HIGHLIGHTS

Local Markets

- 2021 Performance:

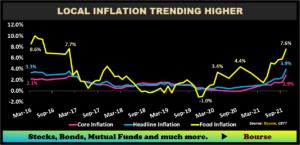

- Inflation soars

- Food inflation: 7.6%

- Headline inflation: 3.9%

- Core inflation: 2.9%

- Repo Rate maintained at 3.50%

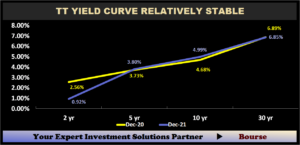

- TT Yield Curve

- 2 Year: 0.92% (↓ 164 bps YTD)

- 10 Year: 4.99% (↑ 31 bps YTD)

- 30 Year: 6.85% (↓ 4 bps YTD)

- Inflation soars

International Markets

- 2021 Performance:

- US Yield Curve rising

- 10 Year: 1.52% (↑ 59 bps YTD)

- 30 Year: 1.90% (↑ 25 bps YTD)

- Inflation climbs

- CPI: 7.0% YoY (Dec 2021)

- PCE: 5.7% YoY (Nov 2021)

- US Yield Curve rising

Investor Considerations:

- Rising Inflation

- Interest rate environment

- Credit Quality and Availability of Assets

- Economic Recovery

- Sensitivity of USD Portfolio to Interest Rate Hikes

This week, we at Bourse consider the key drivers of the often underappreciated fixed income markets in the year ahead. For bond investors, opportunities in international markets have been few and far in between during 2021. Locally, a palpable lack of public bond issuances, among other factors, have also made it tough going for income-oriented, lower-risk investors. Could 2022 be any different, or will the conditions of 2021 roll over into the new year? We discuss below.

Local Market

Short-term bond yields fall

The Government of the Republic of Trinidad & Tobago (GORTT) TT-dollar bond yield curve remained relatively stable over the year for maturities beyond 5 years. 5-year and 10-year bond yields increased marginally to 3.80% from 3.73% & 4.99% from 4.68% respectively between December 2020 and December 2021. 2-year yields, however, fell from 2.56% in December 2020 to 0.92% in December 2021.

Local Inflation Expected to Persist

Domestic inflation has been influenced strongly by external price pressures, with headline inflation climbing to 3.9% in October 2021 compared to 2.4% in the previous month. Food inflation registered at 7.6% in October from 5.8% in September. To note, the latest inflation data does not include recent increases in flour, meats, milk and select alcoholic beverages, among other prices. Core inflation (excluding food items) climbed to 2.9%.

Looming adjustments to utility tariffs, including water and electricity rates, as well as the roll out of property tax all have the potential to further propel inflation. With consumption of both durable and perishable goods having a distinctly imported flavor, the nearly 40-year high reading of the United States’ CPI Year-on-Year change of 7% in December 2021 supports the likelihood of import-driven inflation for the T&T economy in the months ahead.

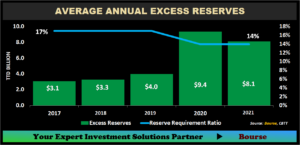

Commercial Excess Reserves Elevated

Despite a decline in commercial banks’ excess reserves by 48% over the year from $12.7B in December 2020 to $6.6B in December 2021, the financial system remains flush with cash. The CBTT’s move to reduce the Reserve Requirement from 17% to 14%, aimed at stimulating economic activity, led to average annual excess reserves increasing from $3.1B-$4.0B during 2017 to 2019 to $9.4B and $8.1B in 2020 and 2021 respectively. Excess Reserves, while creating the potential for greater lending by banks, will be materially influenced by gradually improving credit conditions.

Local Interest Rate to Stay Low?

Despite the likelihood of higher inflation in T&T during the course of 2022, the CBTT’s policy Repo Rate is anticipated to remain stable at or near its current level of 3.50%. With most domestic inflation being of an imported and cost-push (or supply driven) nature, an increase in policy rates is unlikely to have any meaningful impact on curbing price increases. A more potent reason for keeping policy interest rates low would be to facilitate stimulation of the domestic economic activity, which is showing signs of nascent recovery.

