HIGHLIGHTS

FCGFH FY2024

- Earnings: Earnings Per Share up 23.1% to $3.79 from $3.08

- Performance Drivers:

- Increased Revenue Growth

- Higher Operating Profit

- Outlook:

- Continued Economic Activity

- Rating: Maintained at OVERWEIGHT

JMMBGL HY2024

- Earnings: Earnings Per Share declined 67.7% from $0.04 to $0.01

- Performance Drivers:

- Lower Operating Revenue

- Higher Operating Expenses

- Outlook:

- Lower Interest Rate Environment

- Rating: Maintained at UNDERWEIGHT

This week, we at Bourse review the performance of First Citizens Group Financial Holdings Limited (FCGFH) and JMMB Group Limited (JMMBGL) for their respective full year (FY2024) and half year (HY2024) results both ended September 30th, 2024. FCGFH reported higher revenues reflecting generally improving conditions, while JMMBGL was affected by a fall in profits in its Associated Company, Sagicor Financial Corporation. We discuss below.

First Citizens Group Financial Holdings Limited (FCGFH)

First Citizens Group Financial Holdings Limited (FCGFH) reported Earnings per Share (EPS) of $3.79 for the full year ended September 30th, 2024 (FY2024), up 23.1%, relative to $3.08 reported in the prior comparable period (FY2023).

Net Interest Income stood at $2.06B, 11.1% higher than $1.86B reported in the prior year. Fees and Commissions increased 1.3% to $500.7M and Other Income improved 29.6% to $175.5M. Overall, Total Net Revenue improved 10.6% to $2.73B, with a comparable period standing at $2.47B in FY2023. The Group reported a Credit Impairment Loss on Loans of $13.7M in FY2024, 75.6% lower than $56.2M reported in the prior period. Administrative Expenses and Other Operating Expenses increased 5.9% and 9.3% respectively. Share of Profit in Joint Ventures advanced 36.3% to $7.0M, similarly Share of Profit from Associates improved 32.5% to $25.2M in the current period. Profit Before Taxation (PBT) climbed 18.7% to $1.27B from a previous $1.07B. Taxation Expense rose 6.7% to $312.6M, with the taxation rate moving from 27.4% to 24.6%. Profit After Taxation increased 23.2% from $776.8M in the prior period to $956.9M.

PBT Segment Performance Mixed

FCGFH’s Segment Profit Before Tax (PBT) advanced 7.5% YoY. Corporate Banking, contributing 39.0% of segment PBT, grew 12.1% to $762M. Its Treasury and Investment Banking segment PBT – accounting for 31.6% of PBT – dropped 5.8% from $655M in FY2023 to $617M in FY2024. The Retail Banking segment PBT climbed 2.6% to $293M, while Trustee and Asset Management’s PBT contribution increased 13.1% to $59M.

Credit Impairment Losses

FCGFH’s Loans to Customers increased 5.4% from $20.1B in FY2023 to $21.2B in this current period. Credit Impairment losses amounted to $13.7M (with a net impairment loss of 0.06% of total loans), suggesting resilience in terms of stability and credit quality.

Recently, the global credit rating agency, Standard and Poor’s, reaffirmed First Citizens Bank Limited investment grade rating of BBB-/A-3 with a stable outlook, which underlines the Group’s enhanced credit conditions and value creation for shareholders.

Trailing Price-to-Earnings (P/E) multiples across the banking sector currently range from 6.7 times to 14.9 times, with FCGFH (10.7x) currently trading above the banking sector average (10.1x). FCGFH’s trailing dividend yield 5.8% is currently above the sector average 4.8%. Objectively, banking sector stocks appear to be trading at attractive multiples relative to historical levels.

The Bourse View

FCGFH is currently priced at $40.65 and trades at a P/E ratio of 10.7 times, above the Banking Sector average of 10.1 times. The Group declared a final dividend of $0.88 per share payable on December 27th, 2024, to shareholders on record by December 13th, 2024. The stock offers a dividend yield of 5.8%, above the sector average of 4.8%.

The Group remains committed to its broader strategic objectives – continuing to expand its credit portfolio year on year, whilst providing continued quarterly dividends in line with the Group’s policy. On the basis of improving earnings growth and an attractive dividend yield, Bourse maintains an OVERWEIGHT rating on FCGFH.

