HIGHLIGHTS

Local Markets

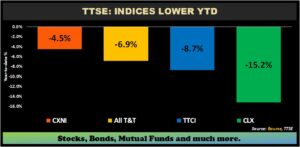

- HY2023 Performance:

- TTCI ↓ 8.7%

- All T&T ↓6.9%

- CLX ↓ 15.2%

- Performance Drivers:

- Cooling inflation

- Resilient Earnings

- Weak Investor Sentiment

- Outlook:

- Economic Normalization

International Markets

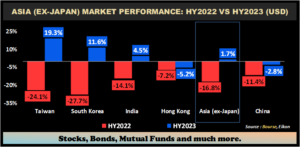

- HY2023 Performance:

- US Markets – S&P 500 ↑ 15.9%

- European Markets- Euro Stoxx 50 ↑11.8%

- Asian Markets – MXASJ↑1.4%

- Latin American Markets – MSCI EM ↑ 14.3%

- Performance Drivers:

- Cooling Inflation

- Strong Corporate Earnings

- Moderating Commodity Prices

- Outlook:

- Economic Uncertainty

This week, we at Bourse recap the performance of local and international stock markets as at the end of the 2nd quarter of 2023 (HY2023). Local equity markets continued their decline, reflecting weaker regional investor sentiment. In contrast, global markets rebounded, buoyed by investor optimism on the near-conclusion of the Fed’s rate hikes, cooling inflation and stronger corporate earnings. Are local market investors being overly conservative? Can international markets maintain momentum in the second half of the year? We discuss below.

Local markets regress

All major indices on the Trinidad and Tobago Stock Exchange (TTSE) closed the second quarter of 2023 lower. The All Trinidad and Tobago Index (All T&T) declined 6.9% for HY2023. The Cross Listed Index (CLX), comprising some of the largest publicly listed regional companies, retreated 15.2% for the period. As a result, the Trinidad and Tobago Composite Index (TTCI), which measures the performance of all 25 ordinary stocks listed on the First-Tier market, dropped 8.7%. In addition, the Caribbean Exchange Index (CXNI),used as a gauge of the Caribbean regions’ overall market performance, traded down 4.5%.

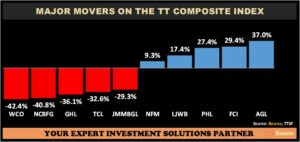

Major Movers

Agostini’s Limited (AGL) advanced 37.0%, boosted by revenue growth, improved margins and continued acquisition activities. The Group recently extended its regional reach through acquisition with AGL’s Subsidiary, Caribbean Distribution Partners Limited purchasing 80% of Chinook Trading Canada Limited. On May 10th, 2023, AGL also acquired 100% of the outstanding shares of the Jamaican pharmaceutical distribution company, Health Brands Limited. FirstCaribbean International Bank Limited (FCI) increased 29.4%, propelled by promising revenue growth. Prestige Holdings Limited (PHL) gained 27.4% as a result of improved profitability, revenues and geographical expansion. Rounding out the top 5 major advancers were L.J. Williams Limited,”A” (LJWB) and National Flour Mills Limited (NFM), which rose 17.4% and 9.3% respectively.

Major decliners for HY2023 included West Indian Tobacco Company Limited (WCO down 42.4%) NCB Financial Group Limited (NCBFG down 40.8%), Guardian Holdings Limited (GHL down 36.1%), Trinidad Cement Limited (TCL down 32.6%) and JMMB Group Limited (JMMB down 29.3%).

US Markets Rally

The S&P 500 closed HY2023 on strong footing, advancing 15.9%. This was bolstered by upbeat economic data which soothed investor concerns of recessionary conditions, triggered by the aggressive rate hike cycle of the Federal Reserve. This is evidenced by the US consumer confidence increasing in June 2023 to the highest level in nearly 1-1/2 years, reflecting overall positive consumer attitudes.

The Technology sector, represented by Technology Fund (XLK) propelled the market, up 39.7% on account of developments in generative Artificial Intelligence (AI) and a broader based recovery from a woeful performance in the prior year. The Communication Services Sector (XLC) advanced 35.6% on better-than-expected earnings reports from Google Parent Alphabet (GOOGL), Meta Platforms (META) and Netflix (NLFX) which make up more than 50% of the sector ETF. On the contrary, Energy Select Sector SPDR Fund (XLE) declined 7.2% in HY2023, with softer energy commodity prices year-to-date halting the stellar run experienced during 2022.

European Markets Broadly Higher

European markets, as gauged by the Euro Stoxx 50, increased 11.8% in HY2023 relative to a 16.7% decline in HY2022. European equities were bolstered by positive momentum in economic growth and corporate earnings. Italy was the best performing market in the region, advancing 21.4% with the consumer confidence index surpassing market expectations in June. Spain and France markets expanded 18.8% and 16.5% respectively for the period under review. German equities also advanced (up 14.5% year-to-date) in the second quarter.

