HIGHLIGHTS

GHL HY2023

- Earnings: EPS climbed 96.4% from $0.55 to $1.08

- Performance Drivers:

- Higher Net Insurance and Investment Result

- Higher Finance / Operating Expenses

- Increased Taxation

- Outlook:

- Economic Normalization

- Rating: Maintained at MARKETWEIGHT.

NCBFG 9M2023

- Earnings: EPS contracted 48.0% from TT$0.36 to TT$0.18

- Performance Drivers:

- Reduced Net Result from insurance activities

- Lower Net Operating Income

- Outlook:

- Economic normalization across operating jurisdictions

- Rating: Maintained at MARKETWEIGHT.

This week, we at Bourse review the performance of Guardian Holdings Limited (GHL) for the six months ended June 30th, 2023 (HY2023) and NCB Financial Group Limited (NCBFG) for the nine months ended June 30th,2023 (9M2023). GHL benefitted from strong insurance revenue and operating income bolstered by improvements in fair value gains. Meanwhile, NCBFG grappled with reduced earnings and operating income as it continues to navigate the still uncertain operating environment. We discuss below.

Guardian Holdings Limited (GHL)

Guardian Holdings Limited (GHL) reported Earnings per Share of $1.08 for its second quarter ended June 30th, 2023 (HY2023) up 96.4% from $0.55 in the prior comparable period. It should be noted that GHL’s implementation of the new International Financial Reporting Standard (IFRS) 17 would have significantly adjusted the presentation of its financial performance.

Insurance Service Result expanded 28.6% from $268.2M in the prior period to $344.9M in HY2022, arising from continued new business growth and policy retentions/renewals. Net Income from Investing Activities also increased 224.2% to $869.1M. Net Insurance finance expense amounted to $441.2M relative to net insurance finance income of $4.3M in HY2022, arising from the LHP segment and the impact of interest rate movements on liabilities. Consequently, Net Insurance and Investment Result amounted to $772.8M compared to $540.6M in HY2022, 43.0% higher. Fee and commission income from brokerage activities advanced by $7.6M or 9.9% year-on-year, supported by increased brokerage activities in the Dutch Caribbean. Net Income from all activities gained 38.9% to $856.7M in the period under review. Other operating expenses rose 12.6% YoY, as a result of sales-related expenses and continued IFRS 17 implementation costs. Operating Profit advanced 144.9% from $143.7M in HY2022 to $351.9M in HY2023. Share of after-tax profits of associated companies declined 40.7% to $6.8M. Profit Before Taxation amounted to $358.7M, 131% greater than the $155.2M in the prior period. Taxation grew from $25.2M to $105.0M in HY2023, with the effective taxation rate expanding from 16.2% to 29.3%. Profit for the Period stood at $253.7M, rising 95.2% from the equivalent prior period (IFRS 17) comparative of $130.0M. Overall, Profit Attributable to Equity Holders of the Company increased to $250.9M, (95.4% higher) compared to the profit of $128.4M HY2022.

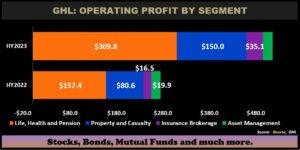

LHP Segment Advances

Operating Profit for the period came in at $351.9M during the six -month period, expanding 144.9% from the prior comparable period.

The Life, Health and Pension (LHP) segment (88.0% of operating profit) increased 96.8% year-on-year from $157.4M to $309.8M, driven by higher insurance revenue contributed by all lines of business. The Group announced at a recent investor forum meeting, an initiative to establish a ‘product factory’, aimed at improving its product portfolio. The Property and Casualty Segment (42.6% of Operating Profit) advanced 86.0% to $150.0M in HY2023. Insurance Brokerage operating profit grew 113.0% to $35.1M, due to increased fee and commission income from brokerage activities. Asset Management rose 5.8% from $19.9M in HY2022 to $21.0M in HY2023. The Group continues to focus efforts on developing this segment through third-party business and product offerings.

