HIGHLIGHTS

GHL 9M2024

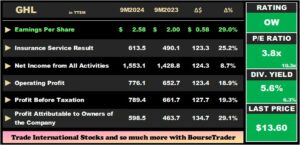

- Earnings: EPS climbed 29.0% from $2.00 to $2.58

- Performance Drivers:

- Higher Insurance Service Result

- Lower Operating Expenses

- Outlook:

- Cost Management Initiatives

- Rating: Upgraded to OVERWEIGHT.

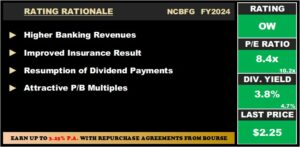

NCBFG FY2024

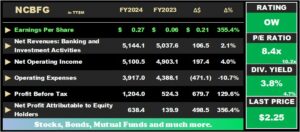

- Earnings: EPS advance 355.4% from TT$0.06 to TT$0.27

- Performance Drivers:

- Increased Insurance service result

- Higher Net Operating Income

- Outlook:

- Increased growth opportunities

Rating: Maintained at OVERWEIGHT

This week, we at Bourse review the performance of Guardian Holdings Limited (GHL) and NCB Financial Group Limited (NCBFG) for their respective nine months ended September 30th, 2024 (9M2024) and full year ended September 30th,2024 (FY2024). GHL and NCBFG both benefitted from strong insurance revenue and lower operating expenses. We discuss below.

Guardian Holdings Limited (GHL)

Guardian Holdings Limited (GHL) reported Earnings per Share of $2.58 for its third quarter ended September 30th, 2024 (9M2024) up 29.0% from $2.00 in the prior comparable period. Insurance Service Result expanded 25.2% from $490.1M in the prior period to $613.5M in 9M2024. Net Income from Investing Activities increased 3.8% to $1.39B. Net Insurance finance expense amounted to $585.4M, up 11.0% year-on-year. Consequently, Net Insurance and Investment Result amounted to $1.42B compared to $1.31B in 9M2024, 8.9% higher. Fee and commission income from brokerage activities advanced by $7.8M or 6.4% year-on-year. Net Income from all activities gained 7.3% to $1.53B in the period under review. Other operating expenses fell 1.3% YoY as a result of effective cost management. Operating Profit rose 18.9% from $652.7M in 9M2023 to $776.1M in 9M2024. Share of after-tax profits of associated companies grew 47.1% to $13.3M. Profit Before Taxation amounted to $789.4M, 19.3% greater than the $661.7M in the prior period. Taxation dropped 4.1% to $185.6M with the effective taxation rate contracting from 29.3% to 23.5%. Profit for the Period stood at $603.8M, rising 29.0% from the equivalent prior period (IFRS 17) comparative of $468.2M. Overall, Profit Attributable to Equity Holders of the Company increased to $598.5M, (29.1% higher) compared to the profit of $463.7M in 9M2024.

LHP Segment Improves

Operating Profit for the period came in at $776.1M during the nine -month period, expanding 18.9% from the prior comparable period.

The Life, Health and Pension (LHP) segment (72.5% of Operating Profit excluding adjustments) climbed 16.1% year-on-year from $642.0M to $745.3M, driven by increased insurance revenue.

The Property and Casualty Segment rose 5.6% to $182.4M in 9M2024, as revenues were boosted from operations in Trinidad, Jamaica and Dutch Caribbean markets. This was offset by higher incurred claim expenses, with total gross claims paid by the P&C segment reaching $494M relative to $325M in the previous year. According to GHL, the reported figure includes the impact of net claims incurred from Hurricane Beryl.

Insurance Brokerage’s operational profit advanced 132.8% to $65.1M in 9M2024, primarily attributable to increased brokerage business in the Netherlands and Dutch Caribbean. On November 19th, 2024, the Group announced that its Board of Directors approved the sale of 100% of Thoma Exploitatie B.V to PIB Group Limited through a Sale and Purchase Agreement.

Asset Management increased marginally by 0.4% to $35.2Min 9M2024. According to GHL, it continues to concentrate on expanding this segment by enhancing third-party partnerships, increasing structured solutions, and boosting trade operations.

