HIGHLIGHTS

NCBFG HY2024

- Earnings: Earnings Per Share of TT$0.16, 84.9% higher from EPS of TT$0.09

- Performance Drivers:

- Resilient Banking Results

- Improved Insurance Results

- Post-Adoption of IFRS 17

- Outlook:

- Resumption of Dividend Payments

- Rating: Maintained as OVERWEIGHT

GHL Q12024

- Earnings: EPS dropped 8.2% from $1.10 to $1.01

- Performance Drivers:

- Lower Net Insurance and Investment Result

- Higher Insurance Revenues

- Post-Adoption of IFRS 17

- Outlook:

- Economic Uncertainty

Rating: Maintained at MARKETWEIGHT

This week, we at Bourse review the performance of NCB Financial Group Limited (NCBFG) and Guardian Holdings Limited (GHL) for its six months (HY2024) and three months (Q12024) ended March 31st, 2024, respectively. NCBFG’s performance was supported by stronger insurance and investment results. Conversely, GHL was impacted by higher insurance finance expenses. We discuss below.

NCB Financial Group Limited (NCBFG)

NCB Financial Group Limited (NCBFG) generated an Earnings Per Share (EPS) of TT$0.16 for the six months ended 31st March 2024 (HY2024), advancing 84.9% from TT$0.09 in the prior comparable period (HY2023).

Net Interest Income and Net fee and commission income increased 1.2% and 14.3% respectively, primarily due to growth in loan and investment portfolios and higher transaction volumes. Net Revenues from Banking and Investment Activities grew 2.1%, improving from TT$1.71B in HY2023 to TT$1.74B in the present quarter. Net Revenues from Insurance Activities expanded 51.5% from TT$726.6M in HY2023 to TT$1.1B in HY2024, led by a 73.0% or TT$374M increase in insurance investment and other income. Net Operating Income rose 16.8% to TT$2.8B in HY2024.

Operating expenses grew 4.5% in HY2024 to TT$2.1B from $1.99B the previous year, while Operating Profit stood at TT$755.8M in HY2024, 72.9% higher than the TT$437.1M reported in HY2023. In the period under review, the Share of Profit of Associates increased 7.5% to TT$10.0M. Profit before Tax expanded 71.5% to TT$765.8M from TT$446.4M in the prior comparable period (HY2023). Resultantly, Net Profit Attributable to Shareholders climbed 88.9% from TT$199.7M to TT$377.3M in the current reporting period.

Operating Income by Activity

NCBFG’s Operating Profit advanced year on year with four of the seven segments yielding improved performance.

Life and Health Insurance & Pension Fund Management amounted to TT$675M relative to TT$251M in the comparable period, reflecting a 168.7% improvement and supported by the adoption of IFRS 17. Treasury and Correspondent Banking expanded 41.8% from TT$194M to TT$275M in the current period. Payment Services climbed 279.8% to TT$22.9M in HY2024 compared to TT$16M in the prior period. General Insurance fell by 26.6% to TT$139M. Wealth, Asset Management and Investment Banking reported TT$51M of operating profit, 66.4% lower than the previous comparable period. The Group’s Corporate and Commercial Banking division contracted 2.3% to TT$134M. Consumer and SME Banking Wealth which contributed the least to Operating Profit, swung from a deficit of TT$24M to a profit of TT$29M, aided by the 10.9% increase in operating income.

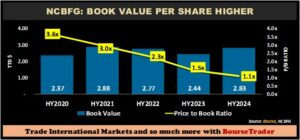

NCBFG’s book value per share grew in HY2024, attributable to growth in retained earnings and a decline in the still-negative Fair Value and Capital Reserves. The Company’s Book Value Per Share (BVPS) has remained relatively range-bound in the past few years, increasing from $2.37 in HY2020 to $2.83 in the current period, resulting in a relatively appealing price-to-book (P/B) ratio of 1.1x (HY2024), below its five-year average of 2.3x.

APO Completed, Assets Sold

The regional financial conglomerate, NCBFG raised J$2.5B or TT$109M (via issuance of 38.5M ordinary shares) in its recently completed Additional Public Offering (APO) on June 3rd, 2024. The APO was undersubscribed by roughly 50%, as the Group sought to initially raise J$5.0B in new capital. According to the Group, proceeds from the APO would be used to reduce debt and capital of its subsidiaries.

