HIGHLIGHTS

UCL HY2024

- Earnings: Earnings Per Share increased 165.0% from $0.20 to $0.53

- Performance Drivers:

- Higher Revenue

- Margin Improvements

- Lower Operating Expenses

- Outlook:

- Increased Economic Activity

- Rating: Upgraded to OVERWEIGHT

WCO HY2024

- Earnings: Earnings Per Share decrease 20.0% from $0.40 to $0.32

- Performance Drivers:

- Reduced Revenues

- Lower Margins

- Outlook:

- New product offering

Rating: Maintained at MARKETWEIGHT

This week, we at Bourse review the performance of Unilever Caribbean Limited (UCL) and The West Indian Tobacco Company Limited (WCO) for the six-month fiscal period ended 30th June 2024 (HY2024). UCL benefitted from resilient revenue and improved cost management, while WCO was hindered by reduced revenues and lower margins. How will both companies fare in the months ahead? We discuss below.

Unilever Caribbean Limited (UCL)

For the six months ended June 30, 2024 (HY2024), Unilever Caribbean Limited (UCL) reported Earnings Per Share (EPS) of $0.53, a 165% increase over the $0.20 reported in the prior comparable period.

Revenue amounted to $120.5M in the current period, a 1.0% increase relative to the $119.3M earned in HY2023. Cost of Sales recorded was 10.5% lower, from $73.5M in HY2023 relative to $65.7M in the current period. Gross Profit advanced 19.5% to $54.7M. Selling and Distribution Costs and Administrative Expenses both fell 7.7% and 9.3% respectively. Impairment reversal on trade receivables also declined 89.2%, resulting in a 113.7% increase in Operating Profit from $10.1M in HY2023 to $21.5M in HY2024. UCL reported nil Restructuring Costs over the period compared to $3.67M in the prior period, which led to an Operating Profit after restructuring costs remaining unchanged at $21.5M. Profit Before Taxation amounted to $21.7M, a 149.0% gain from a prior $8.7M. Overall, UCL’s Profit for the Period amounted to $13.9M, 165.8% higher than $5.2M reported in the prior period.

Revenue Stable

UCL’s revenue trend appears to be stabilizing, after a period of corporate divestiture and the impact of COVID-19 on consumption patterns. Total Revenue modestly grew 1.0%, from $119.3M (HY2023) to $120.5M in HY2024, mainly driven by the consistent growth of the Beauty and Personal Care category, which contributed to increasing profitability. According to the company, improved performance in its Home Care sector assisted in the growth of its Beauty & Personal Care segment.

Margins Improve

UCL’s profit margins improved overall when compared to the prior period. Gross Profit Margin grew from 38.4% in HY2023 to 45.4% in HY2024, on account of lower costs and higher-margin product mix. Profit Before Tax Margin increased to 17.9% from a prior 8.4%. UCL’s Operating Profit Margin advanced to 18.0% in HY2024 from a prior 7.3%, primarily attributable to lower selling and distribution and administrative expenses.

The Bourse View

At a current price of $11.33, UCL trades at a trailing P/E of 11.6 times, above the Manufacturing Sector average of 10.6 times. The Group declared an interim dividend of $0.14 per share payable on September 16th, 2024, to shareholders on record by September 2nd, 2024. The stock offers investors a trailing dividend yield of 5.5%, above the sector average of 3.7%.

The Company would have benefitted from efficient cost management, coupled with stable revenue, resulting in margin expansion and earnings growth. Investors will be keeping an eye on the revenue story of UCL, which will continue to be a primary driver of the stock’s fortunes in future periods.

On the basis of early signs of revenue stabilization, improving profitability margins and an above-sector average dividend yield, Bourse assigns an OVERWEIGHT rating to UCL.

The West Indian Tobacco Company Limited (WCO)

The West Indian Tobacco Company Limited (WCO) reported Earnings Per Share of $0.32 for the six-month period ended June 30, 2024 (HY2024), a 20.0% decline from $0.40 in the prior comparable period (HY2023).

