HIGHLIGHTS

SBTT FY 2021

- Earnings: EPS 15.9% higher, from $2.95 to $3.42

- Performance Highlights:

- Lower Revenues

- Reduced Impairment Losses

- Improved Margins

- Outlook:

- Economic Uncertainty

- Rating: Maintained at NEUTRAL.

FCI FY 2021

- Earnings: EPS of TT$0.52 from a prior Loss Per Share of TT$0.68

- Performance Highlights:

- Lower Revenues

- Absence of Impairment of Intangible Assets

- Reduced Credit Loss Expenses

- Outlook:

- Stabilizing Financial Markets

- Economic Uncertainty

- Rating: Maintained at NEUTRAL.

This week, we at Bourse review the financial performance of Canadian-owned Banking giants FirstCaribbean International Bank Limited (FCI) and Scotiabank Trinidad and Tobago Limited (SBTT) for the year ended October 31st, 2021. Both groups recorded improvement in earnings, despite lower revenues, as economic challenges persist in the region. Could this trend continue? We discuss below.

Scotiabank Trinidad and Tobago Limited (SBTT)

Scotiabank Trinidad and Tobago Limited (SBTT) reported Earnings per Share (EPS) of $3.42 for the Financial Year ended October 31st 2021 (FY 2021), up 15.9% from $2.95 in the prior comparable period.

Net Interest Income fell 7.1%, amounting to $1.22B in FY2021 from a previous $1.31B. Other Income expanded 9.9% from $465.1M to $511.0M. Total Revenue stood at $1.73B for the period, down 2.7% from a prior $1.78B. In the face of lower revenues, the Group continued to focus on operating cost management resulting in a 7.3% contraction in Non-Interest Expenses. Net Impairment Loss on Financial Assets fell by 52.8% to $108.5M from $229.9M. Income Before Taxation moved from a previous $790.9M to $919.7M, a 16.3% increase. Income Tax Expense amounted to $316.2M in FY 2021 for an effective tax rate of 34.38%, relatively consistent with a previous of 34.15%. Overall, SBTT recorded an Income After Taxation of $603.5M, up 15.9% compared to $520.8M in FY 2020.

Revenues Lower

SBTT’s revenue declined marginally as the Group continues to navigate economic pressures caused by the Covid-19 pandemic. Net Interest Income, which contributed 70.5% to Total Revenue, fell 7.2% due to lower loan balances from both retail and commercial customer segments. Meanwhile, Other Income (25.5% of Total Revenue) recorded a 9.9% increase as the Group saw continued recovery in some of their core banking activity lines.

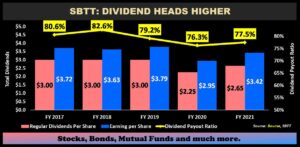

Dividends Increase

SBTT has consistently maintained a dividend payout ratio above 76.0% for the past five fiscal periods, providing a steady stream of income to investors. The Board of Directors approved a final dividend of $0.85 payable on December 27th 2021, pushing the cumulative dividend per share (DPS) for FY 2021 to $3.50 (pay-out ratio: 102.3%).

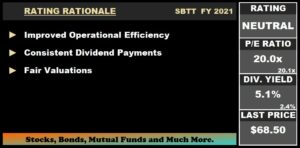

The Bourse View

SBTT is currently priced at $68.50 having appreciated 18.1% year-to-date, and trades at a price to earnings ratio of 20.0 times relative to the Banking Sector average of 20.1 times. The stock offers investors a trailing dividend yield of 5.1% (inclusive of special dividends), above the sector average of 2.4% and the highest on the Trinidad and Tobago Stock Exchange. Any gradual increase in economic activity could lead to increased profitability for the Bank, notwithstanding the prevailing uncertainty brought about by newer strains of the COVID-19 virus. On the basis of improved operational efficiency and consistent dividend payments, but tempered by ongoing economic uncertainty, Bourse maintains a NEUTRAL rating on SBTT.

FirstCaribbean International Bank (FCI)

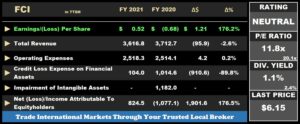

FirstCaribbean International Bank Limited (FCI) reported Earnings Per Share (EPS) of TT$0.52 for the full year (FY) ended October 31th 2021, 176.2% higher compared to a Loss Per Share of TT$0.68 recorded in FY 2020.

