HIGHLIGHTS

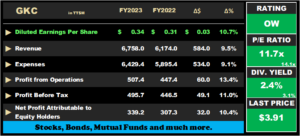

GKC FY2023

- Earnings: Diluted Earnings Per Share 10.7% higher, from TT$0.31 to TT$0.34

- Performance Drivers:

- Revenue Growth

- Improving Margins

- Outlook:

- Acquisition Integration Efforts

- Rating: Maintained at OVERWEIGHT

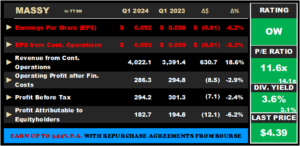

MASSY Q12024

- Earnings: Earnings Per Share 6.2% lower

Continuing Operations: EPS 5.3% lower, from $0.0985 to $0.0933

- Performance Drivers:

- Increased Revenues

- Higher Finance Costs

- Outlook:

- Geographical Diversification

- Acquisition Integration

- Rating: Maintained at OVERWEIGHT

This week, we at Bourse review the performance of two members of the Conglomerate sector on the Trinidad & Tobago Stock Exchange (TTSE), Grace Kennedy Limited (GKC) and Massy Holdings Limited (MASSY) for their three-months (Q12024) period and full year ended December 31st, 2023 (FY2023) respectively. MASSY would have reported a modest decline in earnings, while GKC delivered improved performance driven by improving revenues. Is MASSY’s Q1 performance just a blip, or a sign of challenging conditions for the Group? Can GKC continue its positive earnings momentum? We discuss below.

GraceKennedy Limited (GKC)

GraceKennedy Limited (GKC) reported an Earnings per Share (EPS) of TT$0.34 for fiscal year ended December 31st, 2023, an increase of 10.7% over the corresponding period in FY2022.

Revenue from Product and Services expanded 8.9% from TT$6.0B to TT$6.50B, while Interest Revenue advanced 26.1% to TT$261M. Resultantly, Total Revenue grew 9.5% to TT$6.76B in FY2023 from TT$6.17B in FY2022. Direct and Operating Expenses rose 8.9% to TT$6.41B, while Net Impairment Losses on Financial Assets climbed 56.5% to TT$23.7M, resulting in Total Expenses increasing 9.1% from a previous TT$5.90B in the prior period. Profit from Operations amounted to TT$507.4M, 13.4% higher than previous TT$447.4M (FY2022). Profit Before Tax (PBT) amounted to TT$495.7M, up 11.0% from TT$446.5M in the prior period. Overall, Profit for the period rose 10% from TT$332.0M to TT$365.3M in the current period. GKC’s reported Net Profit Attributable to Owners for FY2023 settled at TT$339.2M, a noteworthy 10.4% increase.

Food Trading, Insurance Boosts PBT

GKC’s Profit before Tax has been on an upward trend over the past 5 year, notwithstanding a modest dip in FY2022. Food Trading, the largest contributor to PBT (57%) increased 17% year on year, from TT$243M in FY2022 to TT$284M in FY2023. GraceKennedy Money Services (GKMS), the second-largest contributor of PBT (27%) fell 5.1% to TT$134M, affected by lower revenues. The Group’s Insurance Segment, which contributed 16.9% of PBT, improved 55.1% year on year from a previous TT$54M to TT$84M in the current period. This performance was most likely driven by existing acquisition activity, notably Scotia Insurance Caribbean (SICL), which rebranded to GK Life. PBT from Banking and Investments (7.2% of PBT) slid 28% to TT$35M (FY2023), impacted by weaker operating results and higher finance expenses.

Margins Increase

For Fiscal year end 2023 (FY2023), GKC’s profitability margins improved modestly, though have not been able to achieve the levels of FY2020 and FY2021. GKC’s Operating Profit margin reflected slight improvement from 7.2% in FY2022 to 7.5% in FY2023. Profit before tax margin improved from 7.2% to 7.3% year on year.

GKC Good Value?

GKC’s 10% increase in reported Diluted Earnings Per Share of TT$0.33 for the twelve months ended December 31st, 2023, relative to its current price puts the stock at a Price-to-Earnings (P/E) multiple of 11.7 times, which appears attractive relative to its historical trading levels, as well as the Conglomerate sector average of 14.1 times.

The Bourse View

At a current price of TT$3.91, GKC trades at a P/E ratio of 11.7 times, below the Conglomerate Sector average of 14.1 times. The Group declared an interim dividend of TT$0.023 per share payable on April 5th, 2024, to shareholders on record by March 15th, 2024. The stock offers investors a trailing dividend yield of 2.4%, below the sector average of 3.2%. In recent developments, GKC announced the repurchase of 236,014 ordinary shares effective March 1st, 2024, under their Repurchase Program (of up to 1% of shares issued).

It is anticipated that the Group will remain committed to its strategy of expanding and creating synergies through integration of its acquisition activities, while simultaneously prioritising cost management measures within its operations. On the basis of revenue growth, improving profitability margins and relatively attractive valuations, fuelled by growth through acquisition activity, Bourse maintains an OVERWEIGHT rating on GKC.

