BOURSE SECURITIES LIMITED

February 6th, 2017

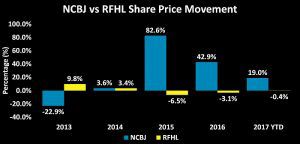

NCBJ, RFHL Post Positive Results

This week, we at Bourse review the first quarter performance for the period ended December 2016 of two Banking sector stocks, National Commercial Bank of Jamaica (NCBJ) and Republic Financial Holdings Limited (RFHL). Both securities have experienced contrasting share performance year-to-date, with NCBJ up 19%, while RFHL has traded relatively flat (down 0.4%). We provide some perspective on the corporate and market performance for NCBJ and RFHL on various factors, which may have an impact in the near term.

National Commercial Bank of Jamaica (NCBJ)

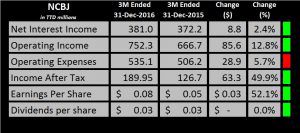

NCBJ generated Earnings per Share of TT$0.08 for the first quarter ended December 2016, up 52% when compared to the prior year. Net interest income grew by 2.4%, from TT$ 372M to TT$ 381M. The primary driver of operating income was Gain on Foreign Exchange and Investment Activities, which increased by 177% (TT$ 57.7M). This was attributable to investment activities executed by the Treasury and greater trading activity. Net fee and commission income also improved, up 31% (TT$ 43.2M) leading to higher operating income of TT$ 85.6M (12.8%). Provision for credit losses declined by TT$ 10M (44.6%). Overall, operating expenses increased by TT$ 28.9M (5.7%). Share of profit of associates amounted to TT$ 43.4M, an increase of TT$36M (489%) when compared to the previous year. This was mainly due to the firm’s 29.99% shareholding in Guardian Holdings Limited (GHL). Overall, net profit increased by TT$ 63.25 M (49.9%), from TT$ 126.7M to TT$ 189.9M.

Outlook

The majority of NCBJ’s revenue stems from Jamaica. Supported by the IMF’s Extended Fund Facility, the Government of Jamaica has been able to improve economic conditions to promote growth, with inflation declining to 1.9% in September 2016 (2.5% in June 2016). This in turn has improved investor sentiments across the board. With a new Precautionary Stand-By Arrangement with the IMF, growth is expected to remain moderate, but on an upward trend. The Central Bank has projected real GDP to grow between 1% and 2% in the upcoming year. This in turn could translate into higher spending which bodes well for NCBJ’s loan growth potential. Additionally, the firm stands to benefit from its ownership in GHL and Jamaica Money Market Brokers Group Limited (JMMBGL), which have both seen recent improvements in its performance. As a result, its Share of Profits of Associates could increase, thereby leading to an overall improvement in Net Profit.

The Bourse View

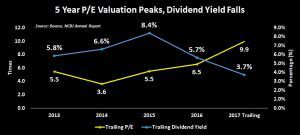

At a current price of $3.57, NCBJ offers investors a trailing dividend yield of 3.7%. Furthermore, the stock trades at a trailing P/E of 9.9 times. This P/E value represents the highest multiple in the last 5 years. Investors have responded positively to the improving performance of NCBJ in recent quarters, so much so, that the stock surged 43% in 2016 and has already 19% year to date. On the basis of NCBJ’s improving corporate performance, but tempered by an aggressive increase in share price and reduced dividend yield, Bourse maintains a NEUTRAL rating on the stock.

Republic Financial Holdings Limited (RFHL)

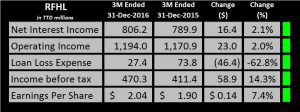

RFHL’s net interest income improved by 2% ($16.4 M), from $790 M to $806 M when compared to the same period a year ago. This was driven by an increase in customer advances of 2.9%. Other income also marginally improved, contributing to an overall increase in operating income of $23 M (1.9%). Partially offsetting income improvements were higher operating expenses of 1.5% ($10 M). Notably, loan impairments declined by 62.9% ($46.4 M). As a result, net profit improved by $31.9 M (10.2%), from $311.3 M to $343.2 M.

Outlook

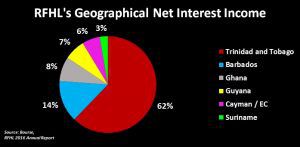

While the Group continued its diversification objectives throughout the year, Trinidad and Tobago remains its major market, accounting for 62% of net interest income. Consequently, the Group’s major operating jurisdiction is likely to confront headwinds in the form of lower economic activity in the near term. Additionally, profits will be taxed at a higher rate in this fiscal year. On a more positive note, its remaining 38% of net interest income is generated from the Caribbean region and Ghana, all of which are expected to grow moderately in 2017.

The Bourse View

At a current price of $107.98, RFHL trades at a trailing P/E of 18 times and pays a trailing dividend yield of 4%. Adjusting for the bank’s one-off impairment expense on it investment in HFC (Ghana) Limited, its P/E would be in the range of 14.5 times. Given RFHL’s ownership structure whereby the top 10 shareholders account for 86% of total outstanding shares, a relatively attractive dividend yield, but modest economic outlook for its main revenue-generating jurisdiction, Bourse maintains a NEUTRAL rating on RFHL.

For the detailed report and access to our previous articles, please visit our website at: http://www.remotestores.com

For more information on these and other investment themes, please contact Bourse Securities Limited, at 628-9100 or email us at invest@boursefinancial.com.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”