HIGHLIGHTS

MASSY 9M 2022

- Earnings: EPS increased 1.5% from $0.24 to $0.25

- Performance Drivers:

- Increased Revenues

- Sale of Non-Core operations

- Outlook:

- Geographical Diversification

- Portfolio Restructuring

- Rating: Maintained at MARKETWEIGHT

AMCL HY 2022

- Earnings: EPS 85.6% lower from $1.11 to $0.16

- Performance Drivers

- Higher Revenues

- Non-Cash Mark-to-Market Losses in Investment Portfolios

- Outlook:

- Growth Opportunities

- Volatile Financial Markets

- Rating: Assigned as MARKETWEIGHT

This week we at Bourse review the performance of two locally-based groups on the Conglomerate sector of the Trinidad & Tobago Stock Exchange (TTSE), Massy Holdings Limited (MASSY) for the nine-month period ended June 30th 2022 and Ansa McAL Limited (AMCL) for the half-year period ended June 30th 2022. MASSY reported improved earnings owing to strong revenue growth, while AMCL’s earnings dipped on account of volatile global financial markets. How will both regional giants fare in the coming months ahead? We discuss below.

Massy Holdings Limited (MASSY)

Massy Holdings Limited (MASSY) reported Earnings Per Share (EPS) of $0.245 for the nine-month period ended 30th June 2022 (9M 2022), 1.5% higher than an EPS of $0.241 reported in 9M 2021.

Revenue from Continuing Operations grew 13.0% YoY, from $8.1B in 9M 2021 to $9.2B in 9M 2022. Operating Profit After Finance Costs advanced 9.7% to $620.4M, while Operating Margin fell from 6.9% to 6.7%. Share of Results of Associates and Joint Ventures fell 26.2% to $23.6M (9M 2021: $32.0M), following operating losses from its Motors and Machines Portfolio’s minority investment in Curbo and the termination and winding down of major contracts at Massy Wood. Resultantly, Profit Before Tax (PBT) increased 7.8% to $644.0M. Income Tax Expense rose to $212.5M ($21.3M or 11.1% higher). Overall, Profit Attributable to Owners of the Parent stood at $484.5M, a 1.5% increase compared to $477.2M reported in the previous period.

Improving Segment Performance

MASSY’s overall PBT expanded 7.8% for the period under review. The Motors and Machines segment (16.8% of PBT) increased 63.5% on account of healthy increases in all of the businesses within the portfolio. Segment PBT moved from $82.8M in 9M 2021 to $135.4M in 9M 2022, driven by strong growth in its Trinidad and Tobago operations which were closed for two of the three months in Q3 2021 due to COVID 19 restrictions.

Integrated Retail (45.2% of PBT) advanced 25.0% from $291.6M in 9M 2021 to $364.4M in 9M2022, with all operating jurisdictions recording growth. The Group’s construction of its new distribution warehouse in Guyana and cold storage facility in Barbados could improve operational efficiency in subsequent periods once completed. Gas Products (26.2% of PBT) increased 18.5% from $178.5M to $211.5M, aided by strong demand for industrial gases and Liquified Petroleum Gas (LPG).

Financial Services reported a 5.8% increase in 9M 2022 from $65.0M to $68.8M, supported by strong performance in its remittance services. The Group’s Remittance Services continues to expand its agent footprint with the launch of 6 new agent locations, 5 of which are in Guyana and 1 in St Lucia. The Real Estate segment posted the best year-on-year percentage gain, increasing 584.6% from $3.8M to $25.7M on account of continued non-core asset disposals.

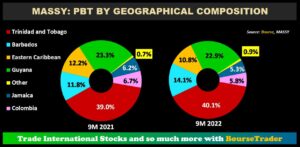

Geographic Diversification Improves

MASSY has been increasing its exposure across the Caribbean and Latin America as part of its regional diversification strategy. Trinidad and Tobago remains MASSY’s core generator of PBT, increasing its contribution to PBT to 40.1% from a prior 39.0%. Barbados continues to grow in prominence in contributing to the Group’s PBT, contributing 14.1% compared to a previous 11.8%. Meanwhile, PBT contributed by Eastern Caribbean fell to 10.8% while PBT contributed by Guyana declined marginally to 22.9%. Colombia now accounts for 5.8% of PBT, relative to 6.7% in 9M 2021.

