HIGHLIGHTS

FCI HY2024

- Earnings: Earnings Per Share 4.4% higher, from TT$0.60 to TT$0.63

- Performance Drivers:

- Marginal Revenue Growth

- Higher Interest income

- Higher Operating Expenses

- Outlook:

- Interest Rate Normalization

- Continued Economic Recovery

- Rating: Maintained at OVERWEIGHT

SBTT HY2024

- Earnings: Earnings Per Share 3.5% higher, from $1.84 to $1.77

- Performance Drivers:

- Higher Revenues

- Increased Expenses

- Outlook:

- Economic Normalization

- Rating: Maintained at

This week, we at Bourse review the performance of Scotiabank Trinidad & Tobago (SBTT) and First Caribbean International Bank Limited (FCI) for their respective six-month fiscal periods (HY2024) ending April 30, 2024. Both SBTT and FCI reported higher profits, despite modest revenue growth. Could FCI and SBTT continue to grow earnings in the current environment? We will discuss below.

FirstCaribbean International Bank Limited (FCI)

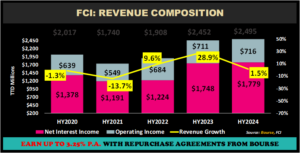

FirstCaribbean International Bank Limited (FCI), now rebranded ‘CIBC Caribbean,’ reported an Earnings Per Share (EPS) of TT$0.63 for the six months ended April 30, 2024 (HY2024), 4.4% higher compared to TT$0.60 recorded in the prior period (HY2023).

Total Revenue grew to TT$2.50B (HY2024), up 1.8%, from the previous TT$2.45B (HY2023). Operating Expenses expanded 3.0% to TT$1.45B. FCI’s Credit loss expense on financial assets contracted from TT$42.8M (HY2023) versus a release of TT$66.6M (HY2024) in the prior period. Income Before Tax (PBT) amounted to TT$1.11B, 11% higher than TT$1.0B reported in the prior period. Income Tax Expense grew to TT$90.3M, with the Group’s effective tax rate increasing from 6% to 8% in the current period. When compared to the previous comparable period, Net Income for the period was 5.1% higher, which amounted to TT$1.02B compared to TT$965.9M in the prior period. Resultantly, Net Income Attributable to Equity Holders increased in shareholder value by 5%, from TT$946.6M in HY2023 to TT$993.1M in HY2024.

Revenue Higher

Total Revenue grew marginally Year on Year (YOY) by 1.8% to $2.50B from a prior TT$2.45B in HY2023. This positive effect on revenue, according to FCI, was as a result of greater net interest margin on the Group’s US dollar loan portfolio. Net Interest Income, the Group’s primary revenue source (71.3%), improved by 1.8% to TT$1.78B from TT$1.75B a year earlier. The Group’s loan portfolio grew marginally by 0.1% from TT$44.1B in HY2023 to TT$45.2B in the current review period. Operating Income (accounted for 28.7% of Total Revenue) expanded marginally by 0.8%, from TT$711M to TT$716M. Despite economic activity nearing pre-COVID levels across most of the region, the major driver of FCI’s fortunes continues to be elevated interest rates. Persistent USD rates should be supportive to earnings momentum in the near-term.

Operating Income by Activity

FCI’s Profit Before Tax (PBT) expanded by 11% Year over Year (YoY). The Bank’s largest contributor to PBT growth, Corporate and Investment Banking (84.6% of PBT), advanced 9.2% from TT$837M to TT$913M. Personal & Business Banking (PBB) contributed 12.2% to PBT, resulted in 23.8% improvement year on year from TT$107M in HY2023 versus TT$132M in the current review period. The Wealth Management (WM) segment (3.1% of PBT) was 10.9% lower, from TT$38M in HY2023 relative to TT$34M in HY2024.

Divestitures and Rebranding

The Group reported its recent completion of the sale of its banking assets in Curacao to Curacao-based OrCo Bank N.V., whilst the sale of banking assets in St. Maarten is still ongoing, subject to closing conditions and is expected to be completed in fiscal year 2025, in line with the company’s overall arching strategic objectives. Furthermore, the Bank officially adopted a new legal name, ‘CIBC Caribbean Bank Limited’ which aligns with the parent CIBC brand.