Domestic bond issuance is expected to remain active by the Government of the Republic of Trinidad & Tobago (GORTT), though through private avenues, as the Government seeks to fund a projected TT$9.1B deficit in FY2021/2022. Demand for new issues should remain robust, supported by persistent excess liquidity and continued interest from asset managers and institutional portfolios.

International Markets

Fed Fund Rate Hikes Imminent

Internationally, investors are preparing for the coming (and well-advertised) increases to US interest rates by the Federal Reserve (the Fed). Having resorted to drastic policy changes in March 2020 to address the economic fallout of the pandemic, the Fed is now poised begin an upward rate cycle, potentially increasing rates in 3 to 4 0.25% moves during 2022 from the current 0.00% to 0.25% range. With the first rate hike set to occur as early as March 2022, USD bond markets have been reacting with gradually higher bond yields.

US Treasury Curve Shifts Upward

US Treasury Yields have increased YoY, with the 2-year US Treasury yield climbing to 0.73% at the end of 2021 (2020: 0.13%). 10-year Treasury yields grew to 1.52% in 2021 (2020: 0.93%), while 30-Year US Treasury yield inched up to 1.90% (2020 1.65%). While US Treasury bond yields remain below their 2019 levels, the reality of the first US interest rate hike could spur a faster-than-anticipated upward adjustment to bond yields in the coming months.

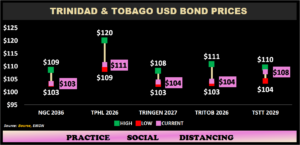

T&T USD Bonds Trend Lower

Prices of T&T USD bonds have trended downward, with most popular issuers (National Gas Company, Trinidad Petroleum Holdings Ltd, Trinidad Generation Unlimited, and the Government of the Republic of Trinidad and Tobago) currently trading at the lower end of their respective trailing 52-week range. One exception is Telecommunication Services of Trinidad & Tobago’s (TSTT) 8.875% USD Bond due 2029, currently trading near its 52-week high at $108.00 and offering investors a yield to maturity (YTM) of 7.30%.

With US interest rates set to increase and investors keeping an eye on T&T’s international credit ratings, T&T USD bond prices could potentially face significant headwinds in the year ahead.

International Market Outlook

Multi-decade higher US inflation is likely to more strongly influence US policy makers, when compared to concerns of slowing global growth and uncertainties arising from the evolving pandemic. Accordingly, multiple US interest rate increases accompanied by the Fed’s announced intentions to taper its asset purchases are likely to proceed in 2022, forcing bond investors to reevaluate their portfolio holdings and near-term strategies. This may be more than enough to unnerve bond investors in the coming months.

Considerations

With the above in mind, how does the fixed income investor position a portfolio?

With the prospect of persistent higher inflation in the coming months, getting your idle cash invested is of utmost importance. This will (at least partially) help to reduce the erosion of your purchasing power. Even with fairly limited bond investment options in the domestic market, there are a host of shorter-term investment solutions offered by broker-dealers, like Bourse, as well as banks and non-bank financial institutions. Investors can consider short-term, lower-risk investments such as income mutual funds and repurchase agreements, as well as traditional term deposits. These solutions all offer a reasonable balance of risk and return, while avoiding the longer-term interest rate risk associated with bonds in an uncertain rate environment.

For the USD investor, in addition to utilizing the short-term investment solutions mentioned above, consideration can be given to instruments which offer some protection against interest rate risk such as floating-rate bonds. In a rising rate environment, floating-rate bonds can prove quite useful to the income-oriented investor. For the investor who intends to buy bonds and hold them until maturity, credit quality remain an important consideration. Of equal importance in the current environment is timing. Practicing some patience in the early stages of 2022 before making your next investment move may be a rewarding strategy, as fixed income markets appear set for a fairly eventful few months.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”