HIGHLIGHTS

Aggressive Investors

- Characteristics

- High Risk Level

- Income Generation & Capital Appreciation

- Aggressive Strategy

- Time Horizon

- Aggressive Investment Options:

- Income Funds

- Repurchase Agreements (Repos)

- Fixed Deposits

- Bonds / High Yield Bonds

- Equity Mutual Funds/ Index ETFs

- Growth Stocks

PLIPDECO HY 2024

- Earnings: Earnings Per Share of $1.05, an increase of 22.1% from an EPS of $0.86

- Performance Drivers:

- Increased Revenue

- Outlook:

- Operational Efficiency

- Rating: Maintained at MARKETWEIGHT

TCL HY 2024

- Earnings: Earnings Per Share of $0.35, an increase of 70.4% from an EPS of $0.20

- Performance Drivers:

- Revenue Growth

- Outlook:

- Return to Dividend Payments

- Rating: Maintained at MARKETWEIGHT

This week, we at Bourse conclude our three-part series aimed at helping individuals better determine the types of investments they should consider, based on their specific investor profile. Having covered both the Conservative and Moderate Investor Portfolios, we consider the ‘Aggressive’ Investor, highlighting several traits, investment options and a portfolio mix that should fit the risk tolerance associated with the investor profile. With earnings season having kicked off, we also provide a review on the performance of Point Lisas Industrial Port Development Corporation Limited (PLIPDECO) and Trinidad Cement Limited (TCL) for their respective six-month periods ended June 30th, 2024.

Are You an Aggressive Investor?

Are You an Aggressive Investor?

The Aggressive Investor tends to display the following traits:

- High Risk-Tolerance. Aggressive investors are willing to maximize returns by taking on higher levels of risk, through assets which offer the potential for faster wealth creation.

- Growth-focused. The Aggressive investor is prepared to embrace uncertainty, willing to accept volatility to his/her portfolio. This investor is primarily focused on rapid growth of capital/wealth, opting to invest in assets which promise significant capital appreciation such as ‘growth’ stocks, small-cap companies and Initial Public Offerings (IPOs) which have the potential for significant returns.

- Liquidity. Relative to the Moderate and Conservative investors, liquidity needs for the Aggressive Investor tend to be lower, on the understanding that the riskier portion of his/her portfolio should be able to remain invested to weather the impact of economic and/or financial market cycles – a smaller component of the Aggressive Investor’s portfolio would be invested in very liquid assets.

- Time Horizon. The Aggressive Investor’s time horizon tends be longer compared to the Moderate Investor. Realizing the potential of high-growth stocks can take patience, with holding periods often being extended. Investing in medium – long term bonds (10-20 years) is common, it requires patience and a willingness to weather market fluctuations.

When Should I Be an Aggressive Investor?

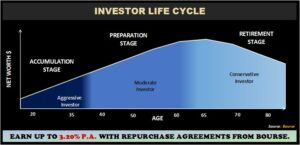

As a reminder, the Investor Life Cycle typically encompasses three basic stages: Accumulation, Preparation and Retirement. Each stage involves different investment strategies tailored to the investor’s age, risk tolerance, investment horizon and financial goals.

Aggressive Investors are generally associated with the Accumulation Stage (Age 20-35) of the investor life cycle. At this stage, investors usually have the longest investment horizon, allowing their portfolios to ‘ride out’ economic and market cycles. Short-term fluctuations tend to be less impactful to long-term wealth accumulation.

Investors beginning earlier in life can effectively leverage the accumulation phase, historically having a higher likelihood of building larger stores of wealth than those who start later. This highlights the importance of early investing, enabling growth through the power of compound interest.

The Aggressive Investor Menu

In addition to Conservative and Moderate investment options such as Income Mutual Funds, Fixed Deposits, Repurchase Agreements, Value Stocks, Dividend Stocks, Investment Grade Bonds, Mutual Funds and Equity Mutual Funds/Index ETFs, the Aggressive Investor’s menu includes options such as ‘Growth’ stocks and High Yield Bonds.

