FIRST HY 2021

- Earnings: Earnings Per Share declined 24.4% from $1.60 to $1.21

- Performance Drivers:

- Reduced Total Net Income

- Increased Impairment Expenses

- Muted Loan Growth

- Outlook:

- Growth Potential from Acquisitions

- Reinstated Lockdown Measures

- Economic Uncertainty

- Rating: Maintained at NEUTRAL

NCBFG HY 2021

- Earnings: Earnings Per Share declined 38.0% to $0.11 from $0.18

- Performance Drivers:

- Improved Financial Markets

- Lower Impairment Losses

- Higher Tax Expense

- Outlook:

- Stabilizing Financial Markets

- Majority Ownership of GHL

- Economic Uncertainty

- Rating: Maintained at NEUTRAL

This week, we at Bourse review the performance of First Citizens Bank Limited (FIRST) and the region’s second largest indigenous bank NCB Financial Group Limited (NCBFG) for the financial half year ended 31st March, 2021. FIRST’s earnings dipped on account of lower income and an increase in impairment expenses. Jamaica-headquartered NCBFG, meanwhile, reported an increase in Operating Income, offset by increased taxation. With both entities reporting a decline in performance, will these conditions persist? We discuss below.

First Citizens Bank Limited (FIRST)

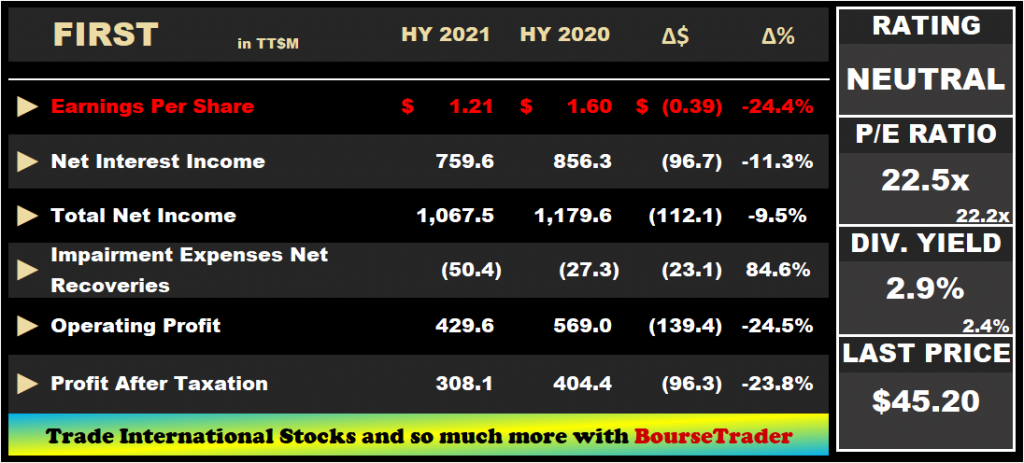

First Citizens Bank Limited (FIRST) reported Earnings Per Share (EPS) of $1.21 for the six-month period ended March 31st 2021, 24.4% lower than a prior EPS of $1.60. Net Interest Income contracted by 11.3%, from $856.3M to $759.6M, while Other Income declined 4.8% to $307.9M. Total Net Income fell 9.5% from $1.18B to $1.07B. Impairment Expenses Net Recoveries amounted to $50.4M, an 84.6% increase from a prior $27.3M. Expenses increased marginally by 0.7% to $587.5M. Operating Profit amounted to $429.6M, 24.5% lower year-on-year from a comparable $569.0M in HY 2020. FIRST recorded a 2.3% increase in Share of Profit in Associates and Joint Venture to $10.6M. Consequently, Profit After Tax stood at $308.1M, 23.8% lower than $404.4M.

