HIGHLIGHTS

MASSY Q12025

- Earnings:

- Earnings Per Share 4.2% higher

- Continuing Operations: EPS 1.9% higher, from $0.0925 to $0.0942

- Performance Drivers:

- Revenue Growth

- Stable Profitability Margins

- Outlook:

- Post-Integration Efforts/Geographical Diversification

- Rating: Maintained at OVERWEIGHT

AGL Q12025

- Earnings: Earnings Per Share (EPS) declined 2.0% from $1.00 to $0.98

- Performance Drivers:

- Revenue Growth

- Outlook:

- Growth from Acquisition Activities

- Rating: Maintained at MARKETWEIGHT

This week, we at Bourse review the performance of Conglomerate and Trading sector giants Massy Holdings Limited (MASSY) and Agostini Limited (AGL) for their respective three months ended December 31st, 2024 (Q12025). MASSY reported higher revenue and stable profitability, while AGL’s profits narrowed despite revenue growth. What might investors in both stocks expect in the coming months? We discuss below.

Massy Holdings Limited (MASSY)

Massy Holdings Limited (MASSY) reported Earnings per Share (EPS) of $0.0962 for the first fiscal quarter ended December 31st, 2024 (Q12025), 4.2% higher than the $0.0923 reported in Q12024. EPS from Continuing Operations grew 1.9% from $0.0925 to $0.0943 per share.

Revenue amounted to $4.16B in Q12025, up 6.0% from $3.92B in Q12024. Operating Profit after Finance Costs climbed 6.9% to $303.5M, with an Operating Profit Margin of 7.3% (prior comparable period: 7.2%). Share of Results of Associates and Joint Ventures swung to a loss of $0.15M, relative to a prior period $7.84M profit. Profit Before Tax (PBT) grew by $11.7M (4.0%) to $303.4M.

Profit for the period from continuing operations amounted to $202.1M, 1.9% higher compared to $198.3M in the prior period. MASSY reported a profit from discontinued operations of $3.84M versus a loss of $0.35M in Q12024. Accordingly, Profit for the period advanced 4.0% to $206.0M compared to $198M from the prior period. Overall, Profit Attributable to Owners of the Parent stood at $190.5M, 4.3% higher, compared to $182.7M reported in the prior period.

Segment Performance Mixed

MASSY’s PBT growth in Q1 2025 was primarily supported by its major segment – Integrated Retail – which resulted in an expansion of 4.0% quarter on quarter.

Integrated Retail, the most significant contributor to PBT (66%), expanded by 14%, from $176M in Q12024 to $200M in Q12025, driven by increased sales volume and improved performance resulting from a shift in product mix, according to the Group.

Gas Products (29.1% of PBT), the second-largest contributor, fell by 8.5% from $96M to $88M, reportedly owing to increased input costs and divestment activities which led the absence of revenue from the recently sold CIG associates business and weaker performance within their associates businesses, according to the Group.

Motor & Machines, (15.3% of PBT) rose 1.7% to $47M from $46M in Q12025, benefitting from improvement in the Group’s Colombia operations amidst a reportedly softer T&T market performance.

Financial Services, representing 7.2% of PBT, grew 6.3% quarter on quarter to $22M, relative to $21M in the prior period.

Margins Stable

MASSY’s profit margins were generally stable when compared to the prior reporting period. Operating Profit Margin rose marginally to 7.3% compared to 7.2% in Q12024. Profit Before Tax Margin dipped slightly to 7.3% in Q12025, from 7.4% a year earlier. Profit after Tax declined from 5.1% to 4.9% in Q12025.

According to the Group, the group’s profitability was weighed on by weaker results from the Gas Products Portfolio, a notable 8.5% contraction in PBT performance quarter on quarter.

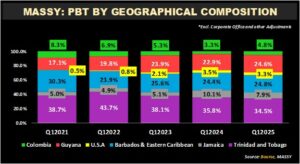

Geographic Diversification Expands

The Group continues to benefit from its recent acquisitions/diversification efforts – locally, regionally and internationally which is reflected in the breakdown of its PBT by geographic composition.

Trinidad & Tobago, the largest geographical contributor to PBT (34.5%), increased 1.7% compared to a year ago, from $121.1M to $123.3M. Barbados & the Eastern Caribbean (24.8% of PBT) advanced 7.2% to $88.5M, relative to $82.5M in the prior reporting period. Guyana’s share of PBT (24.6%) grew by 13.6%, from $77.4M in Q12024 to $87.9M in the current reporting period. Notably, Jamaica’s operations (7.9% of PBT) contracted by 17.4%, from $34.3M in Q12024 to $28.3M in Q12025. Colombia’s operations contributed 4.8% to PBT, significantly higher by 54.9% quarter on quarter from a prior $11.1M. PBT from U.S.A. operations (3.3%) slid 1.1% from $12.0M to $11.8M. Importantly, PBT outside of Trinidad & Tobago grew 7.6% quarter on quarter, as the Group continues its growth strategy for FY2025.