For an ambitious investor who is seeking greater returns through income, high yield bonds are an option. Fixed income holdings in the aggressive portfolio tend to be non-investment grade or lower credit quality/higher default probabilities, for which investors are compensated through higher yields. A higher focus is placed on equity-related assets to benefit from potential capital appreciation in the medium to long term, with investments in growth-oriented stocks.

How Much can an Aggressive Portfolio Earn?

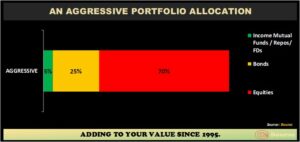

A sample Aggressive Investor portfolio allocation might comprise 5% in Income Mutual Funds/ Repos/FDs, 25% in higher-yielding bonds and 70% in Equities. When considering prevailing returns on each of these types of investments, the weighted return on the Aggressive portfolio would range between 6.5% – 7.0%.

A Conservative, Moderate and Aggressive investor’s sample portfolio yields an average of 3.8%, 5.25% and 7.0% respectively, all effectively outpacing the five-year average inflation in T&T of 2.8%.

In addition to choosing the most appropriate investments from a risk-perspective, we reiterate the importance of (i) building a well-diversified portfolio, (ii) incorporating investments in foreign currencies, if possible and (iii) adopting a long-term approach to your investment portfolio.

Whether you are a Conservative, Moderate or Aggressively minded investor, it is always useful to consult with an experienced advisor to help make the most informed investment decisions.

Point Lisas Industrial Port Development Corporation (PLD)

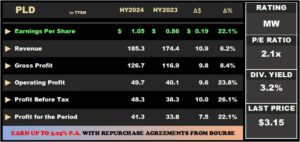

Point Lisas Industrial Port Development (PLD) reported Earnings Per Share (EPS) of $1.05 for the six months ending June 30th, 2024 (HY2024), a 22.1% increase from $0.86 in the prior comparable period. Discounting Unrealized Fair Value Gains, results in an adjusted EPS of $0.32 compared to $0.08 in HY2023.

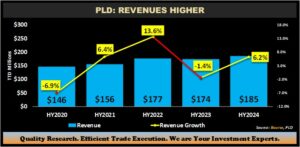

Revenue rose 6.2% to $185.3M from $174.4M in HY2023. The Cost of Delivering Services increased 1.8%, from $57.5M in HY2023 to $58.6M in the present quarter. Gross Profit increased by 8.4% over the previous year, from $116.9M to $126.7M. Unrealized fair value gain on investment properties decreased 5.9% from $30.6M to $28.8M, while Administrative Expenses climbed 4.8% year on year. Other operating expenses fell to $40.7M from $45.9M the previous year, resulting in an Operating Profit of $49.7M, a 23.8% increase. Investment income increased 11.0% year on year, while Finance Costs fell 16.3%. PLD’s Profit Before Taxation for the period grew 26.1%, from $38.3M to $48.3M, resulting from a net impact of increased revenue combined with a decline in some of the operating expenses inclusive of a reduction in repairs and maintenance expenses, finance and depreciation costs. Income tax expenses increased 56.0% to $7.0M. Overall, PLD’s Profit for the Period was $41.3M, 22.1% more than the $33.8M recorded in the previous period.

Revenue Resilience

PLD Revenue increased from $174M in HY2023 to $185M in HY2024, an improvement of 6.2%. This advance stemmed from a reported 6.0% increase in containerized cargo throughput as well as a 25% increase in deliveries from its Less than Container Load (LCL) warehouse.

Revenues from its Port and Related Activities segment advanced 9.5% year-on-year while the Industrial Estate segment marginally fell 0.9% in HY2024.

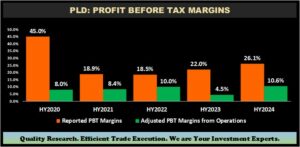

PBT Margins from operations advance

PLD’s Reported Profit Before Tax (PBT) rose from $38M to $48M in HY2024 leading to an increase in PBT margin from 22.0% to 26.1% in HY2024. Unrealized Fair Value Gains on Investment Properties declined from $31M to $29M in HY 2024. Excluding this usually volatile item, adjusted PBT from operations increased 151.6% from $8M to $20M in the current reporting period with adjusted PBT margin moving from 4.5% in HY2023 to 10.6% in HY2024.

