HIGHLIGHTS

RFHL FY 2021

- Earnings: Earnings: Diluted EPS up 44.8% from $5.54 to $8.02 in 2021

- Performance Drivers:

- Revenue Resilience

- Credit Losses Contract

- Outlook:

- Acquisition activity

- Elevated Valuations

- Economic Uncertainty

- Rating: Maintained at NEUTRAL

CIF

- Performance Drivers:

- Increased RFHL Earnings

- Increased Dividend Income

- Outlook:

- Price-to-NAV convergence as maturity nears

- Rating: Maintained at NEUTRAL

This week, we at Bourse review the performance of Republic Financial Holdings Limited (RFHL) for the year ended September 30th, 2021 along with an update on the Clico Investment Fund (CIF). Could RFHL continue to build on its recovery momentum into the coming fiscal year? Could the windup of CIF impact RFHL’s share price? We discuss below.

Republic Financial Holdings Limited (RFHL)

RFHL reported a Diluted Earnings Per Share (EPS) of $8.02 in 2021, 44.8% higher than $5.54 reported in 2020. Net Interest Income marginally declined 0.6% YoY or by 24.9M. Other Income ticked up 7.5% to $1.8B, in 2021 relative to $1.7B in 2020. Operating Income marginally increased by 1.8% to $5.8B. Operating Expenses for the period fell 3.0% from 3.6B in 2020 to $3.5B in 2021, as a result of strategic cost-cutting initiatives. Operating Profit for the period stood at $2.3B, compared to $2.1B in 2021, up 10.1%. Credit Loss Expense contracted by 44.0%, due to the non-recurrence of provisions reserved for the potential impact of the pandemic on the loan portfolio in 2020. Profit Before Taxation (PBT) stood at $1.9B, 33.1% higher than $1.5B in the previous period. Net Profit Attributable to Equity holders of the Parent reportedly rose by $404.0M or 44.7%.

Operating Income Inches Higher

RFHL’s Net Interest Income – which contributes approximately 68.4% to Operating Income marginally fell 0.6% in 2021. The Group earned Net Interest Income of $3.97B in FY 2021, a decrease of $24.9M from the prior year. Net interest margin declined from 4.2% in 2020 to 3.7% in 2021.The drop was mainly attributable to reduced interest rates for loans and investments and lower yields.

On the other hand, Other Income (31.6% of Operating Income) expanded 7.5% or by $127M to $1.8B in 2021. The Group benefitted from increased fees and commissions, particularly on credit card services and higher transaction volumes for the period, following the resumption of economic activity from Covid-19 lockdown.

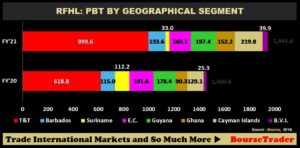

Geographic Diversification Expands

RFHL has been continuing with its efforts of regional diversification. PBT from Trinidad and Tobago, RFHL’s main operating jurisdiction (51.0% of PBT) advanced by 61.5% YoY to record an amount of $1.0B in 2021 compared to $619M in 2020. This is owed to the increases in total loans, deposits, and investments. In August 2021, the Group branched into the Insurance sector under the wholly owned subsidiary, Republic Evolve Limited. Effective September 15th, 2021, the company’s name was changed to Republic Life Insurance Limited. At a broker meeting held on November 22nd, RFHL noted that its strategy – at least initially – was the pursuit of organic growth in this new business line, utilizing its considerable distribution channels.

Cayman Islands which represent the second largest contributor of PBT (11.0%), rose to $220M in 2021, with improvements in investments and corporate, commercial and mortgages portfolios. Guyana (10.0% of PBT) recorded an increased PBT from $178M to $197M for the period, up 10.6%, reflecting growth in all sectors. In response to a question on expansion strategies related to the growing Guyanese economy, RFHL asserted that no acquisitions were planned at this time.

RFHL also recorded a significant uptick across operations in Barbados, Ghana, and British Virgin Islands. Subject to regulatory approval in Barbados and Jamaica, Republic Bank (Barbados) Limited has entered into an agreement with Victoria Mutual Investments Limited (VMIL) to sell 100% of the issued and authorized common shares in Republic Funds (Barbados) Inc. The operations of Republic Bank (Barbados) would be concentrated on its core business of commercial banking.

Despite growth in these territories, RFHL experienced some downturn in other countries where economic conditions were less than favourable. PBT from the Eastern Caribbean fell to $169M in 2021, down 11.8% from $192M in 2020. Suriname’s PBT fell 70.5% moving from $112M in 2020 to $33M in 2021, reflecting of the devaluation of the Surinamese dollar against the US dollar.

EPS Recovers, P/E declines

RFHL’s Earnings Per Share increased 44.8% from $5.54 in FY 2020 to $8.02 in FY 2021, as the Group continues to recuperate from the lingering effects of the Covid-19 pandemic. RFHL’s Price-to-Earnings (P/E) multiple – which has hovered within the 12x-13x range in recent history (FY2017 to FY2019) – rose to its highest level over the past five years of 25.6x in 2020 to 17.0x. the elevated valuations suggest investors remain confident in the Group’s ability to fully recover and growth earnings further, despite the prevailing conditions.

The Bourse View

At a current price of $138.00 and having appreciated 2.2% year to date, RFHL trades at a trailing P/E of 17.2 times, below the sector average of 22.2 times. The stock offers a trailing dividend yield of 2.9% relative to a sector average of 2.4%. The Group has declared a final dividend payment of $3.00 per share payable on December 1st, 2021, from a previous $2.10 in 2020. Collectively, RFHL’s total dividend payment for the current fiscal year 2021 amounted to $4.00, 48.2% higher than 2020. On the basis of continued geographical diversification of operations and growth from acquisition activity but tempered by potential headwinds faced by vaccine hesitancy, elevated valuations and prevailing economic uncertainty, Bourse maintains a NEUTRAL rating on RFHL.

The CLICO Investment Fund (CIF)-RFHL Relationship

For the 2020 financial year, an estimated 58.9% (86.7%: FY 2019) of dividends paid by the CIF were attributable to dividends received from its shares in Republic Financial Holdings Limited (RFHL). RFHL’s dividend reduction from $4.5/share in 2019 to $2.7/share in 2020 ultimately resulted in CIF’s dividend payment to unitholders being decreased from $1.02 in 2019 to $0.68 in 2020. On August 23rd 2021, unitholders received an interim dividend of $0.27, higher than $0.21 paid in the prior period. The recovery in RFHL dividends suggest an improvement in CIF distributions on the horizon.

Could CIF windup affect RHFL share price?

The CIF current market price of $27.96 represents a 9.1% discount to its Net Asset Value (NAV) of $30.77. In effect, investors purchasing the CIF in the past and today would be acquiring the financial assets in the CIF below their current worth (based on prevailing market values). Over the past 12 months, the discount would have narrowed to as little as 7.56% (July 2021). As at December 2020, 89.8% of assets in the CIF were comprised of RFHL shares. Consequently, the performance of RFHL is likely to have a significant impact on the NAV of the CIF.

CIF is expected to ‘wind up’ on January 2nd 2023, with the assets of the Fund being distributed ‘in specie’ to unitholders. This event effectively frees the shareholding of RFHL held in the CIF, with direct ownership of RFHL shares now moving into the hands of former CIF unitholders. A significant increase in the volume of ‘tradable’ RFHL shares could potentially place short-term pressure on the stock price, particularly as smaller investors seek to lock in the gain of having bought the CIF at a discount relative to the its NAV. To note, CIF’s holding of 40,072,299 RFHL shares currently account for 24.5% of RFHL total outstanding shares.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”