HIGHLIGHTS

TTNGL FY 2021

- Earnings: EPS 8,175% higher, from $0.04 to $3.31.

- Performance Drivers:

- Higher NGLs prices

- Outlook:

- International Expansion

- Energy Production likely to rebound

- Rating: Assigned at OVERWEIGHT.

Energy Prices Update

- Year to Date Price Performance:

- WTI Crude ↑ 27.7%

- Brent Crude ↑27.9%

- Henry Hub Natural Gas ↑72.9%

This week, we at Bourse review the performance of the sole member of the Energy Tier of the domestic exchange, Trinidad and Tobago NGL Limited (TTNGL) for the year ended 31st December, 2021. TTNGL reported significantly improved earnings on account of robust energy markets and increased profitability from its solitary investee company, Phoenix Park Gas Processors Limited (PPGPL). Will the trend of high energy prices continue to benefit investors, or could domestic energy production challenges slow progress in the months ahead? We discuss below.

Trinidad and Tobago NGL Limited

TTNGL generated Earnings per Share (EPS) of $3.31 for the year ended 31st December 2021, up 8,175.0% from a previous $0.04. Share of Profit from its Investment in Joint Venture, Phoenix Park Gas Processors Limited (PPGPL) increased by $167.0M, from $45.6M to $212.6M primarily driven by: (i) higher Mont Belvieu NGL product prices, which were up 112.3% in FY 2021 relative to FY 2020, (ii) higher production from gas processing, up 11.8% and (iii) higher NGL content in gas stream.

Interest Income declined 57.8% while Foreign Exchange Gains increased 21.6%. Cumulatively, Total Income was $212.8M relative to $45.9M in the prior year, up 363.6%. TTNGL recorded an impairment reversal of $302.1M, attributable to improved long-term commodity prices. Operating Expenses summed to $1.8M, 31.7% higher than a prior $1.4M. Profit Before Tax was $513.0M a 7,913.6% increase, following $6.4M in the prior year. Overall, Profit for the Period was $512.8M relative to a prior $6.4M.

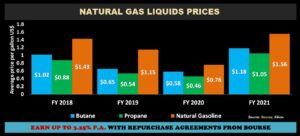

NGLs Prices Recover

TTNGL’s performance was supported by robust energy commodity prices during the 2021 period as measured by Mont Belvieu benchmarks.

Average Butane prices increased 103.4% from US$0.58 per gallon in FY 2020 to US$1.18 per gallon in FY 2021, while average Natural Gasoline prices increased 105.3% from US$0.76 per gallon to US$1.56 per gallon. Propane, which accounts for approximately 35.3% of PPGPL’s exports, experienced the largest price increase with average prices increasing 128.3% to US$1.05 per gallon in FY 2021. Year to date, the weighted basket of NGLs has averaged US$1.67 per gallon.

Domestic Energy Prices Expand

The Energy Commodity Price Index, (ECPI) calculated and published by the Central Bank of Trinidad & Tobago, is a measure of average energy prices faced by domestic production, based on T&T’s top ten energy commodity exports. With international energy prices recovering from pandemic lows to record significant recovery, the ECPI followed a similar trajectory. The ECPI stood at 84.8 in January 2019, before the effects of COVID-19 led it to decline to a low of 41.6 in April 2020. As of June 2020, the ECPI maintained positive momentum, currently peaking at 164.6 in February 2022.

Production and Exports Decline

Despite a 5.0% increase in the NGL content of the gas stream provided by The National Gas Company of Trinidad and Tobago (NGC), Production of NGLs have been on a downward trend since 2019. NGL production fell 16.5% from 6.7M barrels (BBLS) in Jan-Nov 2020 to 5.6M BBLS in Jan-Nov 2021. Exports reach its lowest level of 4.7M BBLS in Jan-Nov 2021 relative to a previous 5.9M BBLS in Jan-Nov 2020 (20.3% lower).

The decline in NGL production and exports were offset by higher NGLs prices during the period. With the decline in natural gas supply already impacting downstream energy participants, if it were to persist, may negatively impact NGL’s performance.