Additionally, NCBFG announced the proposed sale of 30.20% of its equity in Clarien Group Limited, subject to regulatory approvals. The Group entered into a Share Purchase Agreement with Cornerstone Financial Holdings Limited, a privately held company in Barbados to facilitate this transaction. Following the proposed sale, NCBFG will retain a 19.90% interest in Clarien Group.

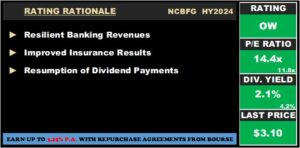

The Bourse View

NCBFG currently trades at a price of $3.10 at a trailing P/E ratio of 14.4 times, relative to the Banking Sector average of 11.8 times. The Group declared an interim dividend of TT$0.022 per share which was paid on June 10th, 2024 to shareholders. The stock offers a dividend yield of 2.1%, below the sector average of 4.2%.

The Group’s recent recovery in financial performance will come as welcome news for investors. NCBFG’s recently concluded APO and assets sales, likely aimed at optimizing its capital structure, should be supportive of greater earnings stability in subsequent periods. On the basis of (i) earnings growth, (ii) the resumption of dividend payments to shareholders and (iii) relatively attractive P/B valuations, Bourse maintains an OVERWEIGHT rating on NCBFG.

Guardian Holdings Limited (GHL)

Guardian Holdings Limited (GHL) reported Earnings per Share of $1.01 for its first quarter ended March 31st, 2024, down 8.2% from $1.10 in the prior comparable period. Insurance Service Result expanded 9.5% from $166.2M in the prior period to $181.9M in Q12024, aided by a 12.2% increase in insurance revenues due to ongoing improvement across its core business operations. Net Income from Investing Activities also increased 7.8% to $533.3M. This was offset by higher Net insurance finance expenses to $213.5M from $152.8M in Q12023, primarily arising from the LHP segment. Consequently, Net Insurance and Investment Result amounted to $501.6M relative to $507.9M in Q12023, 1.2% lower. Fee and commission income from brokerage activities advanced by $4.3M or 8.6% year-on-year, mainly due to increased income from operations in the Netherlands. Net Income from all activities fell 0.3% to $556.1M in the period under review. Other operating expenses rose 0.9% YoY partly impacted by a combination of inflationary pressures on GHL’s cost structure and increased expenditure to support commercial activities. Operating Profit contracted 1.1% from $305.7M to $302.4M in Q12024. Share of after-tax profits of associated companies increased to $3.7M. Profit Before Taxation amounted to $306.2M, relative to $306.8M in the prior period. Taxation grew from $49.8M to $69.5M in Q12024. Profit for the Period stood at $236.7M, dropping 7.9% from the prior period of $256.9M. Overall, Profit Attributable to Equity Holders of the Company recorded a decline of $233.8M by $21.8M, (8.5% lower) compared to the profit of $255.7M in the same period last year.

LHP Segment Down

Operating Profit for the period came in at $302.4M during the three–month period, contracting 1.1% from the prior comparable period. Life, Health and Pension (LHP) (92.3% of operating profit) declined 2.4% year on year from $285.8M to $279.0M, primarily due to higher insurance finance expenses (despite revenue growth). The Property and Casualty Segment (16.8% of Operating Profit) fell 19.3% to $50.8M in Q12024, with higher revenue more than offset by increased expenses. Insurance Brokerage rose to $31.7M, due to increased fee and commission income from brokerage activities. Asset Management saw the largest gain, expanding 30.8% from $15.7M in Q12023 to $20.5M in Q12024.

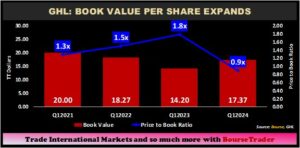

From a value perspective, GHL’s book value per share advanced from $14.20 in Q12023 to $17.37 in the most recent period. The sharp decline in GHL’s price has led to its price to book ratio decreasing from 1.8 times in Q12023 to 0.9 times, indicating that investors are currently paying less on a per-share basis to own net assets of the company.

The Bourse View

GHL is currently priced at $15.69 and trades at a price to earnings ratio of 5.4 times, below the Non-Banking Financial Sector average of 12.8 times. The stock currently offers investors a trailing dividend yield of 4.8% compared to a sector average of 5.0%. On the basis of improved insurance revenue, relatively attractive valuations but tempered by lower earnings and higher financing expenses, Bourse maintains a MARKETWEIGHT rating on GHL.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase, or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives, or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third-party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”