RFHL HY2023

- Earnings: Diluted Earnings Per Share improved 7.8% to $4.81 from $4.46

- Performance Drivers:

- Increased Income

- Increased Credit Losses

- Outlook:

- Economic Recovery across operating jurisdictions

- Rating: Maintained at OVERWEIGHT

AHL Q12023

- Earnings: Earnings Per Share fell 28.6% to $0.10 from $0.14

- Performance Drivers:

- Lower Margins

- Increased Expenses

- Outlook:

- Moderation of supply chain issues

- Economic Normalization

Rating: Maintained at UNDERWEIGHT

This week, we at Bourse review the performance of Republic Financial Holdings Limited (RFHL) for its six months ended 31st March 2023 and Angostura Holdings Limited (AHL) for its first quarter ended 31st March 2023. RFHL would have generated higher operating profits partially offset by higher credit loss expenses, while AHL profitability dipped on account of higher expenses and finance costs. Will RFHL continue to grow its earnings? Can AHL regain ground as the financial year progresses? We discuss below.

Republic Financial Holdings Limited (RFHL)

RFHL reported a Diluted Earnings Per Share (EPS) of $4.81 for the six months ended 31st March 2023 (HY 2023), up 7.8% relative to the $4.46 reported in the prior comparable period (HY 2022).

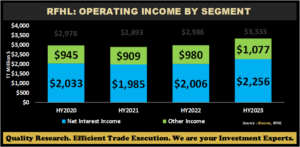

Net Interest Income increased 12.5% YoY by $250M. Other Income rose 9.9% to $1.1B, in HY 2023 relative to $980.1M in HY 2021. Operating Income improved by 11.6% to $3.3B. Operating Expenses for the period increased 2.1% from $1.8B in HY 2023 to $1.82B in HY 2023. Operating Profit for the period stood at $1.5B compared to $1.26B in HY 2022, up 25.6%. Credit Loss Expense expanded by 213.3% in the current period. Profit Before Taxation (PBT) stood at $1.2B, 9.0% higher than $1.1B in the previous period. Taxation Expense increased 12.0% with the Effective Taxation Rate moving from 27.6% in HY 2022 to 28.3% in HY 2023. Overall, Net Profit Attributable to Equity holders of the Parent rose by $58.0M (↑7.96%) to $786.8M.

Revenues Higher

RFHL’s Net Interest Income – which contributes approximately 67.7% to Operating Income increased 12.5% in HY2023. The Group earned Net Interest Income of $2.26B in HY 2023, relative to $2.0B the prior year. Similarly, Other Income (32.3% of Operating Income) expanded 9.9% to $1.08B in HY2023.

Overall, RFHL has was able to improve income across its revenue streams, with Operating Income rising from $2.99B to $3.33B in the period under review. This result is underpinned by Operating Income expansion in Cayman Islands (↑53.7%), Suriname (↑27.4%), Guyana (↑25.4%) and Trinidad and Tobago’s (↑7.3%) operations year-on-year.

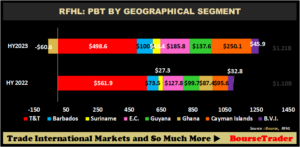

PBT Expands

RFHL recorded an overall expansion in its geographic operations, with PBT advancing 9.0% to $1.2B in the period under review. PBT from Trinidad and Tobago, the Group’s primary operating jurisdiction (41.3% of PBT) declined 11.3% YoY to $498.6M from a previous $561.9M. The Cayman Islands was second largest contributor of PBT for period (20.7%), advancing 161.6% in the period under review from $95.6M to $250.1M.

Eastern Caribbean expanded 45.5%, YoY, moving from $127.8M to $185.8M in HY 2023. Guyana experienced 38.0% growth, from $99.7 in the prior comparable period to $137.6 in the second quarter of 2023. Barbados increased 36.2% to $100.1M. Suriname saw an increase of 77.7% to $48.4M. Ghana declined 169.4% to -$60.6M in HY2023.

RFHL Merger Activity Approved

Effective May 1st, 2023, all regulatory approvals were received for the merger of RFHL’s two subsidiaries – Republic Bank (Cayman) Limited (RBKY) and Cayman National Bank Limited (CNB). CNB will be the surviving entity and RBKY will no longer be a subsidiary within the Republic Group of Companies. This move will enable the RFHL Group to enhance the experience of the existing clients of Republic Bank (Cayman) Ltd. by providing access to a wider array of products and services and eliminating some of the duplication that currently exists across both entities.

