HIGHLIGHTS

PHL HY2024

- Earnings: Earnings Per Share increase 15.6% from $0.32 to $0.37

- Performance Drivers:

- Increased Revenue

- Improving Margins

- New Restaurant Openings

- Outlook:

- Cooling Inflationary pressures

- Geographical Diversification

- Rating: Maintained at OVERWEIGHT

This week, we at Bourse review the financial performance of Prestige Holdings Limited (PHL) for its fiscal six-month ended May 31st, 2024. PHL benefited from revenue growth, increased profit margins and geographical expansion. We also provide an update on current and upcoming capital developments on the Trinidad and Tobago Stock Exchange (TTSE).

Prestige Holdings Limited (PHL)

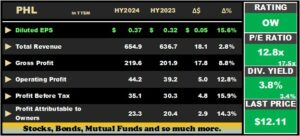

For the six months ended May 31st, 2024, Prestige Holdings Limited (PHL) reported Diluted Earnings Per Share (EPS) of $0.37, an increase of 15.6% from $0.32 reported in HY2023.

Total Revenue grew from a prior $636.7M in HY2023 to $654.9M in the current period, an increase of 2.8%. Gross Profit climbed 8.8% to $219.6M, with Cost of Sales increasing a marginal 0.1%. Operating Expenses and Administrative Expenses went up by 5.5% and 12.9%, respectively. Other income grew 3.0% to $0.8M. Resultantly, PHL reported Operating Profit of $44.2M in HY2024, relative to $39.2M in the prior comparable period (a 13% improvement). Finance Costs increased 2.2% to stand at $9.2M. The Group recorded a Profit Before Tax (PBT) of $35.1M, a 15.9% increase relative to $30.3M recorded in HY2023. Overall, PHL reported Profit Attributable to Owners of the Parent of $23.3M, rising 14.3% from $20.4M in the prior comparable period.

Revenues Higher

PHL’s total revenue advanced to $655M in HY2024 from $637M in HY2023, continuing an upward trend since the Group’s most heavily COVID-affected period. Revenue growth was 2.8% quarter-over-quarter.

New restaurant openings continue to support revenue growth for the Group, with PHL reporting the addition of two Starbucks restaurants in T&T and Guyana.

Margins Improve

The Group’s profitability margins generally improved, with Gross Profit Margin widening from 31.7% in HY2023 to 33.5% in HY202, reflecting astute input cost management. Operating Profit Margin moved from 6.2% to 6.8% in HY2024, with Operating and Administrative Expenses increasing at a slower pace relative to Gross Profit. Profit Before Tax (PBT) margin gained from 4.8% in HY2023 to 5.4% in HY2024.

The Group reasserted its commitment to improving efficiencies and managing input costs, the main contributors to its Pizza Hut and Subway brands which were highlighted as top performing franchises.

The Bourse View

PHL trades at a current market price of $12.11, up 30.2% year-to-date. The stock trades at a trailing 12-month P/E ratio of 12.8 times, below the trading sector’s average of 17.5 times. The group declared an interim dividend payment of $0.16, to be paid to shareholders on August 5th, 2024, and to be registered by July 22nd, 2024. The stock offers investors a trailing dividend yield of 3.8%, above the sector average of 3.4%. On the basis of resilient revenues, improving profitability margins and continued new restaurant openings, Bourse maintains an OVERWEIGHT rating on PHL.

SME IPO Opens

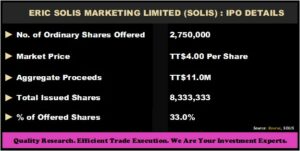

Aiming to become the third listing on the Small-to-Medium (SME) tier of the Trinidad & Tobago Stock Exchange (TTSE), Eric Solis Marketing Ltd (SOLIS) has commenced its Initial Public Offering (IPO).

SOLIS is a subsidiary of Office Authority Ltd and a leading provider of multifunction printers (MFPs), managed print solutions and commercial displays in T&T. It is an authorized dealer for major international brands such as Lexmark, Konica Minolta, HP, Brother, RISO, Fellowes and Samsung. The Company is seeking to raise $11M via an Initial Public Offering (IPO) for 2,750,000 ordinary shares at $4.00 per share, which – if successful – would represent 33 per cent of the total issued ordinary shares in the company post-IPO.

The anticipated use of net proceeds from the IPO includes capital expenditure on rental equipment (approximately 50%), as well as general working capital requirements and acquisition of new lines of business.

The Offer opened to the public on July 16th, 2024, with closing date for submission of subscriptions on August 9th, 2024. The expected notice for allotment of securities is August 30th with the electronic transfer of refunds (if any) expected by September 4th. Unless otherwise indicated, the date for listing the IPO on the Trinidad and Tobago Stock exchange is September 9th, 2024.

How to Invest

In terms of opening a broker account, brokerage accounts can be opened with any broker and prospective applicants must provide the following documents (which varies depending on individual broker):

- Two forms of valid government issued photo identification (ID card, Driver’s permit, Passport)

- Proof of address: a utility bill dated May/June 2024

- Proof of income: a job letter or pay-slip dated May/June 2024

- Proof of chequing or savings bank account number to complete dividend remittance details; Accounts must not be dormant or inactive.

Should you decide that this is a suitable investment for you, you can make an application through any authorized distribution agent or with Bourse Brokers Limited (with a minimum investment of TT$10,000). Notably, all applications must be submitted to the applicant’s broker.

‘Brydens’ Listing Coming?

Investors will be anticipating the cross-listing of Seprod Limited’s AS Brydens & Sons Holdings Limited (ASBH), one of T&T’s largest distributors onto the Trinidad and Tobago Stock Exchange (TTSE). The company successfully listed on the Jamaican Stock Market on November 10th, 2023, at a debut price of JMD$22.50, up roughly 80% from the current price of JMD$40.43.

At its annual general meeting on July 16th, 2024, the Chairman of the Brydens Group noted that delays associated with eventual listing on the TTSE should be resolved by the end of the year. ASBH currently trades at a trailing P/E ratio of 21.7 times on the Jamaica Stock Exchange (JSE).

DISCLAIMER: “This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase, or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives, or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third-party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”