HIGHLIGHTS

GKC HY2024

- Earnings: Diluted Earnings Per Share 6.2% higher, from TT$0.18 to TT$0.19

- Performance Drivers:

- Revenue Growth

- Stable Margins

- Outlook:

- Post-Acquisition Integration Efforts

- Rating: Maintained at OVERWEIGHT

AGL 9M 2024

- Earnings:

- Earnings Per Share (EPS) 42.0% lower from $4.41 to $2.56

- EPS exclusive of one-off non-cash adjustments: 2.7% lower from $2.63 to $2.56

- Performance Drivers

- Revenue Growth

- Lower Margins

- Outlook:

- Continued Acquisition Activity

- Rating: Maintained at MARKETWEIGHT

This week, we at Bourse review the financial performance of Grace Kennedy Limited (GKC) and Agostini’s Limited (AGL) for their respective six-months (HY 2024) and nine-months (9M 2024) reporting period ended June 30th, 2024. GKC’s performance benefitted from increased revenue and relatively stable margins, while AGL’s, meanwhile, experienced a decline in earnings accompanied by lower margins. Will AGL’s performance improve in the latter part of the year? We discuss below.

GraceKennedy Limited (GKC)

GKC reported a Diluted Earnings per Share (EPS) of TT$0.19 for the six months period ended June 30th, 2024 (HY2024), an increase of 6.2% over the prior reporting period.

Revenue from Product and Services expanded by 7.5% from TT$3.29B to TT$3.53B, while Interest Revenue advanced 18.5% to TT$145.8M. This led to a 7.9% increase in Total Revenue to TT$3.68B in HY2024 from $3.41B in HY2023. Direct and Operating Expenses grew 8.1% to TT$3.48B. Net Impairment Losses on Financial Assets increased to TT$10.4M, 79.3% increase year on year. Total Expenses expanded by 8.2% year on year to TT$3.49B. GKC’s Profit from Operations amounted to TT$281.3M, 5.7% higher than previous TT$266.2M (HY2023). Share of Results of Associates and Joint Ventures increased 7.0% to $24.4M compared to the previous comparable period. Profit Before Taxation (PBT) grew to $281.5M, up 5.1% from a prior $267.9M (HY2023). Taxation expense moved from TT$72.3M to TT$76.0M, with the effective tax rate maintained at 27%.

Resultantly, Net Profit for the period improved by 5.1%, from TT$195.5M to TT$205.5M. In comparison to TT$182.7M recorded in the prior period, Net Profit Attributable to Owners of GKC increased by 5.8% to TT$193.4M.

Food Trading, Money Services Boosts PBT

GKC’s profit before tax maintained positive momentum during the last five reporting periods. Food Trading, the largest contributor to PBT (58.8% excluding adjustments) expanded by 9.7% year on year, from TT$172.0M in HY2023 to TT$188.7M in HY2024, benefitting from the implementation of cost management activities and other initiatives. GraceKennedy Money Services (GKMS), the second largest contributor to PBT (19.9% excluding adjustments) fell 11.6% to TT$63.9M from TT$72.3M in the prior comparable period, impacted by reduced remittance inflows to Jamaica. The Group’s Insurance Segment (13.2% of PBT excluding adjustments) advanced 34.5% to TT$42.5M, which the Group attributed to its partnerships and recent acquisitions such as GK General Insurance Limited’s (GKGI) partnership with Scotia General Insurance Agency Limited and its Canopy Insurance joint venture.

The Banking and Investments segment increased 53.1%, from approximately TT$17M to TT$26M, owing to increased transaction volumes. According to the Group, First Global Bank Limited (FGB) reported increased digital transactions, whilst GKCM’S performance was driven by improvements in the delivery of banking transactions and re-positioning of its trading portfolio.

Margins Relatively Stable

For six-month reporting period ended June 2024 (HY2024), GKC’s profitability margins dipped slightly relative to the prior comparable period (HY2023). Operating Profit Margin fell from 7.8% in HY2023 to 7.7% in HY2024, while Profit Before Tax Margin dropped marginally from 7.9% (HY2023) to 7.7% in the current period, despite cost-optimization initiatives.