Profits Decline

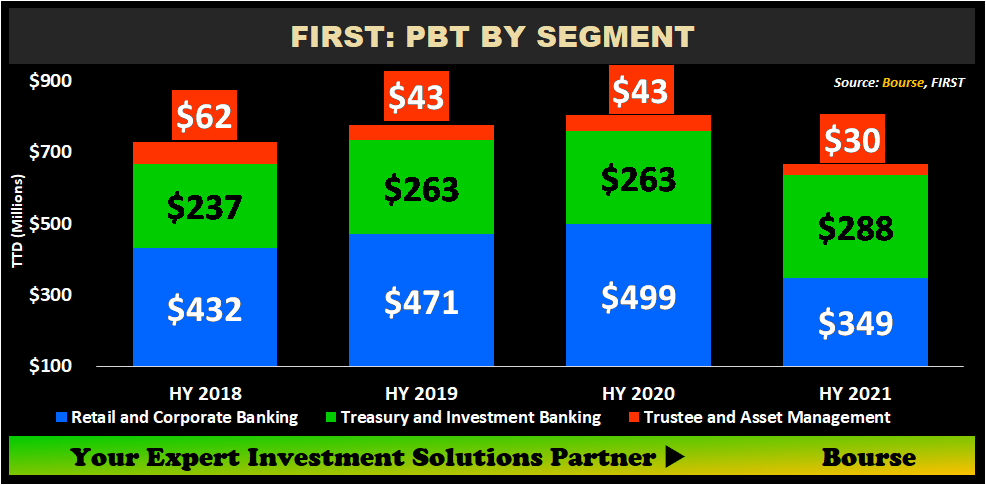

Profit Before Tax (PBT) contributed by FIRST’s Retail and Corporate Banking segment (HY 2021: 52.3% of PBT) contracted by 30.0% during the period. Underpinning this reduction was a 6.1% decline in Total Net Income in the Retail and Corporate Baking segment with a 3.9% reduction in Loans to customers, reflective of the sluggish economic environment. Treasury and Investment Banking, accounting for 43.2% of PBT, grew 9.7% YoY. PBT contributed by the Trustee and Asset Management segment (HY 2021: 4.5% of PBT) declined 30.2% YoY.

Credit Impairment Losses Increase

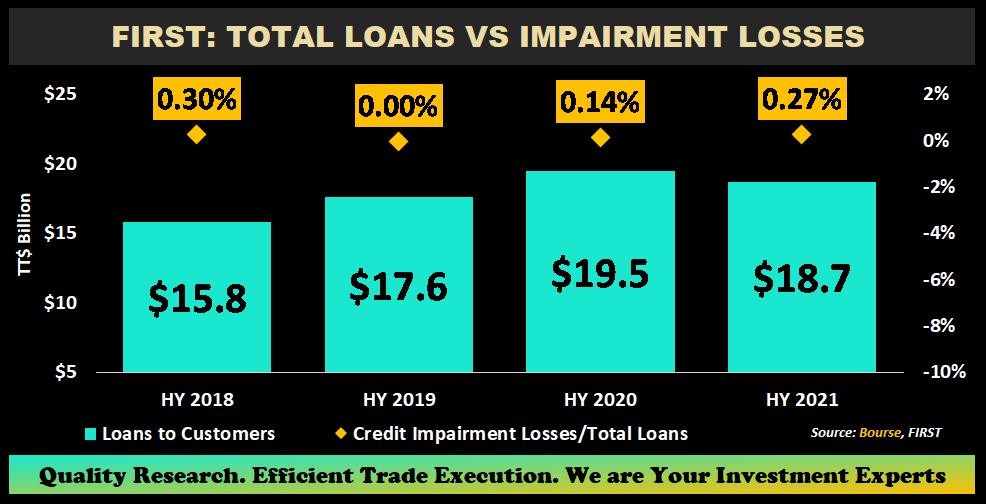

FIRST’s Total Loans fell 3.9% YoY from $19.5B to $18.7B, signaling reduced demand for loans in the context of an economic environment that has been impacted by COVID-19 led restrictions. FIRST recorded Credit Impairment Losses of $27.3M in HY 2020, or 0.14% the value of its Total Loan portfolio. Expected Credit Losses attributable to Loans and Advances grew 116% in HY 2021 relative to the prior comparable period. Credit Impairment Losses amounted to $50.4M, 0.27% the value of the Total Loan portfolio.

