MASSY HY2023

- Earnings: EPS increased 9.3% from $0.154 to $0.168

- Performance Drivers:

- Increased Revenues

- Acquisition Activity

- Outlook:

- Geographical Diversification

- Rating: Maintained at OVERWEIGHT

AMCL Q12023

- Earnings: EPS 168.2% higher from $0.22 to $0.59

- Performance Drivers

- Higher Revenues

- Continued Acquisitions

- Outlook:

- Growth Opportunities

- Rating: Maintained at OVERWEIGHTThis week we at Bourse review the performance of two Conglomerate sector giants of the Trinidad & Tobago Stock Exchange (TTSE), Massy Holdings Limited (MASSY) for the half-year period ended March 31st, 2023 and Ansa McAL Limited (AMCL) for its first quarter ended March 31st, 2023. MASSY and AMCL both reported improved earnings owing to strong revenue growth and improved operating margins. Can both regional giants sustain their performance in the coming months ahead? We discuss below.

Massy Holdings Limited (MASSY)

Massy Holdings Limited (MASSY) reported an Earnings Per Share (EPS) of $0.168 for the six-month period ended March 31st, 2023 (HY2023), 9.3% higher than an EPS of $0.154 reported in HY2022.

Revenue from Continuing Operations grew 10.6% YoY, from $6.1B to $6.8B. Operating Profit After Finance Costs advanced 19.2%, while Operating Margin increased from 6.9% to 7.5%. Share of Results of Associates and Joint Ventures decreased 40.6% to $11.2M. Resultantly, Profit Before Tax (PBT) expanded by 16.7% to $519.9M in HY2023 relative to $445.6M in HY2022. Income Tax Expense increased to $166.4M ($18.7M or 12.6% higher). Overall, Profit Attributable to Owners of the Parent stood at $333.1M, a 9.3% increase compared to $304.8M reported in the previous period.

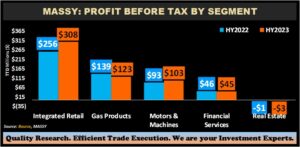

Integrated Retail Propels PBT

MASSY’s overall PBT expanded 16.7% for the period under review. The Group’s Integrated Retail segment (53.5% of PBT) posted the best year-on-year percentage gain, increasing 20.3% from $256M in HY2022 $ to 308M in HY2023, as the segment continues to benefit from its acquisition of Rowe’s IGA supermarkets. According to the Group, the acquisition provides a good platform for further supermarket acquisitions in the U.S. The Group’s retail and distribution businesses also benefitted from a strong tourist season, improved product availability and a reduction in supply chain issues.

Gas Products (21.4% of PBT) fell 11.1% from $139M to $123M, led by Massy Gas Products (Trinidad) Limited due to non-recurring oxygen demands in HY2022 versus the current year HY2023. On January 27th, 2023, the group acquired Air Liquide’s operations in Trinidad. The Group’s IGL Jamaica acquisition is still pending approval with the Jamaica Fair Trade Commission (FTC) and the transaction is expected to close in Q32023. The combination of acquisitions would strengthen MASSY’s regional Gas Products Portfolio market share in the upcoming periods.

The Group’s Motors and Machines segment (17.9% of PBT) increased 11.2% to $103M in HY2023. Financial Services contracted 2.5% from $46M to $45M in the period under review, despite strong loan growth. MASSY’s Remittance Services continues to expand its agent footprint with the launch of 7 new agent locations in HY2023 to a total of 110 agents. The Real Estate segment reported a loss of $3.0M in HY2023.

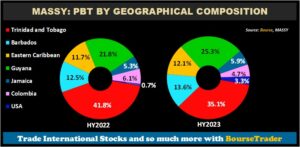

Guyana contribution to PBT Expands

MASSY has been increasing its exposure across the Caribbean and Latin America as part of its ongoing regional diversification initiatives. Guyana continues to grow in prominence in contributing to MASSY’S PBT, contributing 25.3% to PBT as the country continues along its path of economic growth and is projected to expand by 37.2% in 2023 (IMF April 2023 outlook). USA’s PBT by contribution increased from 0.7% to 3.3% in HY2022, positively impacted by the IGA acquisition. Colombia now accounts for 4.7% of PBT, relative to 6.1% in HY2022, as operations were negatively affected by a devaluation of the Colombian Peso and rising inflation. PBT contributed by the Eastern Caribbean and Jamaica increased to 12.1% and 5.9% respectively.

