December 12th, 2016

FirstCaribbean, Scotia deliver strong results

This week, we at Bourse discuss the Year End results of Scotiabank Trinidad and Tobago Limited (SBTT) and First Caribbean International Bank (FCI). Both stocks have posted commendable full-year results, despite an increasingly difficult operating environment. We take a moment to review their respective performances and provide some perspective on future performance.

SBTT Stronger

For the year ended October 31 2016, Scotiabank Trinidad and Tobago Limited reported Earnings per Share (EPS) of $3.55, an improvement of 10.4% when compared to its FY2015 EPS of $3.21. Net interest income increased from $974.6 million to $1,129 million, an increase of $154.4 million (15.8%). This was, however, driven primarily by widening interest margins as Net Loans to Customers increased just 1.4% from $13.09 billion to $13.27 billion. Other Income declined 3.6% from $497.3M in FY2015 to $479.2M in FY2016. In terms of costs, non-interest expenses climbed 5.4%. while loan loss expenses almost doubled from $38.5 million to $76.7 million. As a result, Profit after Tax improved 10.4% from $566.1M to $637M.

Outlook:

For the second consecutive year, SBTT declared a special dividend of TT$1.00 per share, bringing total trailing 12-month dividend payments to TT$3.00 per share. Excluding special dividends, trailing 12-month dividends of TT$2.00 per share would result in a trailing dividend yield of 3.4%.

Like most other businesses, SBTT will confront the effects of lower economic activity in 2017. As recessionary pressures mount, consumers may use more caution as it relates to loans. For SBTT, the firm may focus on improving its expense management, keeping a keen watch over loan losses and searching for efficiency gains. Corporate Taxation changes in 2017 will also weigh on SBTT like all the companies in Trinidad & Tobago. Specifically, the marginal income tax rate of 30% on all profits over $1M will decrease profit after tax and by extension could lead to a decline in earnings per share.

The Bourse View:

At a price of $58.69, SBTT trades at a trailing P/E of 16.6x, marginally above the sector average of 14.4x. Shareholders will welcome the special dividend payment for the 2nd year running, while the trailing dividend yield (based on regular dividends) stands at 3.4%. While this falls below the sector average of 3.9%, the trailing dividend yield combined with the special dividend would translate into 5.1%. On the basis of good dividend yield, but tempered by the effects of subdued economic activity and new taxation measures, Bourse maintains a NEUTRAL rating on SBTT.

FCI grows

CIBC FirstCaribbean International Bank (FCI) reported Earnings per Share of TT$ 0.61 for the year ended October 31 2016, a notable improvement of 48.3% from the previous year (TT$0.41). A 1.9% increase in net interest income, coupled with higher operating income (2.7%) led to an improvement in total revenue by 2.2% from TT$3,551.7 million to $3,629.3 million. FCI reported a 3.4% decline in operating expenses from TT$2.51 billion to TT$2.43 billion. A sharp decrease (-58%) in loan loss impairments to TT$117 million in FY2016 from TT$ 82 million in FY2015 contributed significantly to the improvement in performance. As a result, net income for the year increased from TT$665 million to TT$974 million, up TT$309 million or 46%.

Outlook

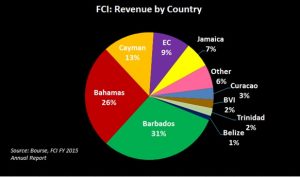

FCI’s revenue is not expected to be significantly impacted from lower economic activity in Trinidad and Tobago, given that just 2% of its revenue comes from T&T. However, the bank’s major markets of Barbados and Bahamas are expected to grow at sluggish rates of 1% and 1.7% respectively in 2017, according to the IMF. For the Trinidad & Tobago investor, FCI offers considerable value being a TT dollar denominated investment which provides US dollar cash flows in the form of dividends.

The Bourse View:

At a current price of $8.50, FCI trades at a trailing P/E of 14 times, just under the sector average of 14.4 times. In addition, the stock offers investors a reasonable dividend yield of 3.6%, with a trailing payout ratio of 50.6%. It should be noted that the stock has appreciated approximately 70% for the year, reflecting investors’ positive sentiments. Given the firm’s low exposure to Trinidad and Tobago, moderate valuation and dividend payments in US dollars, Bourse maintains a BUY rating on FCI.

GORTT new bond issue announced

The government of Trinidad and Tobago announced its first public TT dollar bond issue for fiscal 2016/2017. The TT$500 million issue offers investors a coupon rate of 3.80%, maturing on December 19, 2022. The 6-year bond will be issued through the Central Bank via an auction system. Investors interested in submitting bids can contact a listed government securities intermediary for more information. Though the auction will close at 1:00 pm on Thursday December 15, 2016, applications for non-competitive bids will be accepted up to 12:00 noon on Tuesday December 13, 2016.

The auction is likely to be well received given the paucity of fixed income investment options in TT dollars, combined with the persistent excess liquidity overhang.

For the detailed report and access to our previous articles, please visit our website at: http://www.remotestores.com

For more information on these and other investment themes, please contact Bourse Securities Limited, at 628-9100 or email us at invest@boursefinancial.com.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”