HIGHLIGHTS

International Markets

HY2024 Performance:

-

- US Markets – S&P 500 ↑ 14.5%

- European Markets- MSCI Europe ↑ 5.8%

- Asian Markets – MXASJ ↑ 7.2%

- Latin American Markets – MSCI EM ↓ 18.2%

- Performance Drivers:

- Resilient Economic Growth

- Cooling Inflationary Pressures

- Geopolitical Tensions

- Outlook:

- Economic Normalization

This week, we review the performance of international stock markets for the first six months of 2024 (HY2024). International equities were broadly higher fuelled by strong corporate earnings and continued hopes of US interest rate cuts. We discuss possible drivers that are likely to continue influencing market sentiment and direction as we progress into the latter half of the year. Will markets sustain their upward trend in 2024, or could emerging factors steer investors in a different path? We discuss below.

International Markets Update

US Markets Rally

U.S stocks locked in a solid first half (HY2024) with the S&P 500 advancing 14.5%, attributable to expectations of rate cuts by Federal Reserve amid easing inflationary pressure, strong corporate earnings, and optimism over artificial intelligence (AI).

The Communication Services sector (XLC) and the Technology Sector (XLK) benefitted from double digit returns in HY2024, rising 17.9% and 17.5% respectively. Five of the ‘Magnificent Seven’ companies propelled the gains in those sectors – Nvidia, Microsoft, Amazon, Meta Platforms and Apple – which have all been boosted by the potential of generative AI. The Financials Sector (XLF) and the Energy Sector (XLE) also excelled in HY2024 climbing 9.3% and 8.7% respectively.

The interest rate-sensitive Real Estate Sector (XLRE) is the lone sector with losses for HY2024, falling 4.1%, as the high interest rate environment resulted in the sector being relatively less attractive.

European Stocks Resilient

European equities recorded broadly positive results for HY2024, but lower when compared to returns from the previous comparable period. For HY2024, the European markets benefitted from increased earnings growth due to improved sales and profit margins, as well as generally stable economic conditions across some member countries. The European benchmark climbed 5.8% compared to 13.6% in HY2023, notwithstanding, the benchmark outperformed several European country indexes, including Spain and England. Italian equities (+6.0%), was the best performing index, supported by a relatively stable economic environment, with a steady core inflation rate which suggests moderate price stability in the near term. Spanish and English markets followed closely, with returns of 5.2% and 4.9%, respectively. German equities grew by 2.6% compared to 14.5% in HY2023. French market slid 3.7% into negative growth territory in the current period, versus 16.5% growth in HY2023, amid political uncertainty surrounding parliamentary elections.

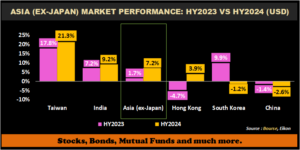

Asian Markets Mixed

For Mid-Year 2024, Asian equities recorded mixed results across its major markets. Asia (excluding Japan) index rose 7.2% in HY2024, relative to 1.7% in HY2023. Taiwanese equities grew by 21.3%, bolstered by increased investor optimism around Artificial Intelligence (AI). Indian equities rose 9.2% for HY2024, driven by strong inflows from institutional investors, robust corporate earnings, and positive economic data. Hong Kong markets gained 3.9% in HY2024 relative to a decline of 4.7% in HY2023. After two consecutive quarters of negative growth, Chinese stocks closed HY2024 2.6% lower, impacted by subdued investor confidence, housing challenges and sluggish retail sales. Similarly, South Korea dipped 1.2% in HY2024. Despite mixed results in some Asian economies, the outlook for investors in the upcoming six months remains relatively upbeat, led by robust economic growth.

