HIGHLIGHTS

TCL 9M2023

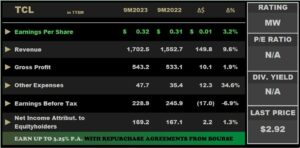

- Earnings: Earnings Per Share increased 3.2% from $0.31 to $0.32

- Performance Drivers:

- Improved Revenues

- Lower Margins

- Outlook:

- Cost management initiatives

- Rating: Maintained at MARKETWEIGHT

WCO 9M2023

- Earnings: Earnings Per Share fell 28.9% to $0.59 from $0.83

- Performance Drivers:

- Reduced Revenues

- Lower Margins

- Outlook:

- New Investments

- Rating: Maintained at MARKETWEIGHT

This week, we at Bourse review the financial performance of Trinidad Cement Limited (TCL) and West Indian Tobacco Company Limited (WCO) for the nine-month period ended September 30th, 2023 (9M2023). TCL benefited from improved revenues reflecting higher cement sales across the group, while WCO’s performance was constrained by reduced revenues and lower margins. How will both companies fare in the months ahead? We discuss below.

Trinidad Cement Limited (TCL)

For the nine months ended September 30th, 2023, Trinidad Cement Limited (TCL) reported an Earnings Per Share (EPS) of $0.32, up 3.2% from an EPS of $0.31 earned in the prior comparable period.

Notably, Revenue advanced 9.6% to $1.70B from a previous $1.55B in 9M2022, boosted by increased cement sale volumes across all operating jurisdictions. Despite a 13.7% uptick in cost of sales, gross profit increased 1.9% from $533.1M to $543.2M. Operating expenses increased 5.3% from $226.0M to $238.1M. Operating Earnings Before Other Income dropped to $305.1M from a prior $307.1M. Other Expenses climbed 34.6%, to $47.7M relative to $35.4M reported in the prior period. Consequently, Operating Earnings increased 3.8% to $264.5M relative to $274.9M in the previous period. Financial Expenses were 34.8% higher, from $29.7M in 9M2022 to $40.1M in the current period. Despite a decrease in taxation expense by 24.3%, Earnings Before Taxation amounted to $228.9M, 6.9% lower than the prior comparable period. Resultantly, Net Income for the period closed at $169.2M, a variance of $2.2M or 1.3% higher than $167.1M reported in the prior period.

Revenue Climbs

TCL’s revenue continued to trend upwards, reflecting consistent improvement in the last five reporting periods, except for a marginal decrease in the heavily COVID-affected 9M 2020. Total revenue advanced 9.6% from $1.55B (9M2022) to $1.70B in 9M2023, impacted by (i) higher sales volume across the group and (ii) the positive impact of price adjustments, implemented previously to offset cost inflation. Cement, TCL’s largest segment (98.2% of Revenue) rose 10.2% to $1.7B from a prior $1.5B. Concrete, accounted for 1.8% of Total Revenue, fell 24.8% YoY to $30.0M and third-party revenue from Packaging, swung from a deficit of $4.3M to $0.9M in the current period. According to the cement producer, continued revenue growth was supported by the rising sales volumes and improved management of working capital across all operating jurisdictions. The Group also highlighted its partnering with government, local agencies, and other related party businesses to deliver on its sustainability development initiatives across the region, notably, the use of 40% to 100% non-freshwater in its cement operations.

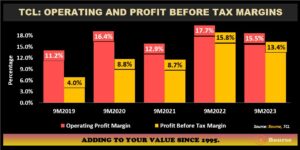

Margins Decline

The company’s profitability margins have fluctuated over the years, with no concrete trends in recent reporting periods. Operating Profit Margin narrowed from 17.7% in 9M2022 to 15.5% in 9M2023, owing to increased operating costs. Similarly, Profit Before Tax Margin decreased to 13.4% from a prior 15.8%, attributable to higher financial expenses. Although, profitability margins are lower in comparison to the prior period, the result of the current performance remains above average amongst the five reporting periods.

The company also reported on increased sustainability initiatives via the reduction of net carbon emissions by 4%, mainly through the use of waste oils in Jamaica. TCL also reported a 3% reduction in heat consumption through the production of low-carbon products in Trinidad and Tobago and Jamaica. The Group’s continued emphasis on sustainability developments and adherence to its Cemex “Future in Action” programme to consistently improve its earnings and profitability may give investors’ confidence in the viability of its business model.

