HIGHLIGHTS

Local Markets

- Year-to-Date Performance:

- TTCI ↓ 14.0%

- All T&T ↓ 13.7%

- CLX ↓ 14.8%

- Performance Drivers

- Resilient Earnings

- Improved economic activity

- Correction in Market Valuations

- Cooling inflationary pressures

This week, we at Bourse, review the local equities listed on the Trinidad & Tobago Stock Exchange (TTSE). Investor sentiment continues to remain weak, reflecting in lower stock prices and trading activity despite earnings being broadly resilient over the course of 2024. Could positive earnings momentum result in price recovery across the market, or will investors continue their more cautious approach to locally listed stocks? We discuss below.

Local markets down

Year-to-date all major local indices are in the red, continuing a trend that began in 2022. Overall, the Trinidad and Tobago Composite Index (TTCI), which tracks the performance of all 24 ordinary stocks on the First-Tier market, fell by 14.0%. The All Trinidad and Tobago Index (All T&T) dropped by 13.7% year-to-date. Meanwhile, the Cross-Listed Index (CLX), which comprises leading regional companies, saw a contraction of 14.8%.

Sectors broadly Lower

Local equities continue to be impacted by subdued investor confidence across all sectors, resulting in negative returns year-to-date across the market. The market capitalization of the Trinidad & Tobago Composite Index (TTCI) currently stands at $99.6M.

Historically, the banking sector has accounted for the highest percentage of the market capitalization on the TTSE, which currently amounts to 55.6%. Year to date the sector’s market capitalization declined 13.7%, following a decline of 11.1% in the prior reporting period. The Conglomerate sector which accounts for 21.4% of total market capital declined by 5.6%. All other sectors recorded declines YTD. In particular, the energy sector, which constitutes 0.6% of the market capital has significantly dropped by 54.5%, owing to lower energy commodity prices and subdued domestic energy production.

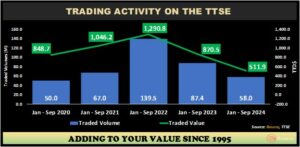

From January to September 2024, trading on the First Tier Market of the Trinidad and Tobago Stock Exchange (TTSE) saw a total volume of 58.0M shares valued at $511.9M. Massy Holdings Limited (MASSY) was the most actively traded stock, representing 19.1% of the total volume.

This period marked a significant decline in trading activity compared to the same timeframe in the previous year, with volumes and values dropping by 33.6% and 41.2% respectively. In the last year, during the period January to September the market also experienced decreased trading activity compared to 2022, when 139.5M shares valued at $1.29B were traded on the first tier. This year’s trading activity is at its lowest level in the past five years.

Attractive P/E Multiples and Dividend Yields

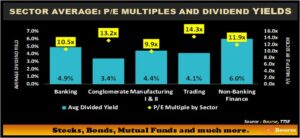

The Banking sector currently trades at an average dividend yield of 4.9% and P/E ratio of 10.5 times. Within the sector, First Citizens Group Limited (FCGFH) and Scotiabank Trinidad and Tobago Limited (SBTT) offer investors 12-months trailing dividend yields of 5.4% and 5.1%, respectively. CIBC Caribbean Limited formerly, FirstCaribbean International Bank Limited (FCI) currently offers a 12-months trailing dividend yield of 4.7% and investors have the additional advantage of receiving dividend payments in US dollars.

The Conglomerates sector has an average dividend yield of 3.4% and P/E ratio of 13.2 times. Massy Holdings Limited (MASSY), a key player within the industry, trades at an average dividend yield of 4.4% and P/E ratio of 9.9 times. GraceKennedy Limited (GKC) also offers investors dividend payments in US dollars.

The Non-Banking Finance sector currently leads the market, in terms of dividend income, trading at an average dividend yield of 6.0%, with a P/E ratio of 11.9 times. Stocks in the industry continue to yield mixed results. Notably, Guardian Holdings Limited (GHL) offers a trailing dividend yield of 5.2%.

The Manufacturing and Trading currently trade at average dividend yields of 4.4% and 4.1%, with P/E ratios of 9.9 times and 14.3 times, respectively.

Sector average dividend yields currently range from 3.0% to 6.0% and may be a good choice for income-oriented investors. However, it should be noted that market volatility can affect even the most dependable dividend stocks.

Resilient Earnings, Lower Prices

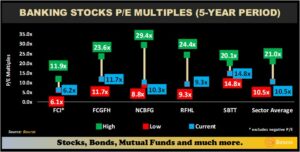

The repricing of equity markets has brought about a general improvement in valuations on offer across most sectors, particularly the Banking sector.

In recent times, the banking stocks have become relatively attractive, amidst positive results, in terms of revenue growth and profitability, which may provide significant opportunities to would be investors, both in terms of dividend income and capital appreciation. Over the past five years, the average Banking Sector Price to Earnings (P/E) has fluctuated between 10.5 times – 21.0 times.

FCI currently trades at the more relatively attractive P/E ratios of 6.2 times, versus Scotiabank Trinidad and Tobago Limited (SBTT) which trades at the relatively more expensive P/E multiple of 14.8 times.

Republic Financial Holdings Limited (RFHL) is the largest stock by value or market capitalization, accounting for 18.5% of the TTSE’s total market value. Taking a closer look at the Bank’s valuation trends – despite strong profits recorded, the concurrent decline in RFHL’s market price (↓ 8.8% YTD) led to the decline in its Price-to-Earnings (P/E) ratio to 9.3 times year-to-date, below the banking sector average of 10.5 times. RFHL currently trades at the lowest P/E ratio relative to its 5-year historical P/E of 15.5 times.

The Group changed its Dividend policy at beginning of fiscal year 2024 wherein the Board of Directors approved the frequency of dividends to shareholders from semi-annually to quarterly. For income focused investors, RFHL’s dividend yield increased from previous years to a trailing 15-month dividend yield of 5.6% YTD, reflecting the company’s consistent dividend payments to shareholders.

RFHL’s combination of earnings, dividends, and attractive valuations create a relatively compelling value proposition for investors from both a capital growth and income perspective.

Equity Investor Considerations

For risk adverse/conservative investors seeking steady income and moderate capital appreciation, dividend-paying stocks are a solid alternative to fixed income investment solutions such as Repurchase Agreements (Repos), Fixed NAV mutual funds and even fixed deposits. Investors can consider equities that exhibit (i) relative price stability, (ii) resilient profitability and (iii) consistent, predictable dividend payments. These stocks not only offer regular income through dividend payments but also have the potential for capital appreciation over time. Notably, the average dividend yield of the TTCI is now approximately 5.1%.

In addition, equities tend to act as a more effective hedge against inflation when compared to fixed-income assets, as most companies can pass on rising input costs to consumers through price adjustments. This aids in maintaining profitability and preserving purchasing power during inflationary periods.

The correction in market prices in local equities presents a potential opportunity for long-term investors to expand their positions in select local stocks. The decline in market prices has improved valuations, with many securities now trading at P/E ratios well below their historical averages, making them attractive for those with a longer investment horizon. The banking sector offer such value, particularly stocks like FCI, RFHL and FCGFH. Maintaining a value focus-objective when selecting stocks locally remains a useful investing approach.

As always, investors should speak with a reliable and knowledgeable advisor like Bourse to make more informed investment decisions.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third-party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”