The Bourse View

FCI currently trades at a price of $6.94 at a trailing P/E ratio of 6.1 times, below the Banking Sector average of 12.0 times. The stock offers investors a trailing dividend yield of 4.8%, above the sector average of 4.2%. The Group announced an interim dividend of US$0.0125 (TT$0.08) per share payable to shareholders on July 19, 2024.

FCI’s profitability should remain resilient in the current rate environment, bolstered by the Group’s positive economic growth outlook for moderate levels of economic activity across the region. On the basis of revenue growth, attractive P/E multiples and USD dividends, Bourse maintains an OVERWEIGHT rating on FCI.

Scotiabank Trinidad and Tobago Limited (SBTT)

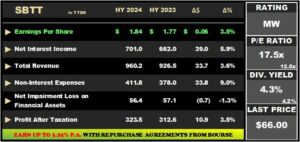

Scotiabank Trinidad and Tobago Limited (SBTT) reported Earnings per share (EPS) of $1.84 for the half year ended April 30th, 2024 (HY2024), a 3.5% increase compared to $1.77 in the prior comparable period.

Net Interest Income rose 5.9% to $701.0M, while Other Income fell 2.1% from $264.6M in HY2023 to $259.2M in HY2024. Total Revenue for HY2024 came in at $960.2M, a 3.6% increase from the prior period. Non-Interest Expenses shifted 9.0% higher from $378.0M in HY2023 to $411.8M in HY2024, due to inflationary pressures and technology-related spend. SBTT recorded a 1.3% decline in Net Impairment Loss on Financial Assets, amounting to $56.4M (HY2023: $57.1M). Profit before Taxation (PBT) expanded marginally to $492.0M, relative to $491.5M recorded in HY2023. The Income tax expense fell 5.8% to $168.5M from $178.9M in the prior comparable period. Overall, SBTT reported a Profit after Taxation of $323.5M, up 3.5% compared to $312.6M in HY2023.

Revenues Higher

SBTT’s Total Revenue recorded $701M for the period ended 30th April 2024, an increase of $34M or 3.6%. This was attributable to growth in Net Interest Income (73.0% of Total Revenue), which rose from $662M to $701M (+5.8%) in HY2024. According to the Group, this increase was driven by higher loan volumes in retail and commercial segments. Other Income (27.0% of Total Revenue) recorded a decrease from $264M to $259M (-1.9%) in the period under review, as a result of lower trading revenues.

From an operating segment perspective, revenue growth occurred across all segments. The Bank’s largest operational segment by revenue, Retail Corporate & Commercial Banking (91.7% of Total Revenue) expanded marginally by 0.1% year-on-year. The Asset management segment experienced a 55.5% increase from the prior comparable period. Its Insurance Services segment displayed growth of 73.6%.

Total Loans increase

SBTT recorded a 9.3% increase in its Total Loan Portfolio from $18.7B in HY 2023 to $20.4B in HY2024, as continued recovery in economic activity supported loan demand. Loans to Customers (95.5% of Total Loans), the Bank’s largest interest earnings asset, saw an increase of $1.3B or 7.2%, while still maintaining high level of credit quality. Loans and advances to banks and related companies improved 81.5%.

Net Impairment losses on financial assets were recorded at $56.4M for the current period under review (1.3% decrease year over year), resulting in a decline in the ratio of Net Impairment Losses to Total Loans to 2.76% in HY2024 from 3.05% in HY2023.

The Bourse View

SBTT is currently priced at $66.00 and trades at a Trailing Price to Earnings ratio of 17.5 times, above the Banking Sector average of 12.0 times. The stock offers investors a healthy Trailing Dividend Yield of 4.3%, above the sector average of 4.2%. The Group declared a final dividend payment of $0.70 per share to be paid on July 15th, 2024, and to be registered by June 24th, 2024.

SBTT’s steady dividend payments remain an appealing value proposition for stock ownership, even as other banking sector stocks offer comparable and/or superior dividend yields. On the basis of improved performance and consistent dividend payments but tempered by elevated sector valuations, Bourse maintains a MARKETWEIGHT rating on SBTT.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third-party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”