RFHL Q1 2023

- Earnings: Diluted Earnings Per Share improved 0.8% to $2.45 from $2.43

- Performance Drivers:

- Increased Income

- Increased Credit Losses

- Outlook:

- Economic Recovery across operating jurisdictions

This week, we at Bourse review the performance of Republic Financial Holdings Limited (RFHL) for its first fiscal quarter ended 31st December, 2022. The Group would have generated higher operating profits, offset by higher credit loss expenses. We also provide a brief update on the termination of the CLICO Investment Fund (CIF) and trading of the assets received as proceeds from the termination.

Republic Financial Holdings Limited (RFHL)

RFHL reported a Diluted Earnings Per Share (EPS) of $2.45 for the three months ended 31st December, 2022 (Q1 2023), a marginal 0.8% improvement relative to the $2.43 reported in the prior comparable period (Q1 2022).

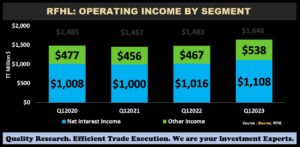

Net Interest Income increased 9.1% YoY by $92.4M. Other Income ticked up 15.2% to $538M, in Q1 2023 relative to $466.9M in Q1 2022. Operating Income advanced by 11% to $1.65B.Operating Expenses for the period increased 4.3% from 871.9M in Q1 2022 to $909.3M in Q1 2023. Operating Profit for the period stood at $737.9M compared to $612.6M in Q12022, leaping ahead 20.5%. Credit Loss Expenses expanded by 366.6% in the current period, attributable largely attributable to the Ghanaian Government’s restructuring of its domestic and international debt.

Profit Before Taxation (PBT) stood at $570.9M, 1.0% lower than $576.8M in the previous period. Taxation Expense rose 13.5%, with the Effective Taxation Rate moving from 25.0% in Q1 2022 to 28.7 % in Q1 2023. Overall, Net Profit Attributable to Equity holders of the Parent reportedly rose by $4.3M or 1.1%.

Revenues Higher

RFHL’s Operating Income continued its upward momentum with a 11.0% increase in Q1 2023. Net Interest Income (67.3% of Operating Income) advanced 9.1% from $1.01B to $1.11, reflecting increasing demand for loans by consumers and supported by a 1.0% ($944.9M) increase in customer deposits. The Group also continued to benefit from higher interest rates on US denominated investments. Similarly, Other Income (32.7% of Operating Income) climbed 15.2%, likely driven by increased fees and commissions as transaction volumes continue to normalize.

PBT falls

RFHL recorded a marginal decline in its operations with PBT down 1.0% to $570.9M in the period under review despite six out of eight operating territories achieving growth.

PBT from Trinidad and Tobago, RFHL’s primary operating jurisdiction (49.6% of PBT) declined 5.0% year-on-year to $283.4M from a previous $298.5M. The Cayman Islands, which represents the second largest contributor to PBT (21.4%) advanced 130.3% to $122.1M. The Eastern Caribbean (19.6% of PBT) increased 73.2% to $111.8M. Suriname expanded 129.8% YoY, with PBT moving from $10.5M to $24.2M in the current period. Guyana recorded an increased PBT from $49.8M to $65.1M for the period, up 30.7%. British Virgin Islands (BVI) expanded 15.4% YoY to $24.0M.

Ghana recorded a loss of $114.2M, falling 381.7%% from $40.5M in Q12022. As mentioned above, this was due to a specific credit loss arising out of the Ghanaian Government’s restructuring of its domestic and international debt.

The Bourse View

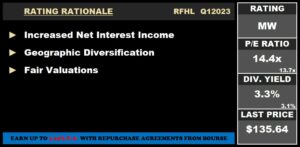

At a current price of $135.64 RFHL trades at a trailing P/E of 14.4 times, above the Banking Sector average of 13.7 times. The stock offers investors a trailing dividend yield of 3.3%, above the sector average of 3.1%.

RFHL has remained resilient despite inflationary pressures and a ‘weaker’ consumer, growing its total assets by 1.5% fuelled by growth in customer deposits across its operating subsidiaries namely T&T, Guyana, Barbados, the Eastern Caribbean and Suriname. Moreover, widespread economic recovery across its jurisdictions should bode well for the Group’s fortunes going forward.

Bourse currently has a target year-end price on RFHL of $147.03 (implying an 8.4% upside over current prices). On the basis of geographical diversification of operations, improved earnings and relatively fair valuations, Bourse assigns a MARKETWEIGHT rating on RFHL.

CIF Termination

The CLICO Investment Fund (CIF) was terminated on January 2nd, 2023 in accordance with its Trust Deed. The trading of CIF units has been suspended, with the last date for trading on the Trinidad and Tobago Stock Exchange (TTSE) having been December 30th, 2022. The distribution of assets commenced on January 24th,2023 with the transfer of the RFHL shares to unitholders. On January 27th, 2023 the RFHL shares were settled into unitholders’ accounts and the Government Bond was allocated pro rata to the Unitholders as well as any payment of residual cash.

An investor holding 1,000 CIF units, for example, would have received 196 RFHL shares, 3445 of the Government of the Republic of Trinidad and Tobago Series (GORTT) 4.25% Fixed Rate Bonds due October 31, 2037 and Residual Cash of $27.55.

CIF Underlying Asset Performance

Unitholders of the Clico Investment Fund (CIF) would have received their allocation of RFHL shares and government bonds on January 27th 2023 which were available for trading on January 30th 2023. Since their listing on the Trinidad and Tobago Stock Exchange, RFHL shares would have traded in a somewhat more erratic manner, peaking at $137.38 before falling to a low of $134.29. The stock closed at $135.64 on Friday 3rd February. Price volatility for RFHL shares may remain volatile in the near-term, as former CIF unitholders attempt to lock in gains made from indirectly buying RFHL shares at a discount.

The Government of Trinidad & Tobago (GORTT) 4.25% 31.10.2037 fixed rate bonds followed a similar path once listed on the Trinidad and Tobago stock exchange. The bond initially traded at 0.88 of par ($88 per $100 Face Value), before falling to a low of 0.84 of par. The bond closed at 0.85 of par on Friday 3rd February. The last traded price corresponds to a yield to maturity of 5.77%. This is slightly lower than the corresponding yield of 5.95% for a similar tenured bond on the prevailing Central Bank of Trinidad & Tobago’s GORTT yield curve. Under current interest rate conditions, this would suggest that the price of the bond should settle closer to an approximate level of $83.50. An investor intending to hold the bond to maturity would be less concerned about day-to-day price changes, focusing instead on the credit quality of the issuer (in this case, GORTT).

Investors interested in either RFHL shares or units of the newly-listed GORTT 4.25% 2037 bond (J314) can contact their preferred Broker-Dealer (including Bourse) for more information.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”