The Bourse View

At a current price of $4.70, MASSY trades at a trailing P/E of 11.7 times, below the Conglomerate Sector average of 16.4 times. Notably, MASSY’s P/E ratio ex-discontinued operations stand at 14.1 times. The stock offers investors a trailing dividend yield of 3.1%, above the sector average of 2.6%. While resilient as a Group, MASSY’s broader operating jurisdictions are likely to confront challenges in the near to medium term as regional economies attempt to cope with the effects of rising inflationary pressures. The Group does, however, remain liquid with very conservative debt levels, which creates the opportunity to readily access capital markets should the right acquisition(s) come along. On the basis of continued revenue growth but tempered by inflationary and supply chain pressures, Bourse maintains a MARKETWEIGHT rating on MASSY.

Ansa McAL Limited (AMCL)

Ansa McAL Limited (AMCL) reported a Diluted Earnings per Share (EPS) of $0.16 for the six months ended June 30th 2022 (HY 2022), 85.6% lower than an EPS of $1.11 reported in HY 2021.

Revenue for the period amounted to $3.1B in HY 2022, up 17.6% or $469.7M as reported in the prior period. Operating Profit declined 69.1% to $97.8M in comparison to $316.9M in HY 2021. Resultantly, the Operating Margin fell from 11.8% to 3.1% Year-on-Year (YoY). Profit Before Tax (PBT) experienced an 69.4% decline for the period, from $304.5M to $93.3M in HY 2022. Finance Costs fell 0.8% or $0.2M. There was a 73.3% increase in Share of Result of Associates and Joint Venture Interests to $18.1M from $10.4M. The Group recorded taxation expenditure of $60.4M, with the Effective Tax Rate moving from 26.1% to 64.7%. Consequently, Profit for the Period contracted 85.4% from $225.0M reported in HY 2021 to stand at $32.9M in HY 2022.

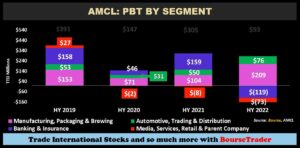

PBT Contracts

The Caribbean’s largest conglomerate reported Profit Before Tax (PBT) of $93M in HY 2022 relative to $305M in HY 2021. The Manufacturing, Packaging & Brewing PBT advanced 101.0% from $104M in HY 2021 to $209M in HY 2022, following the easing of Covid-19 restrictions. The Automotive, Trading & Distribution segment increased 52.8% to $76M relative to $50M in the prior period. PBT by Banking and Insurance services declined 175.2% from $159M to a loss of $119M, likely attributable to volatile financial markets and non-cash mark-to-market losses in their investment portfolios, primarily in TATIL Life.

The Media, Services, Retail and Parent Company segment experienced the sharpest decline of 787.9%. However, this segment may be boosted in the upcoming periods, driven by Guardian Media Limited’s (GML) broadcast in the Hero CPL T20 Caribbean Premier League Tournament in September 2022 as well as the FIFA World Cup Qatar 2022.

According to the Group CEO, AMCL remains interested in the renewable energy sector, having completed acquisitions in the Dominican Republic and Costa Rica. Also, the Group continues to look at opportunities in the financial services sector, both regionally and internationally.

AMCL posted an EPS of $0.16 in HY 2022, down from $1.11 in the prior comparable period resulting in its trailing 12-month EPS to fall to $2.50 in HY 2022. The Group’s Price-to-Earnings (P/E) multiple expanded from 18.4 times to 22.8 times in the current period.

The Bourse View

At a current price of $57.00, AMCL trades at a trailing P/E of 22.8 times, above the Conglomerate sector average of 16.4 times. The stock offers investors a trailing dividend yield of 3.2%, above the sector average of 2.6%. The Group announced an interim dividend of $0.30, to be paid on September 7th, 2022 to shareholders on record by August 24th 2022. AMCL continues to focus on its strategic growth objectives, with the view that headwinds caused by volatility in global financial markets will normalize over time. On the basis of increased revenues, but tempered by lingering financial market uncertainty, Bourse assigns a MARKETWEIGHT rating on AMCL.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”