HIGHLIGHTS

RFHL FY2024

- Earnings: Diluted Earnings Per Share improved 14.8% to $12.29 from $10.71

- Performance Drivers:

- Increased Net Interest Income

- Outlook:

- Geographical Diversification

- Rating: Maintained at OVERWEIGHT

UCL 9M2024

- Earnings: Earnings Per Share increased 45.1% to $0.74 from $0.51

- Performance Drivers:

- Increased Revenue

- Margin Improvements

- Lower Operating Expenses

- Outlook:

- Increased Economic Activity

- Rating: Maintained at OVERWEIGHT

This week, we at Bourse review the performance of Republic Financial Holdings Limited (RFHL) and Unilever Caribbean Limited (UCL) for fiscal year and nine-months reporting periods ended September 30th, 2024, respectively. Both entities would have reported increased revenues and profitability. Could this positive momentum continue in the upcoming months? We discuss below.

Republic Financial Holdings Limited (RFHL)

RFHL reported a Diluted Earnings Per Share (EPS) of $12.29 for fiscal year ended 30th September 2024 (FY2024), up 14.8% relative to the $10.71 reported in the prior comparable period.

Net Interest Income increased 8.6% to $5.1B from $4.7B in FY2023. Other Income grew 3.5% to $2.1B in FY2024, relative to $2.0B in FY2023. Operating Income improved by 7.1% to $7.2B. Operating Expenses also increased 4.8% from $3.9B in FY2023 to $4.0B in FY2024. Operating Profit for the period stood at $3.1B relative to $2.8B in FY2023, up 10.3%. Credit Loss Expense decreased 39.8% from $181.0M in FY2023 to $109.0M in FY2024. Profit Before Taxation (PBT) stood at $3.0B in FY2024, 15.7% higher than $2.6B in the prior comparable period. Overall, Profit Attributable to Equity Holders of the parent rose to $2.0B, a 14.6% increase.

Operating Income Grows

RFHL’s operating income continued to grow by 7.1% in FY2024, continuing its positive trend over the past four (4) comparable reporting periods. Net Interest Income (70.7% of Operating Income) rose by 8.6%, from $4.7B to $5.1B. This increase was supported by continued elevated interest rates on US-related investments and growth in loans and advances, which ticked up by 11.0%, from $60.7B to $67.3B, compared to the same period last year. Likewise, Other Income (29.3% of Operating Income) improved 3.5%, as a result of higher fees and commissions income.

Overall, RFHL successfully increased income across its revenue streams, with Operating Income growing from $6.7B to $7.2B during the review period. Geographically, results broadly improved, supported by an increase in Operating Income in Guyana (↑19.4%), Eastern Caribbean (↑15.8%), Trinidad and Tobago (↑12.7%), Suriname (↑7.9%), Ghana (↑1.5%) and British Virgin Island (↑0.6%) operations year-on-year.

PBT Expands

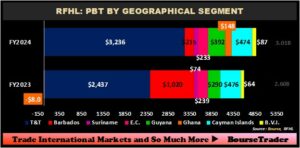

RFHL recorded an expansion in its operations in five out of its eight major operating jurisdictions for the full financial year ended September 30th , 2024, with Profit Before Tax (PBT) advancing to $3.0B.

Trinidad and Tobago, the Group’s largest operating jurisdiction (66.3% of PBT excluding eliminations) grew 32.8% YoY to $3.2B in FY2024 from $2.4B in the prior comparable period, boosted by higher interest income. Guyana (8.0% of PBT) advanced 35.2% in the period under review from $205M to $277M. Ghana (3.0% of PBT) recorded an increase from a prior loss of $8M to a recovered $148M for the reporting period. Suriname (1.9% of PBT) climbed 28.4%, to $95M from the previous $74M. British Virgin Islands (BVI) (1.8% of PBT) expanded 35.9% YoY to $87M.

PBT from Cayman Islands, the second largest contributor of PBT (9.7% of PBT excluding eliminations) fell marginally by 0.4% YoY to $474M from $476M in the previous comparable period. The Eastern Caribbean (4.8% of PBT) contracted 2.5% year-on-year, moving from $239M to $233M in the current reporting period. PBT from Barbados fell 78.9%, to $215M from $1.0B, on account of non-recurring one-off gains in FY2023.

The Bourse View

At a current price of $113.00, RFHL trades at a trailing P/E of 9.2 times, below the Banking Sector average of 10.2 times. The Group declared final dividend of $3.55 per share payable on December 4th, 2024, to shareholders on record by November 21st, 2024. The stock offers investors a trailing dividend yield of 5.0%, above the sector average of 4.7%.

The Group maintains a strong outlook, driven by its diversified portfolio, solid financial performance and growth in core segments. On the basis of geographical diversification of operations, improved earnings and attractive dividends, Bourse maintains an OVERWEIGHT rating on RFHL.

Unilever Caribbean Limited (UCL)

For the nine months ended September 30th, 2024 (9M2024), Unilever Caribbean Limited (UCL) reported Earnings Per Share (EPS) of $0.74, a 45.1% increase from $0.51 reported in the prior comparable period.

Revenue amounted to $173.1M in the current period from $168.1M in 9M2023, an increase in performance by 3%, supported by growth in the Beauty and Personal Care category. Cost of Sales came in 0.1% lower, from $93.6M in 9M2023 relative to $93.5M in the current period. Gross Profit expanded 6.8% to $79.6M. Selling and Distribution Costs and Administrative Expenses both fell 4.4% and 4.6% respectively, leading to an increase of 34.7% in Operating Profit from $20.7M in 9M2023 to $27.9M in 9M2024. There were no Restructuring Costs recorded in the current period, which resulted in an increase of 57.7% in Operating Profit after restructuring costs to $27.9M from a prior $17.7M. Other Income dipped 95.5% to $0.06M (9M2023: $1.34M). Profit Before Taxation amounted to $28.5M, a 38.6% gain from a prior $20.6M. Taxation expense increase 24.9% year on year to $9.1M. Resultantly, UCL’s Profit for the Period amounted to $19.4M, 46.1% higher than $13.3M reported in the prior period.

Revenue Higher

UCL’s revenue trend reflects broad stabilization following several years of volatility. Total Revenue expanded by 3% year on year. The Group continues to yield positive results from the implementation of its strategic business objectives, with Beauty and Personal Care category contributing 55% of total revenue, compared to 50.8% a year earlier.

Margins Higher

Despite modest revenue growth, earnings acceleration was largely attributable to UCL’s profit margins improvement. Gross Profit Margin grew from 44.3% in 9M2023 to 46.0% in 9M2024, on account of higher-margin Beauty and Personal Care category, coupled with the implementation of cost management initiatives. Profit Before Tax Margin increased to 16.5% from a prior 12.2%. UCL’s Operating Profit Margin advanced to 16.1% in 9M2024 from a prior 12.3%.

The Bourse View

At a current price of $11.18, UCL trades at a trailing P/E of 12.7 times, above the Manufacturing Sector average of 9.5 times. The stock offers investors a trailing dividend yield of 5.6%, above the sector average of 4.7%.

Looking ahead, the Group continues to focus on increased profitability, underpinned by cost management and revenue growth initiatives. While this could be tested by consumer buying power in a lower growth environment, on the basis of improved profitability margins and above-sector average dividend yield, Bourse maintains an OVERWEIGHT rating on UCL.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase, or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives, or agents, accepts any liability whatsoever for any direct, indirect, or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third-party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”