Local Market

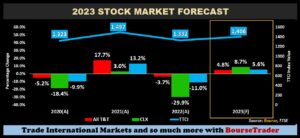

- FY 2023 Projected Performance:

- TTCI: base case↑ 5.6%

- ALL T&T: base case ↑4.8%

- CLX: base case ↑8.7%

- Market Drivers:

- Economic Recovery ↑

- Energy Production Recovery?

- Inflationary Pressures ↓

- Acquisition Activity ↑

- Geographic Diversification Initiatives↑

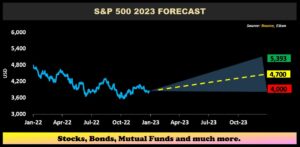

- FY 2023 Performance:

- S&P 500 +54.7% to +4.2%, base case 22.4%

- Market Drivers:

- Economic Reopening ↑

- Supply Chain Constraints ↓

- Inflationary Pressures ↓

With a turbulent 2022 for stock markets now in the rear-view mirror, this week we at Bourse consider the potential direction of equity markets in the year ahead. Several prevailing themes in 2022 are likely to continue influencing market sentiment and direction in the early stages of 2023, with conditions evolving in the latter half of the year. We discuss possible drivers of the investment environment in 2023 and provide an outlook on the various market sectors, given that some themes continue to persist in the markets. Finally, we share some insight on how investors could position their stock portfolio to best manoeuvre the tenuous economic environment. We discuss below.

Local Stocks to Reflect Positive Growth

Aggregating individual company earnings and valuation forecast for most major publicly-listed stocks by market capitalization, the Bourse view for local equities in 2023 is positive growth in the domestic and regional market. The All T&T Index– comprising of stocks domiciled in Trinidad and Tobago – is forecast to increase 4.8% in the year ahead, after decreasing 3.7% in 2022. The T&T Composite Index is projected to advance 5.6%, compared to a 2022 decline of 11%. The Cross-Listed Index, which includes Jamaican and Barbados-based companies listed on the TTSE, is forecast to advance 8.7% in contrast to a sharp downturn of 29.9% in 2022.

Local Markets Drivers

Having declined in 2022, investors will be scouring the local equity market for any potentially attractive opportunities. Several drivers could broadly affect all stocks, as well as specific companies.

Macro or market-wide drivers in 2023 could include:

- A continued rebound in economic activity, which could lead to (i) improved corporate earnings, (ii) potentially higher dividend payouts and (iii) improved investor sentiment.

- Domestic energy production recovery could catalyze economic growth, based on estimates provided in the FY2023 Budget. The fiscal initiatives announced during the FY2023 Budget, such as fuel subsidy reductions, looming property taxes and higher utility (power) rates – when combined with prevailing inflationary pressures – could place additional pressure on consumption patterns and reduce disposable income. Though headline inflation reduced marginally in September 2022, domestic companies may continue to face the challenge of elevated input/producer prices, with varying degrees of ability to pass on higher input costs to consumers.

At the specific stock level:

- Continued acquisition activity should augur well for companies seeking to (i) capture synergies, (ii) build market share and/or diversify by business activity.

- Geographic Diversification Initiatives. Companies placing emphasis on geographic expansion – whether by organic or inorganic means – are likely to receive more favorable sentiment from investors seeking companies with ‘built-in’ diversification benefits.

- New equity opportunities have been few and far in between for investors over the past several years. Investors may therefore be excited to hear about the potential new dual-listing of Seprod Limited’s recently acquired subsidiary – AS Brydens & Sons Holdings Limited, one of T&T’s largest importers and distributors. This capital market opportunity can (i) attract additional retail investors and (ii) improve liquidity on the TTSE. This would be welcome news, given the termination of the CLICO Investment Fund (CIF) in early 2023.

On a smaller scale, CinemaOne Limited (CINE1) is aiming to raise a minimum of TT$6M through the issuance of 1.6M shares in a rights issue to existing shareholders. CinemaOne enjoyed a resurgence in moviegoing last year, following the full relaxation of all government imposed COVID-19 restrictions on April 4, 2022. The Board of Directors fixed January 11, 2023 as the Record date which each Shareholder will be entitled to purchase one share for every four shares held.

Sector Outlooks Brighter

Banking: The Banking sector, the local market’s largest sector by market capitalization accounting for roughly 54.2% of total market value, is forecast to appreciate by 5% in 2023. Some degree of mean reversion took place in 2022, with a combination of stock price correction and earnings improvement resulting in improving P/E multiples in the banking sector. Sector earnings are projected to increase with improving net interest income and lower efficiency ratios, as stocks within the sector are forecast to range from -1% to +11% in individual price changes.

Conglomerates: Accounting for roughly 18% of total market value, the Conglomerate sector is forecast to advance 15% in 2023. Stocks in the sector, based on prevailing conditions, could deliver price changes ranging from of +12% to +17%. Massy Holdings Limited (MASSY) has continued its growth trajectory with strong acquisition activity, further deepening its presence across its key markets and providing a boost to the Group’s asset base and profitability. GraceKennedy Limited (GKC) was supported by its strong mergers and acquisition strategy, as well as organic growth through the introduction of new products and services. Looking ahead, positive drivers include acquisition activity, revenue growth, and a higher likelihood of improving profitability margins given strong ‘pass-through’ pricing power in an inflationary environment.