FCI reported a 2.6% decline in Total Revenue from a previous TT$3.71B to TT$3.62B in FY 2021. Operating Expenses marginally increased 0.2% to TT$2.52B. Credit Loss Expense on Financial Assets declined to TT$104M relative to TT$1.01B in the comparable period, reflecting an improvement in the Bank’s economic outlook and a rebound in origination activity. Income Before Tax (PBT) swung from a previous loss of TT$997.9M to a profit of TT$994.5M, in FY 2021. Resultantly, FCI reported an Income Tax Expense of TT$77.7M compared to a credit of TT$3.0M in FY 2020. Ultimately, Net Income Attributable to Equity holders of the Bank shifted from a Loss of TT$1.07B in FY 2020 to a Profit of TT$824.5M in FY 2021.

Results for the year were affected by the following items of note aggregating to TT$99.5M: a restructuring charge of TT$68.4M, provisions related to the announced divestitures of TT$35.9M, offset by an income tax credit of TT$4.7M. Excluding these items, adjusted Net Income was TT$950.5M for 2021.

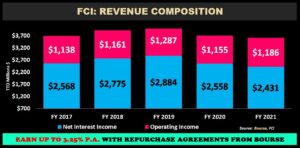

Revenue Slips

With FCI’s core operating jurisdictions being primarily tourist dependent economies, Total Revenue declined 2.6% from TT$3.71B to TT$3.62B in FY 2021, likely associated with the limitations imposed by the pandemic. Net Interest Income, FCI’s largest revenue contributor (67% of Total Revenue) contracted 5.0% from TT$2.56B to TT$2.43B in FY 2021, primarily due to lower US interest rates, partially offset by loan growth. In contrast, Operating Income consisted of 33% of revenue in FY 2021 and increased year-on-year by TT$31.1M or 2.7% owing to increased foreign exchange earnings and gains from deposits in Jamaica’s subsidiary. The Bank continues to be challenged by the prolonged low interest rate environment.

FCI Sells Eastern Caribbean Operations

On October 12th 2021, FCI announced the sale of its banking assets in four territories within the Organization of the Eastern Caribbean States (OECS). It’s wholly owned subsidiary, FCIB Barbados, agreed to sell its banking assets in St. Vincent and the Grenadines, Grenada and the Commonwealth of Dominica and St Kitts and Nevis. Additionally, FCIB Cayman agreed to sell its banking assets in Aruba with all transactions subject to regulatory approval and expected to be finalized in the coming months.

Operating Segment Mixed

Notwithstanding a 2.6% decline in Total Revenue, FCI’s PBT expanded by 199.7% for 2021 primarily owing to the absence of Impairment Costs and significantly lower Credit Loss Expense on Financial Assets.

The Bank’s largest contributor to PBT Growth, Corporate and Investment Banking (CIB:73.7% of PBT), advanced 11.4% from TT$628M to TT$700M. Despite challenges faced by operating in a Covid-19 economic environment, this segment disbursed TT$5.48B in new loans for clients across the Caribbean, resulting in a 4.5% growth in the Bank’s total loan portfolio.

Retail, Business and International Banking (RBB) recorded a Profit Before Tax of TT$214M in FY 2021, a recovery from a Loss of TT$354M in the prior comparable period. This is associated with an increase in card spending and a 22% growth in Performing Loan Sales. On the other hand, Wealth Management recorded a 71.3% decline in performance, from TT$121M to TT$35M for the current year.

The Bourse View

At a current price of TT$6.15, FCI trades at a Trailing Price to Earnings ratio of 11.8 times, significantly below the Banking sector’s average of 20.1 times. The stock also offers investors a Trailing Dividend Yield of 1.1%, below the sector average of 2.4%. The Group declared a final dividend payment of TT$0.068 (US$0.010) per share to be paid on January 25th, 2022. On the basis of USD dividend payments and relatively attractive valuations, but tempered by uncertain economic conditions across the region, Bourse maintains a NEUTRAL rating on FCI.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”