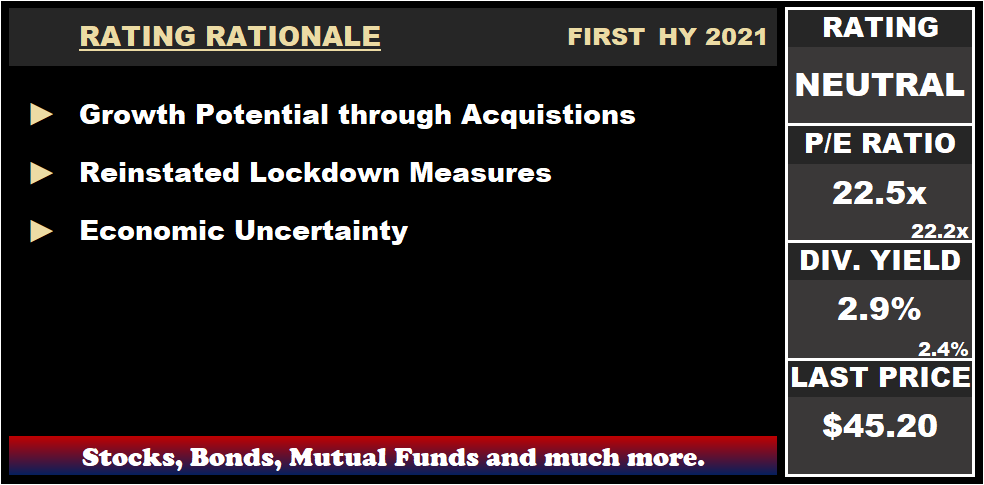

The reinstatement of lockdown measures across Trinidad and Tobago is likely to exacerbate economic pressures on the local economy. Reduced business activity could put further pressure on employment levels, contributing to lower disposable income and affecting general credit quality conditions for FIRST and other financial institutions. FIRST’s acquisition of Scotiabank’s Operations in Guyana, if successful, would enable the Group to benefit from Guyana’s energy-fueled economic growth while expanding its geographic footprint.

The Bourse View

FIRST is currently priced at $45.20 and trades at a P/E ratio of 22.5 times, marginally higher than the Banking Sector average of 22.2 times. The Group declared an interim dividend payment of $0.28 per share, payable on May 28th 2021, consistent with that paid in the comparable period last year. The stock offers a dividend yield of 2.9%, relatively higher than the sector average of 2.4%. On the basis of growth potential from the acquisition of Scotiabank Guyana’s operations but tempered by reinstated domestic lockdown measures and continued economic uncertainty, Bourse maintains a NEUTRAL rating on FIRST.

NCB Financial Group Limited (NCBFG)

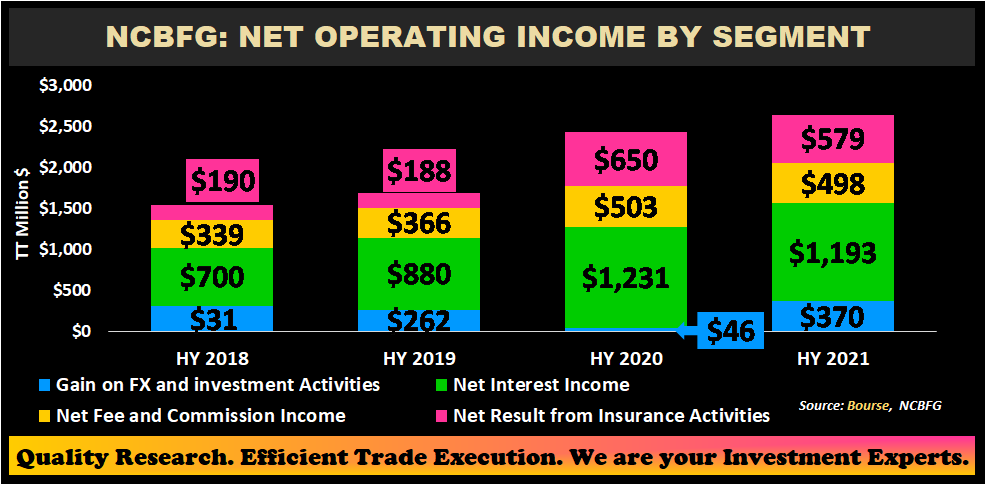

NCBFG reported Earnings Per Share of TT$0.11 for the half year ended March 31st, 2021, 38% less than TT$0.18 reported in the prior comparable period. The Group’s Net Interest Income fell 3.2% to TT$1.19B from a prior TT$1.23B. Net Fee and Commission Income decreased 1.0% to TT$497.6M relative to TT$502.8M in HY 2020. Gains on FX and Investment Activities jumped 8 times higher to TT$370.4M from TT$46.1M, propelled by a rebound in financial markets. Credit Impairment Losses fell from TT$141.5M in the prior period to TT$111.4M, 21.3% lower as the Group noted an improvement in economic conditions. Net Result from Banking and Investment Activities grew 16.5% moving from TT$1.76B in HY 2020 to TT$2.05B in HY 2021. Net Result from Insurance Activities fell 10.9% to TT$579.1M, attributable to a 7.2% increase in Insurance Benefits and Expenses to TT$1.62B as well as a 62.5% jump in Commission and Other Selling Expenses to TT$383.1M. Overall, Net Operating Income stood at TT$2.63B, 9.1% greater than the prior comparable period. Staff Costs rose 11.7%, while Other Operating Expenses increased 13.0%. Finance Costs reported a steeper rise from TT$7.42M in HY 2020 to TT$37.4M in the period under review. Consequently, Operating Expenses climbed 13.3% to $2.07B relative to a previous TT$1.83B. Operating Profit was TT$555.7M, 3.9% lower than TT$578.2M. Profit Before Tax was down 3.6% YoY to TT$557.9M as a TT$1.65M increase in Share of Profit of Associates, lent support. Taxation for the period swung to an expense of TT$151.3M from a prior credit or write back of TT$9.0M. Net Profit totalled TT$406.6M for a 30.8% decline, while Net Profit Attributable to Shareholders fell to TT$259.1M from TT$421.2M, 38.5% lower.