The Bourse View

At a current price of $134.01, RFHL trades at a trailing P/E of 13.8 times, broadly in line with the Banking Sector average of 13.5 times. The Board of Directors declared an interim dividend of $1.10, payable on May 31st, 2023, to shareholders on record by May 12th, 2023. The stock offers investors a trailing dividend yield of 3.4%, above the sector average of 3.0%. RFHL’s performance was supported by improved growth in its loan and investment portfolios, also benefitting from increases in customer deposits as activity levels accelerated. On the basis of continued geographical diversification of operations, fair valuations, and relatively attractive dividends, Bourse maintains a MARKETWEIGHT rating on RFHL.

Angostura Holdings Limited (AHL)

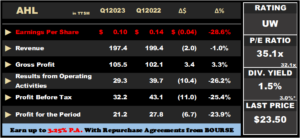

AHL reported an Earnings per Share (EPS) of $0.10 for the period ended 31st March 2023 (Q1 2023), an 28.6% decrease over the $0.14 reported in the prior comparable period.

Revenue for the period stood at $197.4M, a 1.0% decline from $199.4M recorded in Q1 2022. Cost of Goods Sold decreased 5.5% to $91.9M from $97.3M. Resultantly, Gross Profit advanced 3.3% to $105.5M. Selling and Marketing Expenses advanced 29.4% to $45.9M in Q12022 relative to $35.5M in Q12021, as a result of early Q1 investments channelled into Carnival 2023. Administrative Expenses stood at $27.7M, up 8.0% from the prior period. AHL reported an Expected credit loss of $8.1M. Results from Operating Activities stood at $29.3M, a 26.2% decrease compared to $39.7M reported in Q1 2022. Finance Income increased 2.2% to $3.7M (Q1 2022: 3.6M) while Finance Costs climbed 358%% to $8.4M (Q1 2023: $1.8M). Group Profit Before Tax for the period fell 25.4% from $43.1M to $32.2M. Taxation expense declined 23.9% to $11M, with the effective tax rate moving from 35.5% in Q1 2022 to 34.2% in Q1 2023. Overall, AHL recorded a Profit for the Period of $21.2M, 23.9% lower than a previous $27.8M.

Revenue Declines

AHL reported marginal revenue decline of 1.0 % in Q12023. During this period, AHL experienced a delay in shipments in International Markets, namely, Australia which negatively impacted revenue. AHL noted it expects improvements in Revenues in Q22023 and the subsequent quarters as logistics issues abate.

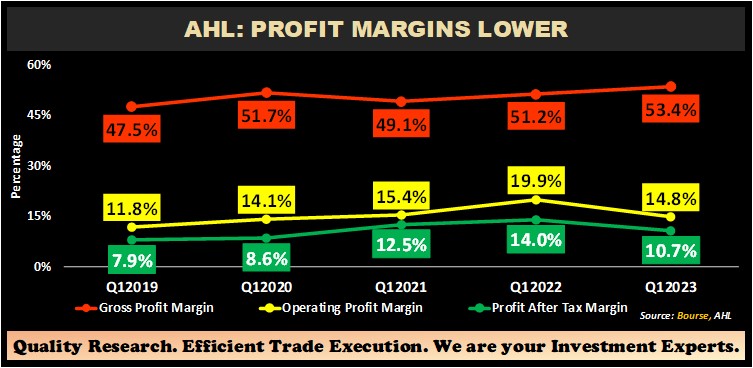

Margins Lower

Gross Profit Margin advanced to 53.4% from 51.2% in Q1 2022 despite the fall in revenues, due to reduced cost of goods as well as improved performance of an internal process which allowed for the increase. Operating Profit Margin fell from 19.9% in the prior comparable period to 14.8% in this current period. This arose due to increases in Selling and marketing expenses and Administrative Expenses. Profit After Tax Margin slid to 10.7% for Q12023 from 14.0% in Q1 2022. The increase in finance income and decrease in taxation expense was not sufficient to offset the diminished results from operating activities and as such, Profit After tax came in lower than the prior comparable period. With anticipated lower seasonal expenses in subsequent quarters, margins could be set to recover.

The Bourse View

AHL is currently priced at $23.50 and trades at a trailing P/E of 35.1 times, above the Manufacturing Sector average of 32.1 times. The Group announced a final dividend of $0.25 payable on July 31st, 2023, to shareholders on record by July 10th, 2023. This brings the total dividend paid by AHL to $0.35, with a trailing dividend yield of 1.5%. With the pandemic now declared ended at a global level and production costs moderating, AHL could be poised for some degree of recovery in the coming quarters. Valuations, however, remain somewhat stretched. On the basis of increased economic activity but tempered by relatively high valuations and weaker near-term margins, Bourse maintains an UNDERWEIGHT rating on AHL.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”