HIGHLIGHTS

TTNGL Q12025

- Earnings: Earnings Per Share: $0.21, 5.0% higher, from EPS of $0.20

- Performance Drivers:

- Higher Profits from PPGPL

- Outlook:

- Potentially Increased Production

- Resumption of Dividend Payments?

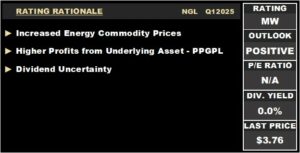

- Rating: Maintained at MARKETWEIGHT

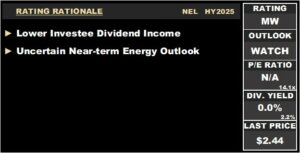

NEL HY2025

- Earnings: Loss Per Share of $0.31 from a prior LPS of $0.22

- Performance Drivers:

- Significant Decrease on Fair Value of Investee Companies

- Lower Dividend Income

- Outlook:

- Potential Increase in Natural Gas Supply

- Rating: Maintained at MARKETWEIGHT

This week, at Bourse, we review the financial performance of Trinidad and Tobago NGL Limited (TTNGL) for its first fiscal quarter ending March 31st, 2025, as well as National Enterprises Limited (NEL) for its fiscal six-month period ending March 31st, 2025. TTNGL reported increased profits, driven by improvements in investee company PPGPL. NEL, meanwhile, experienced reduced dividend income amid ongoing challenges in the energy sector. We discuss below.

Trinidad and Tobago NGL Limited (TTNGL)

TTNGL generated an Earnings Per Share (EPS) of $0.21 for the three months ended 31st March 2025 (Q12025), 5.0% higher than $0.20 per share in Q12024.

Share of Profit from its Investment in Joint Venture, Phoenix Park Gas Processors Limited (PPGPL) rose 4.5% to $32.2M in Q12025 from $30.8M in the prior comparable period. According to TTNGL, PPGPL’s performance was supported by: (i) a rise in Mont Belvieu product prices (ii) improved uptime efficiency, (iii) increase in NGL content, (iv) ongoing cost rationalization, and (v) a marginal drop in gas volumes to Point Lisas.

Interest Income increased 28.1% year-on-year. Cumulatively, Total Income stood at $32.3M relative to $30.9M in the prior year, up 4.5%. Total expenses increased 9.6% from $0.4M to $0.5M in the current period. This translated to a Profit Before Tax of $31.8M in Q12025. Overall, Profit for the Period amounted to $31.8M in Q12025.

Benchmark NGLs Prices Higher

Benchmark Natural Gas Liquids (NGLs) prices were broadly higher for the period as a result of a rise in global demand for NGLs.

Average Butane prices grew 2.9% from US$1.03 per gallon in Q12024 to US$1.06 per gallon in Q12025, while average Propane prices gained 5.9% from US$0.85 per gallon to US$0.90 per gallon. Natural Gasoline dipped marginally to US$1.53 per gallon in Q12025 from US$1.54 in the prior comparable period. Year to date, the weighted basket of NGLs has averaged US$1.02 per gallon.

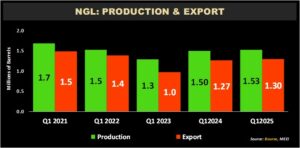

Domestic Production, Exports Grow

Production and exports of NGLs have shown a general downward trend from Q12021 to Q12023. However, a recovery was noted in Q12024 and Q12025.

In Q12025 (January – March 2025), NGL production rose 1.4% to 1.53M BBLS from 1.50M BBLS in Q12024. Exports of NGLs by PPGPL increased from 1.27M BBLS to 1.30M BBLS (+2.3%) in Q12025. This reflects continued improvement following the dip in both production and export volumes in Q12023.

Energy Sector Announcements

The following recent announcements should be supportive to energy production in the medium-to-long term:

- On May 14th, 2025, Perenco T&T Limited announced a major natural gas discovery at the Onyx field and is advancing work in the TSP (Teak Samaan Poui) Block and the CAFI (Cashima, Amherstia, Flamboyant, Immortelle and Parang) fields. The company also acquired the Greater Angostura assets from Woodside Energy.

- On May 29th, 2025, bpTT and EOG Resources Trinidad Ltd. achieved first gas from the Mento project. Their next joint venture project, Coconut is on track for production by 2027.

- On June 1st, 2025 – Shell Trinidad and Tobago, has taken a Final Investment Decision (FID) on the Aphrodite project, an undeveloped gas field in the East Coast Marine Area (ECMA). The development of the field remains subject to regulatory approvals, with production expected in 2027, targeting peak output of 107 MMscf/d.

Dividend uncertainty persists

TTNGL has not declared any dividend payments since FY2022, largely as a result of unresolved regulatory limitations. While the company has emphasized its commitment to finding a sustainable solution, no firm plans have been announced. According to TTNGL in its 2024 annual report, a formal proposal is expected this year, subject to stakeholders and regulatory approvals.