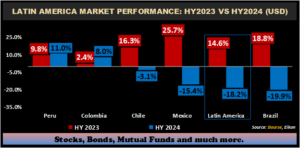

Latam markets lower

Latin American markets dropped 18.2% in HY2024, as inflationary pressures rose and currencies depreciated, while US elections uncertainty drove risk aversion. Peruvian equities advanced 11.0% in HY2024 relative to a growth of 9.8% in the prior comparable period, led by its robust economic growth and sound prudent macroeconomic policies. Colombian stocks advanced 8.0% in HY2024. Chilean equities contracted 3.1% in HY2024, due to a rise in consumer prices. Mexican markets contracted 15.4%, owing to political instability cast by the newly elected President Claudia Sheinbaum which led to a sharp depreciation of the Mexican currency. Brazilian stocks fell into negative growth territory by 19.9% in HY2024 compared to a positive return of 18.8% in HY2023, primarily attributed to a weakening currency amid heightened fiscal uncertainty and elevated interest rates.

Investment Outlook

The S&P 500 advanced 14.5% for the first half of 2024, led by strong corporate earnings, and the prospect of interest rate reductions amid cooling inflation levels. Consensus analyst forecasts call for a 9.0% aggregate S&P500 earnings growth in the second quarter of 2024 with leading Banks like Goldman Sachs and Citi Group analysts projecting the S&P 500 year-end 2024 target to a level of 5,600, 17.4% higher from December 2023 closing level of 4,770 and up 2.6% from June 30th closing level of 5,460.

Looking forward to the second half of 2024, some factors that are likely to drive U.S market sentiment and direction include:

- Resilient economic growth – According to the International Monetary Fund (IMF), U.S economic growth is expected to increase from 2.5% in 2023 to 2.6% in 2024, fuelled by resilient consumer spending and moderate growth in investment. Overall, global growth is projected to hold steady at 3.2% in 2024 and 2025.

- Cooling Inflation- The latest June 2024 consumer price index (CPI) report continued to reflect signs of easing inflationary pressures, bolstering the Federal Reserve’s optimism about the path for inflation. The CPI stood at 3.0% in June 2024 on an annual basis, down from 3.3% in May. If sustained, this may have a positive impact on consumer demand and corporate earnings.

- Peak Interest Rates – After 11 consecutive rate hikes since March 2022, the Fed held interest rates unchanged since its July 2023 policy meeting at a target range of 5.25% to 5.50%. At the June 2024 meeting, Federal Reserve officials now anticipate only one 25 basis points (bps) cut this year, mostly likely expected in September 2024 with a further four cuts in 2025, if inflation data continues to cooperate. The timing of rate cuts depends on how long the policy rates will remain restrictive to ensure that inflation is returning sustainably towards its 2% target. Notably, the Fed cited in its statement that there has been ‘modest further progress’ toward the central bank’s inflation target.

- Geopolitics – Geopolitical tensions are likely to persist in the second half of 2024. Political uncertainty associated with the upcoming U.S Presidential Elections in November 2024 could spur short-term market volatility. Also, issues such as US-China relations, and the ongoing conflicts in Europe or instability in the Middle East could potentially rattle global markets.

Investment Considerations

In summary, the combination of a strong economy, moderating inflation, and accommodative Fed policy, coupled with robust earnings growth expectations, provide a foundation for continued optimism for equity markets. However, investors should be cautiously optimistic and be prepared to adjust when necessary as they navigate the evolving economic landscape.

Diversification remains a cornerstone strategy for mitigating overall portfolio risk and enhancing potential returns. Investors seeking greater control over their investment portfolio can consider diversifying by stock selection or asset class. Investment vehicles such as Exchange Traded Funds (ETFs) or equity mutual funds provides a simpler, more accessible way to achieve broad market diversification. For instance, a single ETF can track the performance and/or provide exposure to a specific market index such as the S&P 500 – gaining broad exposure with minimal effort. Investors can also consider ETF’s which diversify by sector, country or even investment region (Asia, Latin America, US, Europe etc.).

As always, investors are encouraged to consult a trusted investment adviser such as Bourse to make the most informed investment decisions.