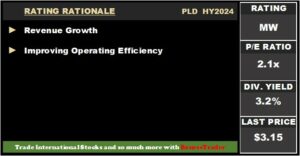

The Bourse View

At the current price of $3.15 and a reported trailing EPS of $1.52, the stock trades at a trailing P/E of 2.1 times. After adjusting for the impact of unrealized fair value gains on investment properties, PLD trades at an adjusted P/E of 6.6 times. The stock offers investors a trailing 12-month dividend yield of 3.2%.

As 2024 progresses, PLD welcomes its newest on the Industrial Estate – TT Iron Steel Company Limited. On the basis of revenue growth tempered by fluctuations in property valuations, Bourse maintains a MARKETWEIGHT rating on PLD.

Trinidad Cement Limited (TCL)

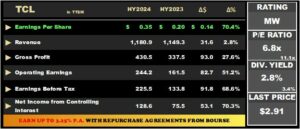

Trinidad Cement Limited (TCL) reported an Earnings Per Share (EPS) of $0.35 for the six months ended June 30th, 2024 (HY2024), up 70.4% from an EPS of $0.20 earned in the prior comparable period.

Notably, Revenue advanced 2.8% to $1.18B from a previous $1.15B in HY2023, impacted by increased costs across operational jurisdictions. Gross Profit increased 27.6% from $337.5M to $430.5M. Operating Earnings Before Other Income grew to $283.3M from a prior $184.3M. Other Expenses climbed 69% to $43.4M relative to $25.7M reported in the prior period. Consequently, Operating Earnings increased 51.2% to $244.2M relative to $161.5M in the prior period. Financial Expenses were 10.9% lower, from $29.3M in HY2023 to $26.2M in the current period. Taxation expense grew 62.1% year on year. Earnings Before Tax amounted to $225.5M, 68.6% greater than the prior comparable period. Resultantly, Net Income for the period stood at $176.0M, while Net Income attributable to Controlling Interest expanded by 70.3% to close at $128.6M compared to a prior $75.5 in HY2023.

Revenue Climbs

TCL’s revenue continued to trend upwards, reflecting consistent improvement in the past five reporting periods. Total revenue advanced 2.8% from $1.15B (HY2023) to $1.18B in HY2024.

Cement, TCL’s largest segment (96.0% of Revenue) rose 1.2% to $1.13B from a prior $1.12B. Concrete, accounted for 4.3% of Total Revenue, expanded by 60.1% YoY to $50.7M, while third-party revenue Packaging, declined by 57.7% to $0.30M in the current period.

According to the cement producer, continued revenue growth will be further supported by recent initiatives, such as the implementation of a Call Centre in Trinidad & Tobago, followed by Jamaica, Barbados and Guyana), with phase one of the expansion of the Jamaican programme expected to lead to an increase in the Caribbean’s Cement Company Limited’s production capacity by up to 30 percent and is slated for completion early 2025.

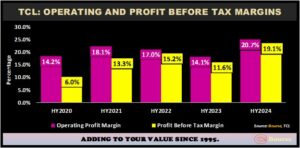

Margins Advance

TCL delivered its highest profitability margins in HY2024 versus comparable periods in recent history. Operating Profit Margin improved from 14.1% in HY2023 to 20.7% in HY2024, benefiting from restructuring activities. Similarly, Profit Before Tax Margin increased to 19.1% from a prior 11.6%, impacted by increased costs.

The Bourse View

At a current price of $2.91, TCL trades at a market to book ratio of 1.2 times and a trailing P/E ratio of 6.8 times, notably below the combined Manufacturing I & II Sectors’ Average of 11.1 times. The Group declared a final dividend of $0.08 payable on September 9, 2024, with record date August 13, 2024, and ex-dividend date August 12, 2024. The stock offers investors a trailing dividend yield of 2.8%, with a combined sector average of 3.4%.

On the basis of greater revenue, improved margins and dividend income, Bourse maintains a MARKETWEIGHT rating on TCL.

DISCLAIMER: “This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase, or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives, or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third-party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”