HIGHLIGHTS

MASSY 9M 2023

- Earnings: Earnings Per Share 0.04% higher

Continuing Operations: EPS 20.5% higher, from $0.24 to $0.20

Discontinued Operations: EPS 92.1% higher, from $0.44 to $0.04

- Performance Drivers:

- Increased Revenues

- Sale of Non-Core operations

- Outlook:

- Geographical Diversification

- Rating: Maintained at OVERWEIGHT

GKC HY 2023

- Earnings: Diluted Earnings Per Share 14.5% higher, from TT$0.16 to TT$0.18

- Performance Drivers:

- Revenue Growth

- Improving Margins

- Outlook:

- Acquisition Activity

- Financial Market Volatility

- Rating: Maintained at OVERWEIGHT

This week, we at Bourse review the performance of two stalwarts of the Conglomerate sector on the Trinidad & Tobago Stock Exchange (TTSE), Massy Holdings Limited (MASSY) for the nine-month period ended June 30th, 2023 and Grace Kennedy Limited (GKC) for the half-year period ended June 30th, 2023. GKC reported improved earnings, and gains on acquisition while MASSY improved on account of increased revenue growth. With both groups building growing earnings on account of increasing revenue, can this momentum be sustained in subsequent periods? We discuss below.

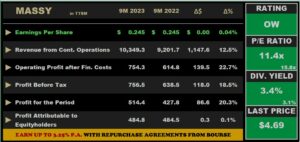

Massy Holdings Limited (MASSY) reported Earnings Per Share (EPS) of $0.245 for the nine-month period ended 30th June 2022 (9M 2023), 0.04% higher than an EPS of $0.245 reported in 9M 2022.

Notably, Revenue from Continuing Operations grew 12.5% YoY, from $9.2B in 9M 2022 to $10.3B in 9M 2023. Operating Profit After Finance Costs advanced 22.7% to $754.3M from the previous comparable period. Share of Results of Associates and Joint Ventures fell 90.7% to $2.2M (9M 2022: $23.6M). Resultantly, Profit Before Tax (PBT) increased 18.5% to $756.5M. Income Tax Expense rose to $242.1M (9M2022: $210.7M, or 14.9% higher). Profit for the period from continuing operations gained 20.3% to $514.4M compared to $427.8M in the 9M 2022. With profit from discontinued operations falling to $7.0M from a prior $87.9M, overall, Profit Attributable to Owners of the Parent stood at $484.8M, a 0.1% marginal increase compared to $484.5M reported in the previous period.

Overall, MASSY’s PBT expanded 18.5% for the fiscal period 9M 2023. Segment PBT moved from $806M in 9M 2022 to $864M in 9M 2023, supported by growth across all major operating segments. Integrated Retail, the most significant contributor of PBT (50%) advanced 18.7% from $364.4M in 9M 2022 to $432.5M in 9M2023, owing to its acquisition of Rowe’s IGA supermarkets in December 2022. According to the group, proceeds from divestments are being leveraged for acquisitions in the Group’s core portfolio as part of its divestment program. Gas Products, the second largest contributor to PBT (26%) expanded 5.5% from $211.5M to $223.2M and Motor & Machines (16% of PBT) grew 4.7% to $141.8M from $135.4M YoY. Financial Services (8% of PBT) reported a 1.1% gain in 9M 2023 from $68.8M to $69.5M, attributable to improved revenue from its remittance services. The Real Estate segment swung from a PBT of $25.7M in 9M2022 to a loss of $3.5M.

Geographic Diversification Expands

MASSY’s continued regional/international diversification initiatives are reflected in its geographical PBT contribution, with acquisitions across the Caribbean, Latin America, and the US. While Trinidad & Tobago remains the largest geographic contributor to PBT, and the fast-growing economy of Guyana continues to increase in prominence. Guyana’s share of PBT has grown significantly from 15.9% in 2019 to 25.7% in the current reporting period. Trinidad & Tobago grew 0.1% YoY (37.5% of total PBT) while Barbados (11.6% PBT contribution) fell 11.8% to $100M, relative to $113.4M reported in the previous comparable period. Eastern Caribbean operations recorded improved results, up 13.3%, relative to $86.9M the prior period. For this fiscal reporting period, Guyana’s operations grew 20.2% YoY. PBT from U.S operations climbed 271.3% from $7.4M, primarily driven by new and existing acquisitions. Jamaica’s operation also recorded improved results, with a 50% jump in PBT, from $43.2M for 9M 2022 to $64.7M in the current reporting period. Jamaica’s contribution to PBT is anticipated to increase noticeably in subsequent periods following the successful acquisition of IGL Limited, a major player in the Jamaican Liquefied Petroleum Gas (LPG) and Industrial Medical Gas (IMG) industries.