Revenue fell 16.8% year on year (YoY) from $307.0M to $255.4M. Cost of Sales was considerably lower by 20.0% year on year, falling to $93.3M from $116.6M in HY2023. Gross Profit fell 14.8% to $162.1M from $190.4M (HY2023). Distribution costs increased by 33.6% to $6.0M compared to the prior period, while administrative expenses increased by 12.9% from $32.8M (HY2023) to $37.1M in HY2024. Other Operating Expenses grew year on year (YoY) to $12.4M in HY2024 from $10.9M. Operating Profit fell 25.0% from $142.2M in HY2023 to $106.6M in HY2024. Finance Income contracted by 23.3% in HY2024. Finance Costs dipped 8.0% year over year. Profit Before Taxation decreased 25.0% from $144.4M to $108.2M in HY2024. Taxation dropped by 32.4% to $28.5M for the period under review, from $42.2M. Overall, Profit for the Period fell 22.0%, from $102.2M to $79.7M in HY2024.

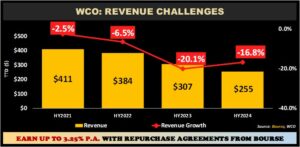

Revenue struggles persist

WCO’s revenue continued to decline in HY2024, mainly impacted by a drop in export revenue. Total Revenue in HY2024 contracted 16.8% from $307M to $255M. WCO’s domestic revenue fell 11.6% year-on-year to $211.6M in HY2024, down from $239.4M reported for the comparative period last year. Additionally, revenue from Caricom and non-Caricom markets decreased 35.2% to $43.8M in the current period under review.

WCO’s second quarter (April – June) 2Q2024, however, was more positive from a revenue perspective. Total Revenue amounted to $180.8M, marginally down 0.7% year-on-year from $182.0M in 2Q2023.

WCO continues to take initiatives to arrest the decline of its revenue, as the Group successfully launched its new vaping product, ‘Vuse’ in the prior quarter. The new offering is intended to cater to customer demand of the alternative smoking segment, which should be supportive of revenue in the upcoming quarters. Investors will, however, be wondering when WCO’s revenues will stabilize.

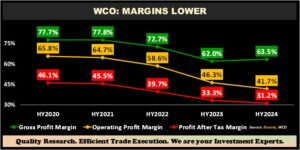

Margins Lower

WCO’s Gross Profit Margin increased in the current period to 63.5% from 62.0% in HY2023, supported by a 20.0% reduction in Cost of Sales, likely reflecting improved operating efficiency and cost management.

Operating Margin saw the largest deterioration as total expenses (Distribution costs, administrative expenses, other operating expenses) increased, declining from 46.3% to 41.7% in HY2024. Consequently, Profit After Tax Margin fell to 31.2% in HY2024 relative to a prior 33.3%.

The Bourse View

WCO’s operating headwinds have been largely reflected in its stock price, which is down 26.9% year to date and down 84.8% since its peak price of $42.96 in December 2019.

At a current price $6.51, WCO trades at a P/E of 6.4 times, below the Manufacturing Sector average of 10.6 times. The company announced an interim dividend of TT$0.20 which was paid on August 26th, 2024. The stock offers investors a trailing dividend yield of 15.1%, above the sector average of 3.7%.

Investors continue to look for concrete signs of performance stabilization in WCO’s revenue and operating numbers, cognizant of the headwinds faced by the Company. Such stabilization is key to any turnaround in the stock’s fortunes, which was once the role model for operating resilience and dividend reliability.

On the basis of relatively attractive valuations, but tempered by continued revenue and margin pressures, Bourse maintains a MARKETWEIGHT rating on WCO.

DISCLAIMER: “This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase, or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives, or agents, accepts any liability whatsoever for any direct, indirect, or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third-party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”