HIGHLIGHTS

WCO Q12025

- Earnings: Earnings Per Share advanced 20% from $0.05 to $0.06

- Performance Drivers:

- Improved Revenues

- Lower Margins

- Outlook:

- New product offering

- Rating: Assigned at OVERWEIGHT

NFM Q12025

- Earnings: Earnings Per Share increased 32.4% from $0.09 to $0.12

- Performance Drivers:

- Modest Revenue Growth

- Margin Improvements

- Outlook:

- Increased Economic Activity

- Rating: Maintained at MARKETWEIGHT

This week, we at Bourse review the performance of The West Indian Tobacco Company Limited (WCO) and National Flour Mills Limited (NFM) for their first fiscal quarters ended 31st March 2025. WCO reported improved revenues but experienced compression in its profitability margins. NFM experienced modest revenue growth and improved margins. How will both companies fare in the months ahead? We discuss below.

The West Indian Tobacco Company Limited (WCO)

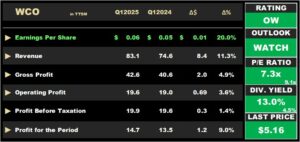

The West Indian Tobacco Company Limited (WCO) reported Earnings Per Share of $0.06 for the fiscal quarter ended March 31, 2025 (Q12025), advancing 20.0% from $0.05 in the prior comparable period (Q12024).

Revenue rose 11.3% year on year (YoY) from $74.6M to $83.1M in Q12025. Cost of Sales increased by 19.0% YoY to $40.5M from $34.1M in Q12024. Gross Profit amounted to $42.6M, higher by 2.0M or 4.9%. Distribution costs grew 43.0% to $6.7M from $4.7M in the prior period, while administrative expenses declined by 26.5% from $18.4M (Q12024) to $13.5M in Q12025. WCO reported other operating expenses of $2.7M in the current period under review, relative to other operating income of $1.4M in Q12024. Operating Profit climbed 3.6% from $19.0M to $19.6M in Q12025. Finance income and finance cost contracted 54.5% and 11.4% respectively. Profit Before Taxation grew 1.4% from $19.6M to $19.9M in Q12025. Taxation dropped by 15.4% to $5.2M for the period under review, from $6.2M. The taxation rate moved from 31.3% to a current 26.1%. Profit for the Period advanced 9.0%, from $13.5M to $14.7M in Q12025.

Revenue Turnaround

Following declines in the preceding two quarters, WCO’s revenue posted a notable recovery in the latest quarter. The Group recorded revenue growth of 11.3% YOY rising from $75M to $83M in Q12025, largely due to improved performance in its premium segment coupled with increased activity in export markets. Additionally, revenue from domestic and Caricom markets increased 3.4% and 39.8% respectively year-on-year.

In April 2024, the Group pivoted to a multi-category offering, introducing ‘Vuse’ -a premium vaping product- to its lineup. Looking forward, investors will closely monitor whether the revenue improvement can be sustained in the quarters ahead.

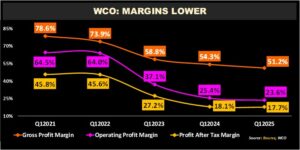

Margins Lower

Despite some recovery in revenue, WCO’s profitability margins continued on a declining trend. The Group’s Gross Profit Margin fell in the current period to 51.2% from 54.3% in Q12024, as the increase in cost of sales outpaced the revenue growth. Operating Margin dropped from 25.4% to 23.6% in Q12025, with higher selling and distribution costs. Consequently, Profit After Tax Margin fell to 17.7% in Q12025 relative to a prior 18.1%.

The Bourse View

At a current price of $5.16, WCO trades at a P/E of 7.3 times, below the combined Manufacturing sector average of 9.1 times. The stock offers investors a trailing dividend yield of 13.0%, well above the sector average of 4.5%. While remaining cautiously optimistic given WCO’s revenue recovery, investors will be focused on the Group’s decision to defer any interim dividend for Q12025, citing ongoing market volatility and an uncertain operating environment. Accordingly, changes to dividend frequency and/or quantity could quickly change WCO’s dividend yield characteristics. Nonetheless, relatively attractive valuations along with its track record of delivering appealing dividends bolster its near-term investment appeal. Accordingly, Bourse maintains an OVERWEIGHT rating on WCO.

National Flour Mills Limited (NFM)

NFM reported Earnings per Share (EPS) of $0.12 for the first quarter ended March 31st, 2025 (Q12025), up 32.4% from $0.09 reported in the prior comparable period (Q12024).

Revenue for the period grew 1.9% from $129.4M in the prior year period to $127.0M in Q12025. Gross profit advanced 10.5% to $41.2M. Selling and distribution expenses and administrative expenses rose by 11.3% and 6.3% respectively. Other operating income also decreased 12.0% to $1.4M from $1.6M a year ago. Operating Profit advanced 11.3% to $17.0M relative to a prior $15.3M in Q12024. Finance cost fell significantly by 77.9% YoY, moving from $0.2M to $0.7M. Profit before Taxation climbed 15.8% YoY and amounted to $16.9M. Taxation expense declined 24.1% from $4.3M to $3.3M in Q12025, leading to a lower effective tax rate of 19.3% compared to 29.5% previously. Overall, NFM declared Profit After Taxation (PAT) of $13.6M, up 32.5% or $3.3M higher relative to $10.3M in Q12024.

Revenue Lower

Revenue grew a modest 1.9% to $129.4M from a prior $127.0M. Commendably, the Company would have taken a decision to reduce consumer prices, sharing the benefits of falling grain commodity prices with its customers. Future revenue momentum is likely to be influenced by evolving consumer trends, as well any conscious alignment of the Company’s product pricing to its major raw material input (grain).

Margins Higher

Notwithstanding normalization of revenue levels, Gross Profit Margin advanced from 29.3% in Q12024 to 31.8% in Q12025. Although there was an increase in expenses, Operating Profit Margin stood at 13.2%, higher than the previous 12.0% in Q12024. Profit before Tax Margin advanced to 13.0% in Q12025, up from 11.5% a year earlier. Notably, NFM’S recent investments reflect a strategic focus on improving operational efficiency, streamlining production and expanding its product offerings.

The Bourse View

At a current price $1.64, NFM trades at a trailing P/E multiple of 4.1 times, below the combined Manufacturing Sector average of 9.1 times. The stock offers investors a trailing dividend yield of 6.1%, above the Manufacturing Sector average of 4.5%. According to NFM, the new investments aim to drive innovation bolster Trinidad and Tobago’s food production capacity. On the basis of increased revenue and improved profitability margins but tempered by higher expenses and ongoing global uncertainty, Bourse maintains a MARKETWEIGHT rating on NFM.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third-party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”