HIGHLIGHTS

GHL FY2023

- Earnings: EPS climbed 53.5% from $2.00 to $3.07

- Performance Drivers:

- Higher Net Insurance and Investment Result

- Higher Finance / Operating Expenses

- Post-Adoption of IFRS 17

- Outlook:

- Economic Normalization

- Rating: Maintained at MARKETWEIGHT

NCBFG Q12024

- Earnings: Earnings Per Share of TT$0.06, 120% higher from EPS of TT$0.03

- Performance Drivers:

- Resilient Banking Results

- Improved Insurance Results

- Post-Adoption of IFRS 17

- Outlook:

- Resumption of Dividend Payments

- Rating: Maintained as OVERWEIGHT

This week, we at Bourse review the performance of Guardian Holdings Limited (GHL) and NCB Financial Group Limited (NCBFG), for the twelve months (FY2023) and three months (Q12024) ended December 31st, 2023, respectively. Both GHL and NCBFG benefitted from strong insurance and investment results. Will both companies continue this positive momentum in the upcoming months? We discuss below.

Guardian Holdings Limited (GHL)

Guardian Holdings Limited (GHL) reported Earnings per Share of $3.07 for its fiscal year ended December 31st, 2023 (FY2023) up 53.5% from a restated $2.00 in the prior comparable period. Note: The implementation of IFRS17 resulted in a restatement of FY 2022 results. Prior to this restatement, EPS for GHL was reported as $4.74, with profit attributable to shareholders of $1.1B.

Supporting this performance was its Insurance Service Result, expanding 4.8% from $706.3M in the prior period to $740.4M in FY2023. Net Income from Investing Activities also increased 133.2% to $1.92B, driven primarily by an almost $900M change in Net Fair Value Gains. Net Insurance finance expense amounted to $789.7M relative to $14.9M in FY2022. Consequently, Net Insurance and Investment Result amounted to $1.87B compared to $1.52B in FY2022, 23.5% higher. Fee and commission income from brokerage activities declined by $155.9M or 0.4% year-on-year, due to the increased brokerage segment from our operations in the Netherlands. Net Income from all activities gained 21.3% to $2.03B in the period under review. Other operating expenses rose 5.4% YoY, as a consequence of mixed inflationary pressures on their cost structure, current investment in IFRS 17 adoption, and expanding technological expenses. Operating Profit advanced 56.8% from $589.8M in FY2022 to $925.0M in FY2023. Profit Before Taxation amounted to $936.9M, 53.7% greater than the $609.4M in the prior period. Taxation grew from $140.9M to $218.6M in FY2023, with the effective taxation rate expanding from 23.1% to 23.3%. Profit for the Period stood at $718.3M, rising 53.3% from the equivalent prior period (IFRS17-restated) comparative of $468.6M. Overall, Profit Attributable to Equity Holders of the Company increased to $713.1M, (53.6% higher) compared to the profit of $464.2M FY2022.

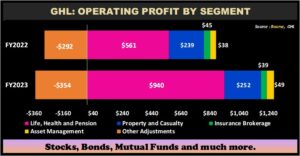

LHP Segment Climbs

Operating Profit for the period came in at $925.0M during the twelve -month period, expanding 56.8% from the prior comparable period. The Life, Health and Pension (LHP) segment (101.6% of operating profit) increased 67.6% year-on-year from $560.8M to $940.2M, supported by robust net income from investing activities The Property and Casualty Segment (27.2% of Operating Profit) advanced 5.5% to $251.7M in FY2023. Insurance Brokerage operating profit dropped 13.7% to $38.8M from $44.9M, essentially from operations in the Trinidad, Jamaica and Dutch Caribbean markets. Asset Management rose 29.4% from $37.7M in FY2022 to $48.8M in FY2023. GHL noted its intention to concentrate on expanding this segment through increased third-party operations and trade activities.

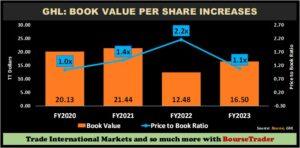

From a value perspective, GHL’s book value per share advanced from $12.48 in FY2022 to $16.50 in the current period under review. The corresponding fall in GHL’s price has resulted in a price-to-book ratio of 1.1 times, down from 2.2 times in FY2022, implying that investors are now paying less per share to possess the company’s net assets.

GHL’s trailing 12M Dividend per Share increased to $0.74, the highest level in the previous 5 comparable periods, from $0.72 in FY2019. Trailing 12M Dividend Yield offered to investors is currently 4.1%. Within recent history, GHL’s dividend payments have been relatively steady, safe and except for FY2020 and FY2021 which were impacted by COVID-19 uncertainty.