PPGPL International Expansion Continues

PPGPL’s North American Subsidiary, Phoenix Park Trinidad and Tobago Energy Holdings Limited (PPTTEHL) continues to grow as the subsidiary experienced high trading volumes for the fiscal period and continued to benefit from improved margins from sales contracts with its counterparties. PPTTEHL contributed approximately 3% to PPGPL’s profit after tax, with the Company expecting continued earnings growth from the business segment.

On January 21st 2022, Phoenix Park Gas Processors Limited (PPGPL) through its wholly owned subsidiary Phoenix Park Energy Marketing LLC (PPEM) completed the acquisition of an NGL terminal in Hull Texas, USA from Keyera Energy Inc. The acquisition serves to broaden PPGPL’s business portfolio, deepen participation in the NGL value chain and advance the Group’s thrust towards international growth.

At a broker meeting held on April 7th 2022, further clarity on PPGPL’s expansion initiatives was provided. PPGPL continues to increase its foothold in the North American energy landscape, with its North American value chain strategy focused on the acquisition and/or capacity development of terminal-related assets over the course of 2022-2024. According to PPGPL, the Hull Terminal acquisition is already a target for capacity expansion to facilitate anticipated increased trading volumes in the near future. PPEM plans to access and aggregate NGL supply to sustain and grow its markets in Mexico, Latin America and the United States.

Energy Production Recovery?

The following developments are anticipated to alleviate ongoing production challenges:

- Shell Trinidad and Tobago delivered first gas at its Colibri project on March 30th, 2022, the project is expected to add approximately 174 mmscf/d of natural gas production, with peak production expected to be 250 mmscf/d. Colibri, along with other development projects, will see natural gas going into both the domestic petrochemical markets and into LNG exports, in line with the energy ambitions of T&T.

- Touchstone’s Coho discovery is expected to receive first gas in May 2022, adding 100 million standard cubic feet per day by the end of 2022 to the country’s natural gas production.

- BHP reported that all of its appraisal wells in its Calypso development, north of Tobago encountered hydrocarbons. The appraisal drilling programme will help determine the actual size of the previously announced 3.5 trillion cubic feet discovery.

TTNGL’s evolving value proposition

TTNGL announced a final dividend of $0.50 per share payable on May 12th, 2022 relative to $0.05 per share in the prior year, bringing the total dividend to $0.75 for FY 2021. Having faced challenges from the COVID-19 Pandemic and domestic energy production weakness, the stock’s major appeal as a high-dividend portfolio holding would have come under pressure in recent years. With now-buoyant energy prices and a cautiously optimistic outlook for domestic energy production increases, investor sentiment would appear to have turned positive once again for TTNGL.

With investee company PPGPL’s international diversification ambitions in mind, however, should TTNGL be considered by a wider audience than just the income-oriented investor? At the April 7th broker meeting, PPGPL emphasized that (i) it was currently debt-free, (ii) would have financed its recent international acquisitions through internally generated cash and (iii) had significant headroom to access debt capital for any larger acquisition activities. For investors, this could suggest that a greater proportion of TTNGL’s value proposition may be derived from longer-term share price growth, relative to short-term income from dividends.

The Bourse View

At a current price of $20.60, TTNGL trades at a trailing P/E of 6.2 times. Excluding the impact of impairment reversals, TTNGL’s adjusted P/E ratio stands at 15.1 times. The company announced a final dividend of $0.50 payable on May 12th 2022 to shareholders on record by April 22nd 2022. This brings the total dividend paid by NGL to $0.75, with a trailing dividend yield of 3.6%.

The current robust energy price environment should be supportive to PPGPL’s earnings and by extension TTNGL in the coming periods. This should be further supported by any modest recovery in natural gas production within the domestic energy landscape.

PPGPL’s well-articulated strategy of focusing on what it knows best (the energy value chain) and growing through international expansion should bode well for the company’s future prospects. Beyond articulating the strategy, the company also appears to be executing its acquisition and development initiatives in a timely manner. PPGPL’s debt-free condition also places the company in a strong position to capitalize on attractive expansion opportunities as they arise.

On the basis of robust energy commodity prices, expected stabilization/recovery of domestic energy production, recovering dividend payments and a focused expansion strategy by investee company PPGPL, Bourse upgrades its rating on TTNGL to OVERWEIGHT.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”