Asian markets mixed

Asian equity markets (excluding Japan) rose 1.4% in HY2023, relative to a 16.8% decline in HY2022. Taiwanese and South Korean equities advanced 17.7% and 9.9% respectively in HY2023, driven by an influx of foreign investment during May with buying focused on shares for semiconductor stocks.

Indian equities rose 7.3% for the first half of the year, supported by persistent foreign investor inflows, strong corporate earnings, and cooling inflation. China markets lagged against its peers, dipping 1.4% in HY2023, as the economy weakened in May due to a slew of soft economic data falling below analysts’ expectations, signaling that its post-pandemic recovery is losing momentum and more stimulus is needed to sustain growth.

Latam markets advance

Latin American markets expanded 14.3% in HY2023, despite rising inflation rates and tightening monetary policies in the region. Mexico was the best performing market, growing 25.7%, a significant improvement led by domestic consumption and a comeback in the export-oriented industrial sector and services. Chilean equities rose 16.2% in HY2023, posting the third straight quarter of growth as the economy regains lost ground. Brazilian equities gained 19.3% moving from negative growth of 0.4% in HY2022, as export growth continues to impress, and foreign direct investment (FDI) has also been notably strong. Peruvian shares advanced 9.9% in HY2023 relative to a decline of 9.1% in the prior comparable period. Colombia stocks posted the smallest advance among its peers, gaining 2.4% in HY2023, supported by the implementation of tight fiscal measures, and tackling of the challenges faced within global and domestic conditions.

Investment Outlook

The first half of 2023 was met with broad-based declines in the local equity market. In terms of market capitalization, declines across the Manufacturing II (-32.6%), Manufacturing I (-22.2%), Energy (-22.4%), Non-Banking Finance (-18.8%), Banking (-7.8%) and the Conglomerates sectors (-2.1%) were observed. The Trading sector was the only positive, up 35.8% for the period. This comes as somewhat of a surprise, given that most domestic companies would have reported improved financial performance.

Preliminary Index data released by the Central Statistical Office (CSO) suggests a moderation in inflation, with headline inflation easing to 5.7% in May 2023 relative to 6.0% in April 2023. Continued moderation would rely on falling food, shipping and raw material prices. However, domestic companies /consumers still continue to face inflationary pressures and adjustments to utility rates and other living costs could keep domestic inflation at above-average levels.

The International Monetary Fund (IMF) estimates a 3.2% GDP expansion in 2023 for Trinidad and Tobago, with several energy sector projects forecasted to modestly boost energy production volumes, while an uptick in business and consumer demand bodes well for non-energy sector activity. At a macro level, the decline in energy commodity prices year-to-date could, however, weigh on total revenue projections for T&T’s Fiscal 2023 Budget.

International Markets has been broadly positive across regions, following the US debt ceiling resolution and receding concerns of banking sector instability. The outlook remains somewhat clouded, as central banks messaging on the direction of interest rates remain mixed. While the U.S Federal Reserve has recently suggested it would raise rates two more times in 2023, it did opt to pause during its June meeting.

The IMF, in its April 2023 World Economic Outlook, forecasts global economic growth to moderate to 2.8% in 2023, before settling at 3.0% in 2024.

For emerging markets, the World Bank in its China’s economic update projects GDP growth of 5.6% in 2023, led by a rebound in consumer demand. S&P Global Ratings recently retained India’s GDP growth forecast at 6.0%, citing that it will be the fastest growing economy among Asia Pacific nations.

Investor Considerations

While global markets have advanced at the end of HY2023, the path higher for international equity markets is not without hurdles. The current economic backdrop, though improved, still includes lingering concerns of recession. The technology/semiconductor stock renaissance, a major driver of market performance, could run out of steam should investors opt to capitalize on gains.

Locally, the combination of (i) falling stock prices and (ii) relatively resilient earnings data has led to an overall improvement in equity market valuations. For the investor with a longer-term time horizon, these conditions are often attractive for adding quality assets to a portfolio.

In the event of uncertainty, diversification across different sectors and asset classes remains a useful approach to reducing overall portfolio risk. The tried and tested long-term investment approach, focusing on companies with (i) solid business models, (ii) sustainable competitive advantages, (iii) attractive valuations and (iv) credible growth prospects remain a valuable strategy.

For investors with lower risk tolerance and a focus on principal preservation, equities remain a less appropriate investment option. Lower risk alternatives include cash or near-cash holdings such as income mutual funds, repurchase agreements, where investment capital is subject to little or no capital risk. As always, investors should consult a trusted and experienced advisor, such as Bourse, to make informed investment decisions.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third-party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”