JMMB Group Limited (JMMBGL)

JMMB Group Limited (JMMBGL) reported an Earnings Per Share (EPS) of TT$0.01 for its six months ended September 30th, 2024 (HY2024), down 67.7% compared to an EPS of TT$0.04 in the prior comparable period.

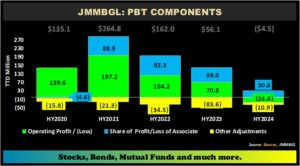

Net Interest Income grew 4.6% to TT$227M from a prior TT$216.9M. Fee and Commission Income contracted 10% to TT$105.3M from TT$117.01M in HY2023, as a result of weak market sentiment. Gains on Securities Trading fell 25.0% to TT$106.8M. Foreign Exchange margins from cambio Trading dipped 34.3% year on year. Subsequently, Operating Revenue net of interest expenses fell 9.9% year-on-year (YOY) from TT$539.9M in HY2023 to TT$486.5M in HY2024. Operating Expenses rose 8.9% to TT$510.9M, driven by inflationary pressures while Impairment Loss on Financial Assets fell by 35.0%, from TT$45.5M in HY2023 to TT$29.6M in HY 2024. Consequently, Operating Profit slipped from a profit of TT$70.8M to an Operating Loss of TT$24.4M. Share of Profit from Associate amounted to TT$30.8M, a drop in performance by 55.3% year on year, resulting in a Loss Before Taxation of TT$4.45M, compared to a profit before taxation of TT$56.1M in the prior period. Taxation credit increased 32.1% YoY to TT$34.2M. Overall, Profit Attributable to Equity Holders stood at TT$24.9M, down 67.8% relative to TT$77.5M in the previous period.

Associate Share of Profit Declines

JMMBGL’s Profit before Tax (PBT) swung to a Loss of TT$4.5M from a Profit TT$56.1M for the six months ended September 30, 2024. Likewise, an Operating Loss was recorded for HY2024 of TT$24.4M, from an Operating Profit of TT$70.8M in HY2023.

JMMBGL’s Share of Profit of Associate amounted to TT$30.8M, falling 55.3% YoY from TT$69.0M in HY2023 and recovering from a loss recorded in the prior quarter (Q12024), due to adverse market conditions and one-off actuarial adjustments. According to the Group, JMMB’s 23.84% shareholding in SFC continues to yield positive results.

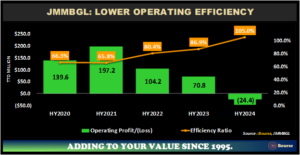

Operating Loss

JMMBGL’s efficiency ratio deteriorated from 86.9% in HY2023 to 105.0% in HY2024, with non-interest expense growth exceeding operating revenue. This suggests that a larger portion of the company’s income, after accounting for interest expenses, is being consumed by operating costs – a lower ratio typically indicates better cost management. Operating expenses rose from TT$469.2M to TT$510.9M, reflecting both inflationary pressures and increased investment in long-term strategic initiatives. The Group’s ability to effectively prioritize investments for scaling and improving efficiency will be key to enhancing long-term shareholder value.

JMMBGL’S financial leverage (measured as Total Assets divided by Total Shareholder Equity) stood at 12.6 times in its latest period HY2024, marking a decline from the 13.7x level in HY2023. Notably, Shareholder Equity advanced 10.9% to TT$2.4B in HY2024 from TT$2.2B in HY2023.

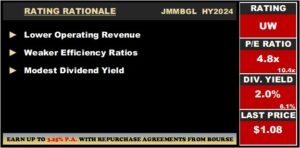

The Bourse View

JMMBGL currently trades at a market price of $1.08 and trades at a P/E ratio of 4.8 times, below the sector average of 10.4 times. The stock offers investors trailing dividend yield of 2.0%, below the Non-Banking Finance sector average of 6.1%.

The Group’s core financial performance remains influenced by difficult economic conditions, including elevated interest rates, inflationary pressures, and reduced trading activity in regional markets. The Group indicated that ongoing interest rate cuts by the U.S Federal Reserve through 2025 could foster a more favourable market environment presenting enhanced opportunities for growth. On the basis of lower operating revenue, reduced operational efficiency and a modest dividend, Bourse maintains an UNDERWEIGHT rating on JMMBGL.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase, or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives, or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third-party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”