Massy Holdings Limited (MASSY)

Massy Holdings Limited (MASSY) reported Earnings per Share (EPS) of $0.092 for the three-month period ended December 31st, 2023 (Q1 2024), 6.2% lower than an EPS of $0.098 reported in Q1 2023.EPS from Continuing Operations slipped 5.3% from $0.099 to $0.093 per share.

Revenue from Continuing Operations grew 18.6% YoY, from $3.4B in Q1 2023 to $4.0B in Q1 2024. Operating Profit after Finance Costs contracted 2.9% to $286.3M, while Operating margin declined from 8.7% to 7.1%. Share of Results of Associates and Joint Ventures climbed 20.9% to $7.8M (Q1 2023: $6.5M). Resultantly,Profit Before Tax (PBT) decreased 2.4% to $294.2M. Income Tax Expense rose to $94.1M ($1.3M or 1.4% higher). Profit for the period fell 5.0% to $198.0M, compared to $208.4M from the prior period. Overall, Profit Attributable to Owners of the Parent stood at $182.7M, a 6.2% loss compared to $194.8M reported in the previous period.

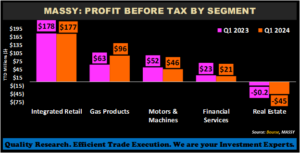

Lower Segment Performance

Integrated Retail, the largest contributor to PBT (60.0%), remained relatively consistent falling just 0.7%, from $177.8M in Q12023 to $176.6M in Q12024. According to the Group, strong performance of retail stores in Trinidad, Barbados and the USA were offset by unforeseen distribution-related issues in Trinidad and Barbados.

Gas Products, the second-largest contribution to PBT (32.8%), increased 54.3% from $62.5M to $96.5M. According to MASSY, the Gas Product Portfolio’s (GPP) performance without acquisitions (Air Liquide and IGL Jamaica Limited) would have recorded growth of 25% in Q12024.

Motor & Machines (15.5% of PBT) fell 12.5% to $45.7M from $52.3M in Q12023, owing to excess inventory from importers in Columbia, leading to higher finance costs and the absence of extended credit for new car purchases resulted in a decline in sales of industrial equipment and vehicles in Guyana.

Financial Services (7.0% of PBT) posted a 12.2% fall in Q12024 to $20.6M, despite improved revenue. As indicated by the Group, revenue generation and the anticipated isolation of on-off occurrences in Q1 provides a degree of confidence for the remaining fiscal year.

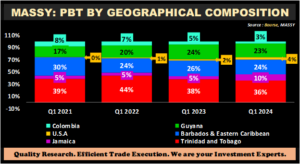

Geographic Diversification Decreases

MASSY’s continued regional/international diversification initiatives are reflected in its geographical PBT contribution, with acquisitions across the Caribbean, Latin America, and the US. While Trinidad & Tobago remains the largest geographic contributor to PBT, Jamaica and U.S.A would have benefitted from a prominent increase in PBT contribution. Jamaica’s operations recorded improved results, with a 120.8% jump in PBT, from $16.0M for Q1 2023 to $35.3M in the current reporting period. Jamaica’s contribution to PBT has increased noticeably in Q12024 from 5% to 10% due to the successful acquisition of IGL Limited, a major player in the Jamaican Liquefied Petroleum Gas (LPG) and the Industrial Medical Gas (IMG) industries. PBT from U.S.A. operations climbed 80.0% from $6.6M to $12.0M, primarily driven by new and existing acquisitions. Guyana’s share of PBT declined modestly from 24% in Q1 2023 to 23% in the current reporting period. Trinidad & Tobago grew 0.6% YoY (36% of total PBT) from $121.1M to $120.5M. Barbados and Eastern Caribbean (24% PBT contribution) advanced 2.1% to $82.5M, relative to $80.8M reported in the previous comparable period.

MASSY’s trailing 12-month EPS from continuing operations stood at $0.39 per share as at Q1 ended December 2023, up 16.9% from $0.33 the prior year. Continuing EPS has maintained an upward trajectory since December 2021, surpassing pre-covid levels of $0.25 and $0.21 per share recorded in December 2019 and December 2020 respectively. Massy’s P/E ratio from continuing operations currently stands at 11.1 times which is relatively lower than its pre-covid level of 12.3 times in December 2019.

Total Trailing 12-month EPS (inclusive of Discontinued Operations), however, contracted 8.0% to $0.38 per share from $0.41 per share in quarter one ended December 2022, as the Group nears completion of its divestment agenda. Massy’s P/E Ratio based on total EPS is at 11.6 times, rising from a low of 8.4 times in December 2020.

The Bourse View

MASSY currently trades at a market price of $4.39 with a market-to-book ratio of 1.19 times, in line with the Conglomerate sector average and a trailing 12-month P/E ratio of 11.6 times, below the sector average of 14.1 times. MASSY’s P/E ratio based on continuing operations stands at 11.2 times. MASSY offers investors a trailing dividend yield of 3.6%, above the sector average of 3.1%.

Looking ahead, MASSY’s continuing earnings may be poised for improvement as the group extracts the potential benefits accrued from its recent acquisitions. On the basis of continued revenue growth, and relatively attractive valuations when compared to the sector, Bourse maintains an OVERWEIGHT rating on MASSY.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase, or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives, or agents, accepts any liability whatsoever for any direct, indirect, or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third-party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”