HIGHLIGHTS

NFM 9M2024

- Earnings: Earnings Per Share increased 47.4% from $0.22 to $0.32

- Performance Drivers:

- Lower revenue

- Higher Margins

- Reduced Finance Costs

- Outlook:

- Cost Management

- Increased economic activity

- Rating: Maintained at MARKETWEIGHT

OCM 9M2024

- Earnings: Diluted Earnings Per Share decrease 19% from $0.21 to $0.17

- Performance Drivers:

- Reduced Revenues

- Mixed Margins

- Outlook:

- Lower Operating Expenses

Rating: Maintained at MARKETWEIGHT

This week, we at Bourse review the performance of National Flour Mills (NFM) and One Caribbean Media Limited (OCM) for their respective nine-month periods ended September 30th 2024. NFM would have benefitted from improved profitability margins, while OCM continued to be constrained by reduced revenues and profitability. How will both companies fare in the coming months ahead? We discuss below.

National Flour Mills Limited (NFM)

NFM reported Earnings per Share (EPS) of $0.32 for the nine months ended September 30th, 2024 (9M2024), up 47.4% from $0.22 reported in the prior comparable period (9M2023).

Revenue for the period contracted 10.5% from $431.3M in the prior year period to $386.1M in 9M2024. Gross profit advanced 5.1% to $116.1M. Selling and distribution expenses and administrative expenses grew 7.6% and 3.6% year-on-year respectively. Other operating income increased 6.0% to $4.6M from $4.3M a year earlier. Operating Profit advanced 4.8% to $46.2M relative to a prior $44.0M in 9M2023. Finance cost declined 83.0% YoY from $4.6M to $0.8M. Profit before Taxation climbed 15.1% YoY and amounted to $45.4M. Taxation expense dropped 47.7% from $13.4M to $7.0M in 9M2024, with the effective tax rate moving from 34.0% to 15.5%. Overall, NFM declared Profit After Taxation (PAT) of $38.4M, up 47.5% or $12.4M higher relative to $26.0M in 9M2024.

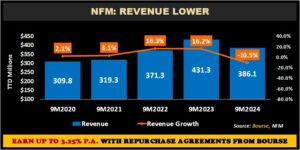

Revenue Lower

NFM’s revenue declined by 10.5% to $386.1M from a prior $431.3M, consistent with prior quarters, as the Company shared the benefits of lower input costs (lower purchasing cost of feedstock) through reduced prices.

Margins Higher

Gross Profit Margin improved from 25.6% in 9M2023 to 30.1% in 9M2024, with grain prices falling relative to the prior comparable period. Operating Profit Margin stood at 12.0%, higher than a previous 10.2% in 9M2023. Profit before Tax Margin advanced to 11.8% in 9M2024, up from 9.1% a year earlier. NFM reiterated its focus on increasing exports and expanding its reach within the Caribbean market.

The Bourse View

At a current price $1.70, NFM trades at a trailing P/E multiple of 4.2 times, below the Manufacturing Sector average of 9.6 times. The stock offers investors a trailing dividend yield of 5.9%, above the Manufacturing Sector average of 4.5%. On the basis of improved profitability margins and below sector average valuations but tempered by lower revenues and the impact of volatile commodity prices on earnings stability, Bourse maintains a MARKETWEIGHT rating on NFM.

One Caribbean Media Limited (OCM)

OCM reported Diluted Earnings per Share (EPS) of $0.17 for their respective nine months reporting period ended September 30th, 2024 (9M2024), 19.0% lower relative to $0.21 reported in the prior comparable period (9M2023). Revenue for the period contracted 6.2% year-on-year (YoY) to $221.8M from a prior $236.4M. Cost of providing services fell by 6.4% to $158.6M from $169.5M. Consequently, Gross Profit for the period declined 5.5%, from $66.8M to $63.1M in 9M2023. Administrative Expenses amounted to $44.1M, an improvement of 0.3% year-on-year, conversely, Marketing Expenses dropped 13.5% to $1.3M, compared to $1.5M in the prior period. For nine months 2024, Operating Profit contracted by 17%, from a prior $21.4M. Profit before Taxation declined 15.3% year on year, which amounted to $18.6M from a prior $21.9M. Overall, OCM declared Profit After Taxation (PAT) of $14.1M, up 12.3% or $2.0M lower relative to $16.1M in 9M2023.

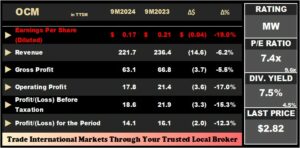

Revenue Lower

OCM’s Total revenue fell 6.2% year on year. The company’s performance was impacted by poor cyclicality in its T&T geographic segment, as well as sub-par performance in its none-core business in Barbados. Overall, Revenue has remained relatively rangebound over the past 5 comparable periods ($217-241M).

Mixed Margins

OCM’s profitability margins have shown mixed results in 9M2024, relative to historical levels. Gross Profit Margin improved slightly from 26.7% in 9M2023 to 30.1% in 9M2024. Despite this improvement, Operating Profit Margin was marginally lower by 8.0%, from a prior 9.1% in 9M2023. Profit before Tax Margin fell 8.4% compared to 9.3% a year earlier.

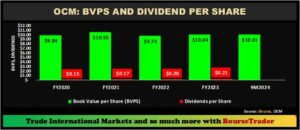

BVPS, Dividends Stable

OCM’s Book Value per Share have remained relatively stable, ranging between $9.74 -$10.55 over the past five years, with the current Book Value per Share at $10.01. The group would have paid a final dividend of $0.21 for the fiscal year 2023 compared to $0.20 in fiscal year 2022. Income-oriented investors would be keenly anticipating a final dividend payment for FY2024.

The Bourse View

At a current price $2.82, OCM trades at a trailing P/E multiple of 7.4 times, below the Manufacturing Sector average of 9.6 times. OCM trades at a price-to-book value of 0.28 times, below the sector average of 1.2 times. The stock offers investors a trailing dividend yield of 7.5%, above the Manufacturing Sector average of 4.5%.

Despite broadly lower profitability margins, OCM continues to navigate, on both an operational and strategic level, the challenges faced within its operations, whilst maintaining consistent dividend payments to investors. On the basis of above sector average dividends and fair valuations tempered by reduced revenues, Bourse maintains a MARKETWEIGHT rating on OCM.

DISCLAIMER: “This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase, or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives, or agents, accepts any liability whatsoever for any direct, indirect, or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third-party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”