all segments, which in turn pushed revenue up 10.7% YOY. Despite this, GKC’s stock price marginally declined 0.4%.

Manufacturing

There was a consistent theme of revenue declines across most companies in the Manufacturing sector, undoubtedly owing to lower consumer spending throughout the economy. Despite the decline, companies such as NFM and WCO were able to reduce expenses and improve/maintain operating efficiency. Even with improved efficiency, companies across the sector felt the negative impact of higher corporate taxation, which in turn weighed on earnings. NFM for example posted Profit Before Tax growth of 29%, but Profit After Tax growth of only 1.9%. A similar trend is seen in the results of UCL, where Profit Before Tax growth was 2.4% but Profit After Tax growth was -4.6%.

The standout movements in EPS included TCL and AHL, which fell 91.6% and 26.3% respectively. In terms of price movement, TCL fell 4.5% while UCL declined 3.1%. NFM traded up 3.2%, with AHL and WCO remaining stable.

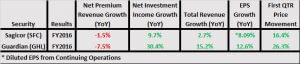

Non-Banking Finance

Both SFC and GHL faced lower premium revenue of -1.5% and -7.5% respectively. SFC experienced Net Investment Income growth of 9.7%, while GHL’s Net Investment Income improved 30.4%. SFC’s Total Revenue moved up 2.7%, with an improvement in diluted EPS from continuing operations of 8.09%.The strong performance of GHL’s Net Investment Income pushed Total Revenue growth to 15.2%, leading to an increase in EPS of 12.6%. The results were reflected in the stock price movement of both Groups, with SFC trading up 16.4% during the quarter and GHL increasing 26.3%.

Energy

The sole company in the Energy sector, NGL, experienced an increase in the Share of Profit from PPGPL of 20.3% in 2016. Both prices and exports of NGLs declined 3.9% and 21.5% respectively. However, prices and exports of NGLs trended upward in the latter part of 2016, leading to the increase in Share of Profits. Adjusting for an impairment reversal, NGL’s EPS improved 19.2% YOY. During the quarter, NGL’s stock price increased 2.4%.

Investor Implications

Market participants will now keenly focus on the pending quarterly financial results of companies, particularly those based in Trinidad & Tobago, to evaluate the impact of higher corporate taxation and possible lower consumer spending on performance. .

With the above in mind, investors may be wondering how to adjust their portfolios to minimise risk and maximise potential returns. Firstly, investors should target stocks with relatively attractive valuations (low price/earnings multiples), as well as above-average dividend yields. Stocks which have low payout ratios (and therefore a higher capacity to preserve the level of dividends paid to investors) may also be favoured. Finally, investors should consider companies with a lower exposure to Trinidad and Tobago and revenues/earnings in US dollars, as this could mitigate the impact of lower economic activity and potentially provide a hedge against depreciation of the TT dollar. As always, investors should consult a trusted and experienced advisor, such as Bourse, to help make better investment decisions.

For the detailed report and access to our previous articles, please visit our website at: http://www.remotestores.com

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”