The Bourse View

At a current price of TT$3.61, GKC trades at a P/E ratio of 10.4 times, below the Conglomerate Sector average of 13.5 times. The Group declared an interim dividend of TT$0.02 per share payable on September 23rd, 2024, to shareholders on record by August 30th, 2024. The stock offers investors a trailing dividend yield of 2.7%, below the sector average of 3.3%.

Overall, the synergies of the Group’s recent acquisitions continue to be profitable, in terms of increased market share and revenue growth, as well as increased service delivery through the expansion of their digital channels. On the basis of enhanced earnings growth, stable profitability margins and relatively attractive valuations, Bourse maintains an OVERWEIGHT rating on GKC.

Agostini Holdings Limited (AGL)

Agostini’s Limited (AGL) generated an Earnings Per Share or EPS of $2.56 for the nine months ended June 30th, 2024 (9M2024), 42.0% lower than $4.41 (inclusive of one-off gain) reported in the prior comparable period. Excluding the one-off gain in 9M2023, EPS would have amounted to $2.63, contracting 2.7% year-on-year in 9M2024.Revenue grew 7.7% to $3.8B from the previous $3.6B, driven by both organic sales growth and the impact of acquisition activity. Operating Profit rose 2.8% to $386.1M, compared to $375.7M in 9M2023. Compared to the prior period, Finance Costs increased 38.8% to $46.0M (9M2024). Profit Before Taxation declined 26.5% from $462.6M to $340.0M. Taxation expense was $98.7M, up 3.5% relative to $95.4M (9M2023). Profit for the period dropped 34.3% to $241.3M in 9M2024, from $367.2M reported in the prior period. Resultantly, Profit Attributable to Parent Owners was $176.7M, a 42.0% drop from the previous comparable period. The Group’s earnings dipped largely as a result of non-realized gains in the prior period, which included the benefit from the disposal of AGL’s contracting division.

Notably, for the three months period ended 30th June, 2024 (3Q2024) – excluding the adjustment for the net gain on acquisitions in 3Q2023, AGL’s revenue, profit before tax and profit for the period rose 9.2%, 6.9% and 4.3% respectively in 3Q2024 from the prior comparable quarter.

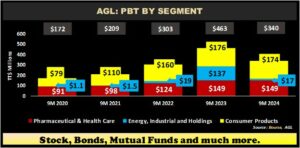

PBT Advance

Consumer Products, contributing 51.2% of PBT, marginally declined 1.0% year-on-year to $174M. Pharmaceutical and Health Care accounting for 43.9% of PBT, remained flat year-on-year at $149M. In June 2024, the Group announced the acquisition of three pharmaceutical and personal care distribution companies in the Dutch Caribbean as part of its strategic regional expansion of its pharmaceutical segment. All regulatory requirements associated with the acquisitions of Aventa Group in Curacao and Aruba and Pharmaceutical Warehousing Incorporated (Curacao) were met and completed on June 28th, 2024.

Energy, Industrial and Holdings, accounted for 4.9% of PBT, significantly declined 88.0% over the period to $17M from a prior $137M, in the absence of the one-off non-cash gain on acquisitions.

Margins Decline

AGL’s operating and profit before tax margins declined in the reporting period, despite revenue growth. The Group’s Operating Profit margin fell to 10.1% in 9M2024 from 10.6% in 9M2023, perhaps reflecting the lingering impact of above-average inflationary pressures Profit Before Tax Margin narrowed to 8.9% relative to 13.0% in the prior period. Excluding the one-off gain, PBT margin would have been an estimated 9.6% in 9M2023. The contraction in adjusted PBT margin would have been largely driven by the substantive increase in finance costs for AGL.

The Bourse View

At a current price of $68.00, AGL trades at a Price to Earnings P/E ratio of 20.2 times, above the sector average of 16.2 times. The stock offers investors a trailing dividend yield of 2.2%, below the sector average of 3.5%.

AGL continues to strategically expand its operating segments through organic growth and via acquisitions, enhancing and strengthening the group’s geographical footprint. On the basis of acquisition activities and revenue growth, tempered by lower margins and elevated valuations, Bourse maintains a MARKETWEIGHT rating on AGL.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase, or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives, or agents, accepts any liability whatsoever for any direct, indirect, or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third-party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”