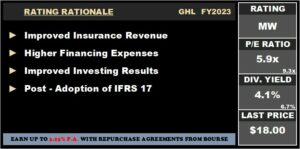

The Bourse View

GHL is currently priced at $18.00 and trades at a price to earnings ratio of 5.9 times, below the Non-Banking Financial Sector average of 9.3 times. The stock currently offers investors a trailing dividend yield of 4.1% relative to a sector average of 6.7%.

The implementation of IFRS 17 has contributed to a change in revenue recognition, making GHL’s performance less comparable to previous periods from a financial reporting perspective. On the basis of improved insurance revenue, but tempered by financing expenses and fluctuating investment income, Bourse maintains a MARKETWEIGHT rating on GHL.

NCB Financial Group Limited (NCBFG)

For the three months ended December 31, 2023 (Q12024), NCB Financial Group Limited (NCBFG)reported an Earnings Per Share (EPS) of TT$0.06, up 120%, relative to TT$0.03 reported in the previous comparable period.

Interest Income improved by 14.7% from TT$823M to TT$944.3M. Interest Expense climbed 33.4% to TT$438.6M and as a result, Net Interest Income rose 2.3% to TT$505.7M. Net Fee and Commission Income improved 8.6% from TT$260M to TT$282M. Gain on Foreign Exchange and Investment Activities fell 24.3% to TT$82.7M from a previous TT$109.1M. Net Result from Banking and Investment Activities settled at TT$850.7M, an improvement of 3.8% relative to TT$819.3M in the prior period. Net Result from Insurance Activities amounted to TT$654.3M, grew 85.3%, from TT$353M in Q12022. Net Operating Income expanded 28.4%, from TT$1.17B (Q12022) to TT$1.50B. Operating Profit improved 115.2%, from a previous $169.2M in Q12022. NCBFG’s Share of Associate Profit amounted to TT$2.0M, 76.3% lower than previously reported in Q12023. Notably, Net Profit after Tax grew by 170% to TT$260.3M, leading to NCBFG’s Net Profit Attributable to Equity Holders for the Period climbing 123% to TT$134.2M from TT$60.1M in the previous comparable period.

Operating Profit by Activity

NCBFG’s Operating Profit yielded improved results year on year. Life and Health Insurance & Pension Fund Management amounted to TT$424.7M relative to TT$87.7M in the comparable period, reflecting increased improvement by 384.1% and supported by IFRS17 actions.

Treasury and Correspondent Banking expanded 58.4% from TT$76.8M to TT$121.7M in the current period. Wealth, Asset Management and Investment Banking contributed Operating Profit of $13.4M, 66.9% lower than the prior comparable period. The Group’s Corporate and Commercial Banking division declined 11.1% to TT$52.5M. Payment Services grew 116.6% to TT$22.9M in Q12023 compared to TT$10.6M in the prior period. General Insurance fell by 15.9% from TT$109.2M to TT$91.8M. Consumer and SME Banking Wealth which contributed the least to Operating Profit, swung from a deficit of TT$26.2M to TT$6.6M, up 125%, owing to increased growth in net of credit impairment losses.

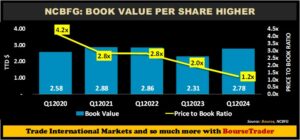

NCBFG’s book value per share recovered in Q12024, attributable to growth in retained earnings and reductions in the still-negative Fair Value and Capital Reserves. The Company’s Book Value Per Share (BVPS) increased from $2.58 in Q12020 to $2.78 in the current period contributing to a relatively attractive P/B ratio of 1.2x (Q12024), below its five-year average of 2.6 times.

The Bourse View

NCBFG currently trades at a price of $3.06 at a trailing PE ratio of 17.7 times, relative to the Banking Sector average of 13.8 times. The Group declared an interim dividend of TT$0.022 per share payable on March 18th, 2024, to shareholders on record by March 4th, 2024. The stock offers a dividend yield of 1.4%, below the sector average of 3.8%.

For this fiscal quarter Q12024, NCBFG experienced increased revenue from its banking and investment operations, as well as strong results from its insurance division. Notably, new reporting procedures have been standardized in the aftermath of IFRS 17 implementation, and overall economic indicators reflected broad signs of generally improving market conditions across all stakeholder markets. On the basis of (i) increased earnings growth, (ii) the resumption of dividend payments to shareholders and (iii) relatively attractive P/B valuations, Bourse maintains an OVERWEIGHT rating on NCBFG.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase, or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives, or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third-party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”