Non-Banking Finance: The Non-Banking Finance sector is estimated to grow in value by 4%, with constituent individual performance ranging from -5% to +18%. Underpinning performance in this sector is the prospect of improving financial markets and potentially higher insurance premiums.

Manufacturing and Trading: The Manufacturing I sector declined 7.4% in 2022 as companies were adversely affected by the challenging macroeconomic environment, underpinned by rising inflation and supply chain constraints which weighed on margins. Notably, the Manufacturing II sector advanced 8.9% in 2022, through improved sentiment for Trinidad Cement Limited (TCL). The Trading Sector had a stellar year, delivering a 43.2% increase in 2022, largely attributable to Agostini’s Limited’s improvement in earnings and expected synergies from recent acquisitions. Constituent performance is estimated to range from -13.5% to +5.7%.

Energy: Lone energy sector constituent Trinidad and Tobago NGL Limited (TTNGL) advanced 22.9% in 2022. PPGPL’s recent acquisitions and capacity development of terminal-related assets are expected to increase international trading volumes and provide a platform for earnings growth in subsequent periods. Despite a brighter outlook for domestic energy production volumes, lower forecast crude oil (expected to average $92.33/barrel in 2023) and natural gas (expected to average $5.43/mmbtu) prices could weigh on TTNGL’s earnings. For 2023, TTNGL (and by extension the energy sector) is forecast to contract -0.9%.

US Equities More Upbeat?

The S&P 500 fell 19.4% in 2022, marking a painful year for US equities. As we enter 2023, some of the drivers that are likely to move US markets are:

- Economic Reopening– Most major economies have relaxed Covid 19 restrictions, the exception being China who is currently in the process of reopening. China’s progressive easing of its zero-covid strategy can have profound consequences (positive or negative) on global supply chains, energy supplies and inflationary pressures.

- Inflationary Pressures– The latest consumer price index (CPI) reading in December 2022 may help to confirm that inflation has peaked, with consumer prices declining month over month for the first time since May 2020. If sustained, this may have a positive effect on consumer demand and corporate earnings.

- Monetary Policy Changes – The Federal Reserve’s ongoing commitment to price stability through elevated interest rates is likely to weigh on U.S. economic indicators in 2023. Market participants are keen on anticipating monetary policy chiefs, which – if ill-timed – could prove to be a costly pursuit.

- Consecutive down years are rare for the S&P 500, having occurred on only four occasions since 1928. In a still-tough macroeconomic environment, history favours US equity markets.

The median forecast level for the S&P 500 Index is 4,700, a 22.4% appreciation in 2023 from its December 2022 closing level of 3,839. The highest 2023 target by US analysts is currently 5,393 (or 54.7% up), while the ‘gloomiest’ forecast is a level of 4,000 (or 4.2% higher).

The median forecast level for the S&P 500 Index is 4,700, a 22.4% appreciation in 2023 from its December 2022 closing level of 3,839. The highest 2023 target by US analysts is currently 5,393 (or 54.7% up), while the ‘gloomiest’ forecast is a level of 4,000 (or 4.2% higher).

This optimism may be premised on (i) inflation moderating and (ii) the Federal Reserve reversing its restrictive monetary policy and cutting interest rates. This seems less likely, however, as Fed officials reiterated their commitment to getting inflation back to its 2% target (6.5% in December 2022). Persistent inflation and peak interest rates could extend the horizon of uncertainty pervading earnings expectations across the world’s largest stock market. It should be noted that consensus forecasts in 2022 projected a 3.0% increase for the S&P 500 (actual performance: 19.4% decline).

Investor Considerations

The outlook for local and US equity markets appear brighter for 2023. Locally, companies are poised to benefit from some recovery in economic activity, while acquisition activities and more stable financial markets will also be supportive to stocks. Internationally, consensus estimates for US markets suggest an increased level of optimism for international equity investors.

The outlook for local and US equity markets appear brighter for 2023. Locally, companies are poised to benefit from some recovery in economic activity, while acquisition activities and more stable financial markets will also be supportive to stocks. Internationally, consensus estimates for US markets suggest an increased level of optimism for international equity investors.Despite the rosier forecasts, investors should be cautiously optimistic heading into 2023. While stocks are relatively more attractive than they were a year ago, the uncertainty which has led to price corrections over the past 12 months still linger. Investors should be ready to adapt to changing economic conditions and prepare to make adjustments when necessary.

Maintaining a value bias when selecting stocks both locally and internationally remains a useful investing approach. Investors unable to stay abreast of market developments may consider a broad-market investment vehicle such as a mutual fund or Exchange Traded Fund (ETF) in order to gain market exposure while benefitting from a ready-made diversified portfolio.

As always, it makes good sense to consult with a trusted investment adviser such as Bourse to make the most informed investment decisions.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”