The Bourse View

At a current price of $3.84, MASSY trades at a trailing P/E of 11.5 times, below the Conglomerate Sector average of 13.0 times. The Group declared an interim dividend of $0.0354 per share payable on March 28th, 2025, to shareholders on record by February 28th, 2025. The stock offers investors a trailing dividend yield of 4.3%, above the sector average of 3.4%.

MASSY continues to pursue its strategic objectives, while it pivots on the benefits of integration from existing acquisitions, growing momentum with a well-diversified portfolio, while maintaining its optimistic view for fiscal year 2025. On the basis of continued modest revenue growth, accretive acquisition activity and fairly attractive valuations when compared to the sector, Bourse maintains an OVERWEIGHT rating on MASSY.

Agostini Limited (AGL)

Agostini Limited (AGL) reported an Earnings Per Share of $0.98 for the three months ended December 31st, 2024 (Q12025), a decline of 2.0% relative to $1.00 reported in the previous comparable period.

Revenue expanded 8.7% to $1.48B from a previous $1.36B, driven by recent acquisition activities. Operating Profit fell 3.9% to $154.5M, compared to $160.7M in Q12024. Finance Costs marginally increased 0.3% to $15.50M. Resultantly, Profit Before Taxation fell 4.3% from $145.3M to $139.0M. Taxation Expense dropped from $40.7M in Q12024 compared to $38.3M in Q12025, with AGL’s Profit for the Period amounting to $100.7M compared to $104.5M (3.7% lower). Overall Profit Attributable to Owners of the Parent decreased by 1.9% to $68.0M from $69.3M reported in the prior period.

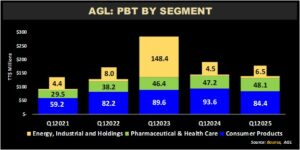

PBT Lower

For the first quarter of 2025 (Q12025), AGL’s Profit before Taxation decreased by 4.3% to TT$139.0M. The Consumer Products segment, which accounted for 60.7% of PBT, declined 9.9% to $84.4M from $93.6M in Q12024. The Pharmaceutical & Health Care segment, contributing 34.6% of PBT, grew 2.0% from $47.2M in Q12024 to $48.1M in Q12025. The Energy, Industrial, and Holdings segment made the smallest contribution to PBT (4.7%) but experienced a notable 43.8% growth to $6.5M.

Recent Developments

- On February 3rd 2025, AGL announced, via its subsidiary, Caribbean Distribution Partners Limited (CDP) signed a Share Purchase Agreement to acquire 100% of the issued and outstanding shares of Massy Distribution (Jamaica), a pharmaceutical and consumer products distribution company. This strategic acquisition is expected to boost the Group’s Consumer Products and Pharmaceutical businesses.

- The Group received requisite approvals for a name change from Agostini’s Limited to Agostini Limited, together with the introduction of a new corporate logo.

- Additionally, the Group is progressing with plans to rebrand its Pharmaceutical & Healthcare Distribution companies under the name Aventa, and the Caribbean Distribution Partners Limited (CDP), a joint venture of the Consumer Products business, will be rebranded to Acado, effective in the second quarter.

Margins Decline

AGL’s Operating and Profit before Tax margins declined year-on-year to 10.4% and 9.4%, respectively. Operating Profit Margin decreased from 11.8% in Q12024 to 10.4% in Q12025, falling below the Group’s trailing five-period average of 11.4%. Meanwhile, the Profit before Tax Margin narrowed to 9.4% from 10.7%.

According to the Group, overall profitability was impacted by challenging market conditions in Trinidad and Tobago, along with restructuring efforts and associated costs relating to integrating its acquisitions in both the local and regional space.

The Group’s 12M Trailing EPS amounted to $3.49 in Q12025, a 65.4% increase compared to $2.11 in Q12024. The Group’s Price-to-Earnings (P/E) multiple fell to 19.5 times from 32.5 times in the prior corresponding period, still reasonably fair compared to its 5-year historical average of 17.8 times and current trading sector average of 18.5 times.

The Bourse View

AGL currently trades at a price of $68.00, offering a dividend yield of 2.3%, below the sector average of 5.7%. AGL’s revenues continue to trend positively through both organic and inorganic means. The company continues to execute on its growth strategy via acquisitions within the regional markets allowing for greater geographical diversification within the Group. On the basis of increased revenue, and continued acquisition activities but tempered by relatively fair valuations, Bourse maintains a MARKETWEIGHT rating on AGL.

This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third-party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”