MASSY has been increasing its exposure across the Caribbean and Latin America as part of its ongoing regional diversification initiatives. Guyana continues to grow in prominence in contributing to MASSY’S PBT, contributing 25.3% to PBT as the country continues along its path of economic growth and is projected to expand by 37.2% in 2023 (IMF April 2023 outlook). USA’s PBT by contribution increased from 0.7% to 3.3% in HY2022, positively impacted by the IGA acquisition. Colombia now accounts for 4.7% of PBT, relative to 6.1% in HY2022, as operations were negatively affected by a devaluation of the Colombian Peso and rising inflation. PBT contributed by the Eastern Caribbean and Jamaica increased to 12.1% and 5.9% respectively.The Bourse View

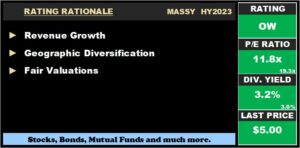

At a current price of $5.00, MASSY trades at a trailing P/E of 11.8 times, below the Conglomerate Sector average of 19.3 times. MASSY’s P/E ratio ex-discontinued operations stand at 13.5 times. The stock offers investors a trailing dividend yield of 3.2%, in line with the sector average of 3.0%. The Board of Directors declared an interim dividend of $0.0315, payable on June 15th, 2023, to shareholders on record by June 1st, 2023. On the basis of continued geographical diversification, margin improvement and growth via acquisitions, Bourse maintains an OVERWEIGHT rating on MASSY.

At a current price of $5.00, MASSY trades at a trailing P/E of 11.8 times, below the Conglomerate Sector average of 19.3 times. MASSY’s P/E ratio ex-discontinued operations stand at 13.5 times. The stock offers investors a trailing dividend yield of 3.2%, in line with the sector average of 3.0%. The Board of Directors declared an interim dividend of $0.0315, payable on June 15th, 2023, to shareholders on record by June 1st, 2023. On the basis of continued geographical diversification, margin improvement and growth via acquisitions, Bourse maintains an OVERWEIGHT rating on MASSY.Ansa McAL Limited (AMCL)

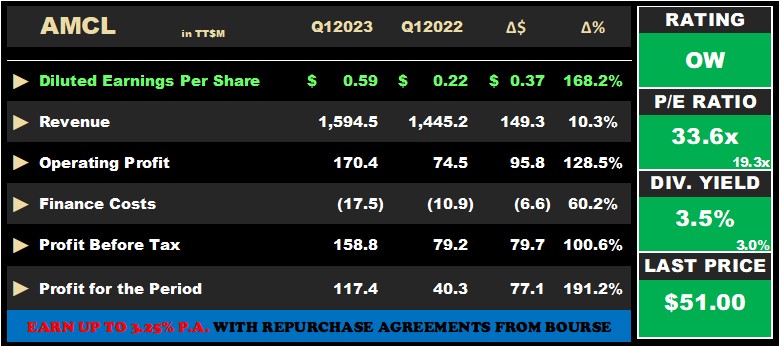

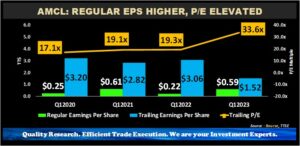

Ansa McAL Limited (AMCL) reported a Diluted Earnings per Share (EPS) of $0.59 for the three months ended March 31st,2023 (Q12023), 168.2% higher than an EPS of $0.22 reported in Q12022.