Investing Activity Propels Operating Income

Despite the performance in most of NCBFG’s Operating Income generating segments being marginally lower YoY, Total Net Operating Income for the period still rose 9.1%. Net Interest Income, the largest component of Net Operating Income accounting for 47.4% of the total, contracted 3.2% due to (i) flat Interest Income growth of 0.3% and (ii) an 8.4% increase in Interest Expense. Notably, the Group’s Loan Portfolio combined with its Investment Securities portfolio (including Pledged Assets and Reserve Repurchase Agreements) increased 12.8% or by TT$6.81B. On the other hand, it’s Customer Deposit Portfolio combined with its Repurchase Agreements and Obligations under Securitisation Agreements grew a cumulative 20.8% or $6.65B. In absolute terms the change in the Group’s interest earning portfolio marginally outweighed the growth in its portfolio of interest demanding liabilities. A noted decline in loan rates also weighed on the interest income spread earned by NCBFG.

Net Fees and Commissions Income, accounting for 19.8% of Total Operating Income, fell 1.0% YoY. The waiver of fees on NCBFG’s electronic channels as well as reduction in retail and corporate activities were attributable factors to decline in this segment. Net Results from Insurance Activities, which contributed approximately 23% of Total Operating Income, decreased 10.9% in the period.

Gain on Foreign Currency and Investment Activities was a crucial contributor to the increase in Total Operating Income and the only segment to record YoY growth. With financial markets rebounding in the last quarter of 2020 into the first quarter of calendar 2021, NCBFG was able to report a 704% increase in Gains on Investments. For the period, NCBFG’s Investment Securities portfolio grew a considerable 71% from TT$16.4B in HY 2020 to TT$28.1B in HY 2021. Another influential component of the improvement in NCBFG’s Total Net Operating Income relative to the prior period was a TT$30.1M decline in Credit Impairment Losses.

Outlook

According to its 2020 Annual Report, Jamaica remains NCBFG’s largest jurisdiction by Operating Income accounting for 39%. Trinidad and Tobago, through consolidation of Guardian Holdings Limited (GHL), became the second largest at 26%, with the Dutch Caribbean accounting for 17%, Bermuda at 5% and Other at 13%. With Covid-19 restrictions being re-imposed in Trinidad and Tobago following a recent surge in cases, activity in the jurisdiction may be slowed. However, ongoing vaccine rollouts and potential improvements in the domestic energy sector could improve prospects going forward. Jamaica, meanwhile, has administered 135,473 doses of Covid-19 vaccines thus far, relative to a population approximately 2.9 million. Although, the country continues to benefit from stable flow of remittances and tourism generated revenue, curfew measures which will remain in place until at least the 2nd of June, could hinder economic recovery. Additionally, the country is likely to maintain a tight leash on measures, with the Minister of Health and Wellness for the island warning citizens of the possibility of a third wave of the virus.

The Bourse View

NCBFG is currently priced of $8.00, having depreciated 1.6% year to date. The stock trades at a price to earnings ratio of 27.5 times relative to a Banking Sector average of 22.2 times. Having declared an interim dividend of TT$0.02 payable on 31st of May, the Group now has a trailing dividend yield of 0.3% compared to the sector average of 2.4%. Prior guidance provided by the Bank of Jamaica in 2020 restricted NCBFG to pay dividends only to shareholders with a 1% or less ownership stake. This guidance has now been eased, marking NCBFG’s first dividend payment since March, 2020. NCBFG, whose Investment Securities portfolio is 34% larger than its Loan portfolio, may benefit from improving financial markets as well as its majority ownership of established insurance provider, GHL. However, the reintroduction of Covid-19 measures may lead to an uneven recovery in the short run. On the basis of recovering financial markets but tempered by relatively high valuations and economic uncertainty, Bourse maintains a NEUTRAL on NCBFG.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”