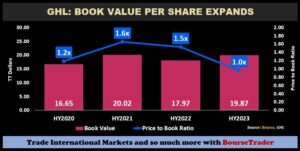

From a value perspective, GHL’s book value per share advanced from $17.97 in HY2022 to $19.87 in the current period under review. The concurrent decline in GHL’s price has led to its price to book ratio decreasing from 1.5 times in HY2022 to 1.0 times, suggesting that investors are currently paying less on a per-share basis to own net assets of the company.

The Bourse View

GHL is currently priced at $19.01 and trades at a price to earnings ratio of 3.6 times, significantly below the Non-Banking Financial Sector average of 10.8 times. The stock currently offers investors a trailing dividend yield of 3.9% relative to a sector average of 7.0%. The Group announced an interim dividend of $0.22 to be paid to shareholders on September 8th, 2023. Investors would be keenly observing the impacts of IFRS17 on a full reporting year for GHL, which would likely influence confidence/sentiment. Similarly, investors would be monitoring the pronounced impact of fair value gains/losses on GHL’s net income from investing activities and overall result, which has been broadly positive in FY2023 thus far. On the basis of increased insurance revenue and favourable market movements, but tempered by higher finance expenses, Bourse maintains a MARKETWEIGHT rating on GHL.

NCB Financial Group Limited (NCBFG)

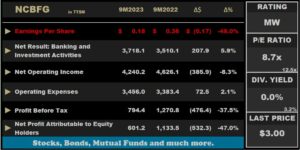

For the nine months ended June 30, 2023 (9M 2023), NCB Financial Group Limited (NCBFG) reported an Earnings Per Share (EPS) of TT$0.18, 48.0% below the previous comparable period.

Interest Income increased 17.5% from TT$2.96B to TT$3.48B. Interest Expense climbed 44.8% to TT$1.21B and as a result, Net Interest Income rose 6.8% to TT$2.27B. Net Fee and Commission Income was boosted 11.1% from TT$838.6M to TT$932M. Gain on Foreign Exchange and Investment Activities reflected an improved performance by 54.7% to TT$475.7M from a previous TT$307.6M. Net Result from Banking and Investment Activities experienced amounted to TT$3.72B, representing a gain of 5.92% relative to TT$3.51B in the previous reporting period. Net Result from Insurance Activities stood at TT$522.1M compared to TT$1.12B recorded in the previous comparable period, reflecting negative growth of 53.2%. An 8.3% decline in Net Operating Income (from TT$4.63B to TT$4.24B), coupled with a 2.14% increase in Operating Expenses (from TT$3.38B to TT$3.46B) resulted in an Operating Profit of TT$784.2M, down 36.9% compared to 9M2022. NCBFG reported Share of Associate Profit of TT$10.2M, representing a decline in performance by 63.8%. Profit Before Tax decreased by 37.5% to TT$794.4M. Overall, Net Profit Attributable to Equity Holders for the Period amounted to TT$601.2M in the nine months ended June 30, 2023, down 47% from TT$1.1B in the prior period.

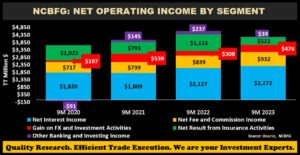

Operating Income Trends

NCBFG’s reported 8.3% decline in Net Operating Income to TT$4.24B in 9M 2023 was primarily attributable to weaker Net Results from Insurance Activities.

Net Interest Income, the largest component of Net Operating Income (53.6%), improved 6.8% as the Group’s interest-earning portfolios continue to grow. The Group has recorded continually improved revenue growth Year-on-Year (YoY) for the past four reporting periods. The Company recorded a 11.1% increase in Net Fee and Commission Income (22.0% of Net operating Income), resulting from growth in loans and investments portfolios and increased transaction volumes. Net Revenues from Insurance Activities (12.3% of Net Operating Income) contracted considerably by 53.2% from TT$1.11B in 9M 2022 to TT$522M in 9M 2023. Although, the segment recorded an improvement of 3.36% in premium income, it was overshadowed by higher commission and selling expenses. Gains on Foreign Currency and Investment Activities (11.2% of Net Operating Income) jumped 54.65% to TT$475.7M, likely driven by higher gains from the sale of debt securities as well as fair value gains from equity investments. Other Banking and Investing Income lowered 83.7% to TT$39M relative to $237 in 9M2022, primarily driven by increased credit impairment provisions.