The Bourse View

At a current price of $2.92, TCL trades at a market to book ratio of 1.4 times, notably below the combined Manufacturing I & II Sectors’ Average of 1.79 times.

TCL’s continued revenue growth across all jurisdictions, driven by improving sales volumes, may be indicative of a pickup in regional economic activity. The Group has managed to deliver modest earnings growth while pursuing its environmental sustainability initiatives, which is credible. On the basis of increased revenue growth and earnings but tempered by higher input costs, below sector average valuations and a recent absence of dividends, Bourse maintains a MARKETWEIGHT rating on TCL.

The West Indian Tobacco Company Limited (WCO)

The West Indian Tobacco Company Limited (WCO) reported Earnings Per Share of $0.59 for the nine -month period ended September 30th, 2023 (9M2023), a 28.9% decline from the $0.83 reported in the prior comparable period.

Revenue fell 14.6% Year on Year (YoY) from $548.9M to $468.6M, accompanied by an 8.9% increase in Cost of Sales. Consequently, Gross Profit fell to $295.3M, 24.2% lower compared to $389.8M reported in 9M2022. Increases in distribution costs of 39.0% and administrative expenses (up 3.5%), were offset by a 13.4% ($3.8M) decline in other operating expenses, resulting in Operating Profit of $209.9M in 9M2023 or a 31% decline relative to the prior comparable period. Profit Before Tax declined 30.1% from $304.9M to $213.1M. Taxation Expense for the period decreased 34.0% to $63.6M. Overall, WCO reported a Profit for the Period of $149.5M in 9M2023, down 28.3% from $208.6M reported in 9M2022.

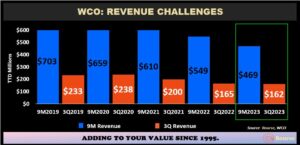

Revenue Lower

Revenue for the first nine-months of WCO’s 2023 fiscal year continued to decline, falling 14.6% to $469M relative to the corresponding period last year of $549M.

On a comparable quarter basis, WCO’s 3rd quarter (July- September) 3Q2023 recorded revenue of $162M, 1.9% or $3.1M lower than the $165M in 3Q2022. WCO still continues to face market challenges primarily influenced by changing consumer preferences characterized by lower demand and a growing appetite for lower-priced products.

Margins Pressured

WCO’s profitability margins have struggled relative to its usually consistent levels in the past two comparable periods. Gross Profit Margin fell from 71.0% to 63.0% in 9M2023, following a $14.1M or 8.9% increase in Cost of Sales. Operating Profit Margin fell to 44.8% in 9M2023 relative to a prior 55.5%, attributable to higher distribution costs and administrative expenses. Profit After Tax Margin weakened to 31.9% from 38.0% in the prior comparable period. With revenue showing some early signs of stabilization in the immediate previous quarter (2Q2023) and current 3Q2023, investors will be keenly monitoring WCO’s ability to stabilize or improve profitability margins in subsequent periods.

The Bourse View

At a current price $10.29, WCO trades at a P/E of 12.9 times, below the Manufacturing Sector average of 13.4 times. The company announced an interim dividend of $0.26 to be paid on November 28th, 2023, to shareholders on record by November 8th, 2023. The stock offers investors a trailing dividend yield of 7.6%, relatively in line with the sector average of 7.0%. Excluding Unilever Caribbean Ltd. (UCL’s) abnormal and likely one-off dividend, the sector average dividend yield would stand at 3.4%.

Early signs of revenue stabilization may be viewed as positive by investors, despite the narrowing of margins and reduction in dividends in recent periods. Investor sentiment to performance has been visible in the share price, which has corrected from an all-time high of $42.96 in December 2019 to its current market price of $10.29. The stock is down 51.0% year-to-date. According to WCO, innovation remains a pivotal factor in propelling the company’s future growth, positioning itself to maintain market leadership through the introduction of new product offerings. On the basis of relatively attractive valuations, but cognizant of lower margins and revenues, Bourse maintains a MARKETWEIGHT rating on WCO.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase, or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives, or agents, accepts any liability whatsoever for any direct, indirect, or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third-party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”