Ansa McAL Limited (AMCL) reported a Diluted Earnings per Share (EPS) of $0.59 for the three months ended March 31st,2023 (Q12023), 168.2% higher than an EPS of $0.22 reported in Q12022.Revenue for the period amounted to $1.6B in Q12023, up 10.3% or $149.3M as reported in the prior period. Operating Profit climbed 128.5% to $170.4M in comparison to $74.5M in Q12022. Resultantly, the Operating Margin increased from 5.2% to 10.7% Year-on-Year (YoY). Profit Before Tax (PBT) experienced a 100.6% improvement for the period, from $79.2M to $158.M in Q1 2023. Finance Costs rose 60.2% or $6.6M. There was a 45.0% fall in Share of Result of Associates and Joint Venture Interests to $7.0M from $15.6M. The Group recorded taxation expenditure of $42.4M, with the Effective Tax Rate moving from 49% to 26.7%. Consequently, Profit for the Period expanded 191.2% from $40.3M reported in Q1 2022 to stand at $117.4M in Q12023.

PBT Expands

AMCL’s Profit Before Tax (PBT) recovered to $159.8M in Q1 2023 relative to $79.2M in Q12022. Manufacturing, Packaging & Brewing PBT declined 25.8% from $89M in Q12022 to $66M in Q1 2023, as a result in increased input costs. The Automotive, Trading & Distribution segment increased 11.8% to $38M relative to $34M in the prior period as there was a notable increase in sales as supply chain issues moderated. PBT by Banking and Insurance services significantly advanced 250.0% from a loss of $40M to a gain of $60M, attributable primarily to non-cash mark-to-market gains across investment portfolios. The Media, Services, Retail and Parent Company segment experienced a decline of 33.3%.

According to the Group Chairman, AMCL continues to exhibit low leverage at 7.7% in Q1 2023 and Expenditure undertaken during Q1 2023 to facilitate the Acquisition of Insurance Company COLFIRE is expected to accrue gains to the Banking and Insurance Segment.

AMCL posted an EPS of $0.59 in Q1 2023, up from $0.22 in the prior comparable period. Its trailing 12-month EPS fell to $1.52 in Q12023 from $3.06 in Q12022. The Group’s Trailing Price-to-Earnings (P/E) multiple significantly expanded from 19.3 times to an acute 33.6 times in the current period.

The Bourse View

At a current price of $51.00, AMCL trades at a trailing P/E of 33.6 times, well above the Conglomerate sector average of 19.3 times. It should be noted that AMCL’s earnings, on a trailing basis, would have been adversely impacted by non-cash mark-to-market losses which reflect financial market volatility but not necessarily increased business risk. The stock offers investors a trailing dividend yield of 3.5%, above the sector average of 3.0%. The Group announced an interim dividend of $1.50, to be paid on June 2nd, 2023 to shareholders on record by May 18th, 2022. AMCL’s willingness to pursue growth via inorganic means was highlighted in its April 27th, 2023 announcement of a minority interest stake acquisition in Bahamian Brewery and Beverage Company Limited, which has received all regulatory approvals to proceed. On the basis of increased revenues and continued acquisition activity, Bourse maintains an OVERWEIGHT rating on AMCL.

At a current price of $51.00, AMCL trades at a trailing P/E of 33.6 times, well above the Conglomerate sector average of 19.3 times. It should be noted that AMCL’s earnings, on a trailing basis, would have been adversely impacted by non-cash mark-to-market losses which reflect financial market volatility but not necessarily increased business risk. The stock offers investors a trailing dividend yield of 3.5%, above the sector average of 3.0%. The Group announced an interim dividend of $1.50, to be paid on June 2nd, 2023 to shareholders on record by May 18th, 2022. AMCL’s willingness to pursue growth via inorganic means was highlighted in its April 27th, 2023 announcement of a minority interest stake acquisition in Bahamian Brewery and Beverage Company Limited, which has received all regulatory approvals to proceed. On the basis of increased revenues and continued acquisition activity, Bourse maintains an OVERWEIGHT rating on AMCL.“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”

MASSY has been increasing its exposure across the Caribbean and Latin America as part of its ongoing regional diversification initiatives. Guyana continues to grow in prominence in contributing to MASSY’S PBT, contributing 25.3% to PBT as the country continues along its path of economic growth and is projected to expand by 37.2% in 2023 (IMF April 2023 outlook). USA’s PBT by contribution increased from 0.7% to 3.3% in HY2022, positively impacted by the IGA acquisition. Colombia now accounts for 4.7% of PBT, relative to 6.1% in HY2022, as operations were negatively affected by a devaluation of the Colombian Peso and rising inflation. PBT contributed by the Eastern Caribbean and Jamaica increased to 12.1% and 5.9% respectively.