Operating Profit by Activity

Operating Profit dropped 36.9% Year-over-Year (YoY) to TT$784.2M from TT$1.24B in the prior comparable period. Life and Health Insurance & Pension Fund Management (43.1% of Operating Profit) amounted to TT$491M relative to TT$895M in the comparable period, a decline of 45.1%. Treasury and Correspondent Banking, the second largest contributor of OP (17.9%) fell 15.7% year over year. Asset Management and Investment Banking, which accounted for 14.1% of Operating Profit, fell 3.8%, producing Operating Profit of TT$282M, likely attributable to higher interest rates and increased fair value gains. The Group’s Corporate and Commercial Banking division (10.5% of Operating Profit) gained 3.6% and amounted to TT$225M. Whilst Payment Services consisted of 4.7% of Operating Profit, dropped significantly by 61.1% to TT$38M relative to $98M in the prior period. General Insurance (7.6% of OP) climbed 84.6% from TT$159M to TT$293M, which generated improved revenue and profitability. Consumer and SME Banking Wealth contributed the least to Operating Profit, negatively impacted by higher credit impairment losses, which resulted in a deficit of $16M. According to the Group, the adoption of IFRS 17 will be implemented in the financial year end results which would materially change the recognition and measurement of insurance contracts – company presentation and disclosures, particularly in the LHP segment.

NCBFG posted an EPS of TT$0.18 for the nine months ended June 30, 2023, down from TT$0.36 in 9M2022. The Group’s trailing 12-month EPS totalled TT$0.34 in 9M2023, 21.7% lower than TT$0.44 in 9M2022. The Group’s Price-to-Earnings (P/E) multiple decreased from 12.5 times to 8.7 times in the current reporting period, still relatively attractive to its 5-year historical average of 18.1 times and the current banking sector average of 12.5 times.

Leadership Developments

Recently, the Board of Directors announced the departure of both the CEO, Patrick Hylton and Deputy CEO, Dennis Cohen from the NCB Financial Group (NCBFG), effective July 18th, 2023. The sudden departures would have naturally raised investor eyebrows as to the reasons behind their abrupt exits, weighing on near-term confidence in the Group.

In a press release dated July 21, 2023, it was announced that Robert Almeida will be Interim Group Chief Executive Officer and Malcolm Sadler will serve as Interim Group Chief Financial Officer of NCB Financial Group Limited (NCBFG) effective July 20, 2023. On August 30, 2023 it was announced that Jacqueline De Lisser will be appointed as Interim Chief Financial Officer of National Commercial Bank Jamaica Limited.

The Bourse View

NCBFG currently trades at a price of $3.00 at a trailing PE ratio of 8.7 times, relative to the Banking Sector average of 12.5 times. The stock offers investors a trailing dividend yield of 0.0%, below the sector average of 3.2%, with the Group not having issued a dividend payment since May 2021. At its recently held Investor Forum, the Group Chairman stated its intention to return to regular dividend declarations while remaining aware of increasing regulatory capital requirements. Despite reduced Net revenues from Insurance Activities, the net result from Banking and Investment Activities continue to remain resilient, which yielded improved results, particularly in Foreign and Investment activities. On the basis of higher interest income, relatively attractive P/E multiples but tempered by volatile profitability as well as lingering uncertainty related to the reporting impact of IFRS 17 from an investor perspective, Bourse maintains a MARKETWEIGHT rating on NCBFG.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase, or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives, or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third-party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”