HIGHLIGHTS

Local Markets

- Q12024 Performance:

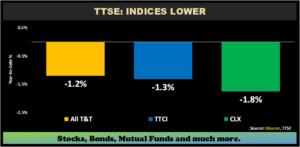

- TTCI ↓ 1.3%

- All T&T ↓ 1.2%

- CLX ↓ 1.8%

- Performance Drivers:

- Resilient Earnings

- Weak Investor Sentiment

- Outlook:

- Economic Normalization

International Markets

- Q12024 Performance:

- US Markets – S&P 500 ↑ 10.2%

- European Markets- Euro Stoxx 50 ↑ 5.7%

- Asian Markets – MXASJ ↑ 1.3%

- Latin American Markets – MSCI EM ↓ 4.8%

- Performance Drivers:

- Cooling Inflationary Pressures

- Geopolitical Tensions

- Outlook:

- Economic Normalization

This week, we review the performance of local and international stock markets for the first quarter of 2024 (Q12024). Locally, generally improving earnings were not enough to enough to improve investor confidence. Meanwhile, international equities were broadly higher fuelled by strong corporate earnings and continued hopes of US interest rate cuts. Will markets maintain momentum in 2024 or could new developments and/or changes in investor sentiment change their course? We discuss below.

Local markets regress

All major indices on the Trinidad and Tobago Stock Exchange (TTSE) closed the first quarter of 2024 lower. The All Trinidad and Tobago Index (All T&T) contracted 1.2% for Q1 2024. The Cross Listed Index (CLX), comprising some of the largest publicly listed regional companies were down 1.8% for the period. Resultantly, the Trinidad and Tobago Composite Index (TTCI) declined 1.3% to close at 1,197.97. MASSY Holdings Limited (MASSY) followed by JMMB Group Limited (JMMBGL) were the volume leaders on the First Tier Market for Q12024, with 8.1M and 4.0M shares being traded respectively.

Major Movers

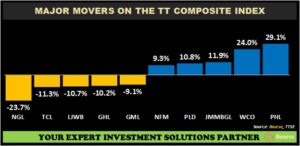

Prestige Holdings Limited (PHL) led gains appreciating 29.1% during the quarter, supported by increased revenues and higher profitability margins. West Indian Tobacco Company Limited (WCO)advanced 24.0%, benefitting from revenue growth. JMMB Group Limited (JMMBGL) increased 11.9% despite lower operational performance. Point Lisas Industrial Port Development Corporation Limited (PLD) rose 10.8%, while National Flour Mills Limited (NFM) rebounded 9.3%.

For Q12024, major decliners included Guardian Media Limited (GML, ↓ 9.1%), Guardian Holdings Limited (GHL, ↓ 10.2%), LJ Williams Limited (LJWB, ↓ 10.7%), Trinidad Cement Limited (TCL, ↓ 11.3%), Trinidad and Tobago NGL (NGL, ↓ 23.7%).

Energy, Communication Services lead broad U.S. market rally

The bellwether index for US equity markets, the S&P 500 got off to a strong start advancing 10.2%. Energy, Communication Services, Financial and Industrials sectors all delivered double-digit returns in Q12024.

The energy sector represented by the Energy Select Sector SPDR Fund (XLE) experienced a notable upswing, advancing 12.6%, attributable to various factors including the increased demand for oil and gas and supply chain disruptions impacting the sector. The Communication Services Sector (XLC), which encompasses stocks including Meta Platforms, Inc. (META), Walt Disney Co. (DIS) and Netflix Inc. (NFLX) – posted a gain of 12.4% driven by the demand for digital services and content consumption. The Financials Sector (XLF) and the Industrials Sector (XLI) also excelled in Q12024 expanding 12.0% and 10.5% respectively.

In contrast, the Real Estate rate sensitive sector lost ground in Q12024, down 1.3% on concerns that the Federal Reserve won’t bring down interest rates as quickly as the markets hope.

European Stocks Higher

European equities recorded a solid performance supported by generally improving market conditions and increased investor confidence. The benchmark European Stoxx 50 advanced 5.7% relative to 9.3% in Q1 2023. Several European country indexes outperformed the benchmark, including Italy, Spain, France, and Germany. Italian equities (+11.9%) performed the best amongst its peers, with improved business confidence in manufacturing and construction sectors, followed closely by German and Spanish markets, with returns of 7.5% and 7.2%, respectively. French equities advanced 6.3%, relative to 14.6% in 2023. English stocks advanced a more modest 2.0%.

Asian Markets struggle

Asian equities eked out an overall gain in Q12024, with mixed results across it major markets. Asia (excluding Japan) index rose 1.3% in Q12024, relative to 4.7% in Q12023. Taiwanese equities (+7.7%) recorded positive results, boosted by technology stocks and growing investor sentiment around Artificial Intelligence (AI). Indian equities rose 1.8% for the first quarter of 2024, supported by widespread buying across sectors. Chinese stocks closed the quarter in negative territory, down 2.3%. South Korea and Hong Kong markets lagged against peers, dipping 0.9% and 3.2%, respectively. Looking ahead, growth in many Asian economies is expected to remain resilient in 2024, fuelled by regional economic growth.

Latam stocks lower

Latin American markets declined 4.8% in Q12024 relative to a positive 3.1% increase in the prior comparable quarter. Colombia was the best performing market, advancing 12.5%, supported by moderating inflation and foreign direct investment inflows. Peruvian shares gained 8.9%, while Mexican equities advanced 2.0%. Brazil equities declined 7.6%, with evidence of a softer labour market and tepid exports.

Investment Outlook and Considerations

Locally, the non-energy sector continues to support muted energy sector activity. Generally, corporate earnings of several major constituents on the Trinidad & Tobago Stock Exchange (TTSE) continue to trend positively, particularly in the Banking sector. In the medium-term, The Government of Trinidad and Tobago recently received a 30-year exploration and production licence for Dragon Gas field, which should lead to improved gas production in the latter half of the decade. The IMF, January 2024 World Economic Outlook Update forecasts moderate growth in Latin America and the Caribbean to 2.3% in 2024 and 2.5% in 2025, with Trinidad and Tobago’s GDP expected to expand by 2.4% in 2024, owing to generally improving economic conditions in the region, coupled with moderating inflation levels.

Local equities continue to trade at relatively attractive levels, with earnings growth not being met with a commensurate response in investor confidence. Investors should continue to focus on equities that demonstrate (i) attractive valuations through lower price-to-earnings (P/E) multiples, (ii) strong company fundamentals, (iii) above-average dividend yields and (iv) provide a partial hedge to the TTD through USD earnings/dividends.

Internationally, economic growth remains relatively resilient, despite stubborn inflationary trends. The forecast for US interest rates and their (eventual) decline remains uncertain, though investors remain fairly confident of rate cuts beginning in the latter part of 2024. According to the IMF’s January 2024 World Economic Outlook, global growth is expected to increase to 3.1% in 2024 and 3.2% in 2025, benefitting from a rebound of investor confidence across major economies (US, Euro, China).

Diversification across different sectors and markets remain a useful approach to reducing total portfolio risk for investors who may wish to reduce their exposure to equities. One of the better options for a relatively passive investor to gain more exposure to the market is to invest in equity mutual funds and equity index exchange traded funds. As always, investors should seek advice from a trusted and expert advisor, like Bourse, to better position their portfolios.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase, or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives, or agents, accepts any liability whatsoever for any direct, indirect, or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third-party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”