MASSY has been increasing its exposure across the Caribbean and Latin America as part of its ongoing regional diversification initiatives. Guyana continues to grow in prominence in contributing to MASSY’S PBT, contributing 25.3% to PBT as the country continues along its path of economic growth and is projected to expand by 37.2% in 2023 (IMF April 2023 outlook). USA’s PBT by contribution increased from 0.7% to 3.3% in HY2022, positively impacted by the IGA acquisition. Colombia now accounts for 4.7% of PBT, relative to 6.1% in HY2022, as operations were negatively affected by a devaluation of the Colombian Peso and rising inflation. PBT contributed by the Eastern Caribbean and Jamaica increased to 12.1% and 5.9% respectively. At a current price of $5.00, MASSY trades at a trailing P/E of 11.8 times, below the Conglomerate Sector average of 19.3 times. MASSY’s P/E ratio ex-discontinued operations stand at 13.5 times. The stock offers investors a trailing dividend yield of 3.2%, in line with the sector average of 3.0%. The Board of Directors declared an interim dividend of $0.0315, payable on June 15th, 2023, to shareholders on record by June 1st, 2023. On the basis of continued geographical diversification, margin improvement and growth via acquisitions, Bourse maintains an OVERWEIGHT rating on MASSY.

At a current price of $5.00, MASSY trades at a trailing P/E of 11.8 times, below the Conglomerate Sector average of 19.3 times. MASSY’s P/E ratio ex-discontinued operations stand at 13.5 times. The stock offers investors a trailing dividend yield of 3.2%, in line with the sector average of 3.0%. The Board of Directors declared an interim dividend of $0.0315, payable on June 15th, 2023, to shareholders on record by June 1st, 2023. On the basis of continued geographical diversification, margin improvement and growth via acquisitions, Bourse maintains an OVERWEIGHT rating on MASSY. Ansa McAL Limited (AMCL) reported a Diluted Earnings per Share (EPS) of $0.59 for the three months ended March 31st,2023 (Q12023), 168.2% higher than an EPS of $0.22 reported in Q12022.

Ansa McAL Limited (AMCL) reported a Diluted Earnings per Share (EPS) of $0.59 for the three months ended March 31st,2023 (Q12023), 168.2% higher than an EPS of $0.22 reported in Q12022.

At a current price of $51.00, AMCL trades at a trailing P/E of 33.6 times, well above the Conglomerate sector average of 19.3 times. It should be noted that AMCL’s earnings, on a trailing basis, would have been adversely impacted by non-cash mark-to-market losses which reflect financial market volatility but not necessarily increased business risk. The stock offers investors a trailing dividend yield of 3.5%, above the sector average of 3.0%. The Group announced an interim dividend of $1.50, to be paid on June 2nd, 2023 to shareholders on record by May 18th, 2022. AMCL’s willingness to pursue growth via inorganic means was highlighted in its April 27th, 2023 announcement of a minority interest stake acquisition in Bahamian Brewery and Beverage Company Limited, which has received all regulatory approvals to proceed. On the basis of increased revenues and continued acquisition activity, Bourse maintains an OVERWEIGHT rating on AMCL.

At a current price of $51.00, AMCL trades at a trailing P/E of 33.6 times, well above the Conglomerate sector average of 19.3 times. It should be noted that AMCL’s earnings, on a trailing basis, would have been adversely impacted by non-cash mark-to-market losses which reflect financial market volatility but not necessarily increased business risk. The stock offers investors a trailing dividend yield of 3.5%, above the sector average of 3.0%. The Group announced an interim dividend of $1.50, to be paid on June 2nd, 2023 to shareholders on record by May 18th, 2022. AMCL’s willingness to pursue growth via inorganic means was highlighted in its April 27th, 2023 announcement of a minority interest stake acquisition in Bahamian Brewery and Beverage Company Limited, which has received all regulatory approvals to proceed. On the basis of increased revenues and continued acquisition activity, Bourse maintains an OVERWEIGHT rating on AMCL.