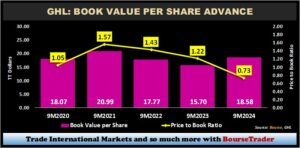

From a value perspective, GHL’s book value per share advanced from $15.70 in 9M2023 to $18.58 in the current period under review. The concurrent decline in GHL’s price has led to its price to book ratio moving from a high of 1.57 times in 9M2021 to a low of 0.73 times in 9M2024 (below its five-year average of 1.2 times). This implies that investors are currently paying less on a per-share basis to own net assets of the company, often interpreted as an indicator of value.

The Bourse View

GHL is currently priced at $13.60, down 28.2% year-to-date. The stock would have last traded at a 10-year low of $12.00 on August 20th, 2024. GHL trades at a price to earnings ratio of 3.8 times, significantly below the Non-Banking Financial Sector average of 10.3 times. The stock currently offers investors a trailing dividend yield of 5.6%, below the sector average of 6.3%. On the basis of higher insurance revenue, attractive valuation multiples and a reasonably generous dividend yield, Bourse upgrades its rating on GHL to OVERWEIGHT.

NCB Financial Group Limited (NCBFG)

NCBFG reported an Earnings Per Share (EPS) of TT$0.27 for the Financial Year ended September 30th, 2024 (FY2024), 355.4% more than the EPS of TT$0.06 reported in FY2023.

The Group’s core Revenue driver, Net Interest Income, grew 2.2% YoY to TT$2.6B from a previous TT$2.5B. Net Revenues from Banking and Investment Activities advanced 2.1% (TT$5.1B) from a prior TT$5.0B, led by increased foreign currency and investment activities and higher unrealized gains on equity investments. Insurance service result increased from TT$617.5M in FY2023 to TT$787.1M in the current period (+27.5%). Overall, Net Operating Income improved by 4.0%, to TT$5.1B from a previous TT$4.9B. Notably, Operating Expenses declined 10.7% to TT$3.9B, due to the Group’s cost optimization efforts. Operating Profit advanced 129.8% significantly to roughly TT$1.2B. Share of Profit of Associates moved from TT$9.3M to TT$20.5M in FY2024. Profit Before Tax was $1.2B, 129.6% higher than $524.3M recorded in FY2023.

Net Profit totalled TT$988.1M, up 173.6% from TT$361.1M in FY2023. According to the Group, the Net Profit for FY2024 excludes a one-off gain of roughly TT$127.5M (after taxes), which was previously accounted for in Q12024. Overall, Net Profit Attributable to Shareholders rose to TT$638.4M from TT$139.9M, 355.4% higher.

Operating Profit by Activity

Three of NCBFG’s seven operating segments recorded year-on year improvements. Life and Health Insurance & Pension Fund Management, which accounts for 58.5% Operating Profit, advanced 34.0% from $759M to $1.0B in FY2024, driven by improved revenues. Treasury and Correspondent Banking (31.5% of Operating Profit) expanded 30.6% from $420M to $549M. Payment Services (5.9% of Operating Profit) increased to a significant 60.7% from $63M to $102M on higher card transaction volumes. Conversely, Wealth, Asset Management, and Investment Banking (4.8% of Operating Profit) contracted 76.9% from $359M to $83M.

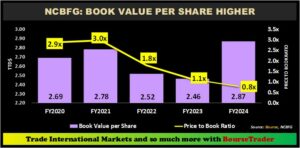

NCBFG’s book value per share reported substantial growth in FY2024, increasing from $2.46 in FY2023 to $2.87 in the current period, contributing to a relatively attractive P/B ratio of 0.8 times (FY2024), compared to the previous period of 1.1 times.

The Bourse View

NCBFG is currently priced at $2.25 at a trailing P/E ratio of 8.4 times, below the Banking Sector average of 10.2 times. The stock offers investors a trailing dividend yield of 3.8%, below the sector average of 4.7%. The Group announced an interim dividend of TT$0.021 to be paid on December 13th, 2024, and recorded by shareholders on November 29th, 2024.

According to NCBFG’s Chairman, Michael Lee-Chin at an investor briefing on November 15th – the intentions for the Group moving forward is to continue to boost profits while lowering debt, paving the way for shareholders to benefit from an increase in dividend income. NCBFG continues to place emphasis on optimizing efficiency and costs, while strengthening its competitive position. On the basis of improved segments revenues, attractive valuations and more reliable dividend payments, Bourse maintains an OVERWEIGHT rating on NCBFG.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase, or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives, or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third-party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”