As at March 2025, the company held cash and near-cash resources totaling $164.5M, the equivalent of approximately $1.06 per share.

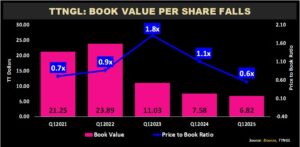

The company’s Book Value Per Share (BVPS) declined from $7.58 in Q12024 to $6.82 in the most recent period. After peaking at 1.8 times in Q12023, the Price-to-book (P/B) reached to a low of 0.6 times in Q12025, led by a weakening in the stock price.

The Bourse View

TTNGL currently trades at a market price of $3.76 down 21.2% year-to-date. The stock currently trades at a market-to-book ratio of 0.6 times.

Despite an improved first quarter performance, the Company continues to face near-term headwinds. Investor sentiment remains cautious, driven by concerns over the near-term energy production outlook and the palpable absence of dividend payments. The Company’s ability to resume dividends, however modest, will be key to changing investor perspectives on the stock. Accordingly, Bourse maintains a MARKETWEIGHT rating on TTNGL.

National Enterprises Limited (NEL)

NEL reported a Loss per Share (LPS) of $0.31 for the six months ended 31 March 2025 (HY2025), wider than the Loss Per Share of $0.22 in the prior comparable period. Notably, included in this loss per share was a non-cash decline in fair value of assets amounting to $235.9M (2024: $241.5M).

The Group’s Dividend Income declined by 57.3% to $45.8M from $107.2M in the previous period. Other Income rose slightly by 6.6% to $8.1M, while Foreign Exchange Gains dropped significantly by 66.4%, from $0.7M to $0.2M in HY2025. Operating Expenses decreased by 14.8% to $2.8M in the current period, from $3.3M in HY2024. Operating Income fell by 54.1% to $50.8M in HY2025, reflecting the combined impact of lower dividend income. NEL reported a Loss before Tax Expense of $185.0M for HY2025, widening from a loss of $130.8M (HY2024). The Change in Fair Value of Assets amounted to $235.9M, a narrower decline than the $241.5M year-on-year. Tax expense declined slightly by 3.6% to $2.4M. Overall, the Group recorded Total Comprehensive Loss to $187.5M in HY2025, 40.7% higher than the previous comparable period.

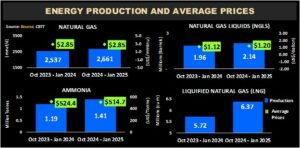

Energy Prices Mixed

During the period October 2024 – January 2025 Natural Gas production in T&T averaged 2,661 mmcf/d, slightly higher than the 2,537 mmcf/d recorded in the prior comparable period. The average price of Natural Gas (based on Henry Hub pricing) remained stable at US$2.85/MMBtu for the period October 2024 – January 2025, unchanged from the previous year.

Domestic production of Natural Gas Liquids (NGLs) improved by 9.3%, from 1.96M barrels/day to 2.14M barrels/day over the comparable period. However, the average price of NGLs (propane, butane, and natural gas) increased 6.6%, moving to US$1.20/Gallon from US$1.12/Gallon in the prior comparable period.

NEL’s exposure to the Ammonia industry faced headwinds, with ammonia prices declining 1.9% to US$514.7/Tonne from US$524.4/Tonne in October 2024 – January 2025. Despite the price decrease, Domestic Ammonia production increased by 18.4%, moving from 1.19 Million Tonnes (MT) to 1.41 MT.

In the same period, Liquefied Natural Gas (LNG) production rose by 11.5%, totalling 5.72M cubic meters compared to 6.37M cubic meters in the prior period.

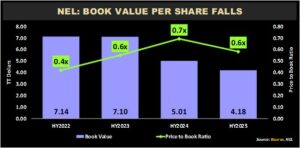

NEL’s Book Value Per Share (BVPS) dropped to $4.18 in HY2025, down 16.4% from $5.01 in the prior period, reflecting the change in fair value of its investee companies. With the accompanying fall in share price, the Group’s price-to-book ratio fell from 0.7 times in HY2024 to 0.6 times in the current period.

The Bourse View

At a current price of $2.44, NEL is trading at a market-to-book ratio of 0.6 times, below its recent historical average of around 1.0 times. Reduced cash flow from investee companies via dividends and continued fair value declines will weigh on the minds of existing and potential investors.

While the medium-to-long term outlook could potentially improve with more favourable energy production, near-term activity in the energy sector is expected to remain relatively subdued. Investors remain cognizant of the ongoing uncertainty in the energy sector, the volatility in global energy markets and regional geopolitical factors. Accordingly, Bourse maintains its MARKETWEIGHT rating on NEL.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.