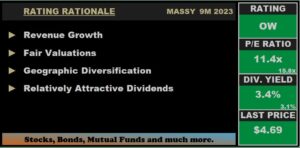

MASSY currently trades at a price of $4.69, up 4.22% year-to-date. The stock trades at a market to book ratio of 1.28 times, compared to the Trading sector average of 1.17 times and a trailing 12-month P/E of 11.4 times, below the Conglomerate Sector average of 15.8 times. MASSY offers investors a trailing dividend yield of 3.4%, above the sector average of 3.1%.

On the basis of continued revenue growth, accretive acquisition activity and relatively attractive valuations when compared to the sector, Bourse maintains an OVERWEIGHT rating on MASSY.

GraceKennedy Limited (GKC)

GKC reported Earnings per Share (EPS) of TT$0.18 for the half year period concluded on June 30th, 2023 (HY2023), an increase of 14.5% over the corresponding period in HY2022.

Revenue from Product and Services improved 7.2% from $TT3.1B to TT$3.3B, while Interest Revenue advanced 25.3% to TT$123.3M. Notably, Total Revenue advanced 7.8% to TT$3.4B in HY2023 from $3.2B in HY2022. Direct and Operating Expenses grew 7.6% to TT$3.2, and Net Impairment Losses on Financial Assets climbed 13.3% to TT$5.8M. As a result, Total Expenses expanded by 7.6%. GKC’s Profit from Operations increased 13.3% from TT$235.6M (HY2022) to TT$266.8M (HY2023). Interest Income from Non-Financial services gained 22.9% year on year (YoY), accompanied by a 24.1% increase in Interest Expense from Non-Financial Services. Share of Results of Associates and Joint Ventures increased 23.0% to $22.8M from $18.6M in the prior comparable period. Profit Before Tax (PBT) grew to $268.5M, up 13.2% from $237.2M in HY2022. Taxation expense moved from TT$62.8M to TT$72.5M, increasing 12.6% from HY2022. Resultantly, Profit for the period was up 13.4%, an increased from TT$172.8M to TT$196.0M in the current review period. In comparison to TT$160.3M recorded in the prior comparable period, Net Profit Attributable to Owners of GKC increased by 14.5% to TT$183.2M in HY2023.

Food Trading Segments Buoys PBT

Food Trading, the largest contributor to PBT (58.7%) increased 30.0% from TT$132.6M in HY2022 to TT$172.4M in HY2023. GKC’s food businesses reportedly generated improved profitability across all businesses.

GraceKennedy Money Services (GKMS), the second largest contributor to PBT (24.7%) experienced a marginal increase of 2.6%, producing PBT of $72.5M in HY2023 relative to the prior comparable period’s $70.7M. Despite reduced remittances inflows, GKMS showed resilience and delivered stable profits attributable to partnership with Unicomer Jamaica Limited and its local network of Courts Retail stores.

The Group’s Insurance Segment, which accounted for 10.8% of PBT, experienced significant growth of 30.8% as a result of the successful acquisition of Scotia Insurance Caribbean, presently, GK Life. GK Life is expected deliver improved profitability with anticipated expansion to a thirteenth market, The Dutch Caribbean via St. Maarten, proposed to commence before end of 2023.

Banking and Investments (5.8% of PBT) declined 50.2%, on account of GK Capital Management Limited’s (GK Capital) decline in revenue and profitability. The positive results reported by First Global Bank (FGB) was not sufficient to offset the negative performance of GK Capital which was underpinned by the underperformance of the Jamaican equity market and higher interest rates.

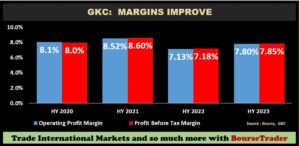

Margins Improve

GKC margins improved in the current quarter, primarily driven by the cooling global inflationary pressures, with continued positive momentum anticipated as gains accrue from acquisition activity and the implementation of technological and green initiatives to enhance operational efficiency. Operating Profit Margin improved notably from 7.1% in HY2022 to 7.8% in HY2023. Similarly, Profit Before Tax Margin increased from 7.2% (HY2022) to 7.9% in the current period. Looking ahead, the Group stated that it will maintain its focus on improving profitability and the expansion its portfolio of production and distribution operations, signalling the potential for greater margin improvement in upcoming quarters.

The Bourse View

At a current price of $3.34, GKC trades at a P/E ratio of 10.3 times, below the Conglomerate Sector average of 15.8 times. The stock offers investors a trailing dividend yield of 2.7%, below the sector average of 3.1%. The Group announced the third interim dividend of TT$0.02, payable on September 22nd, 2023.

The Group is expected to continue pursuing its growth strategy, with inorganic opportunities (acquisitions) remaining a priority. On the basis of improving margins and relatively attractive valuations, aided by acquisition activity, Bourse maintains an OVERWEIGHT rating on GKC.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase, or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives, or agents, accepts any liability whatsoever for any direct, indirect, or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third-party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”