FCGFH HY2023

- Earnings: Earnings Per Share increased 9.8% from $1.32 to $1.45

- Performance Drivers:

- Improved Net Interest Income

- Higher Operating Profit

- Impairment Expense Writeback

- Outlook:

- Increased economic activity

- Rating: Maintained at MARKETWEIGHT

UCL FY2022

- Earnings: Earnings Per Share declined 94.9% to $0.37 from $7.19

- Performance Drivers

- Higher Revenues

- Higher Operating Profit

- Outlook:

- Moderation of Supply Chain Disruptions

- Cooling inflationary pressures

- Rating: Assigned at MARKETWEIGHT

This week, we at Bourse review the performance of First Citizens Group Financial Holdings Limited (FCGFH) for its six months (HY2023) ended 31st March, 2023 and Unilever Caribbean Limited (UCL) for its financial year ended December 31st, 2022. FCGFH benefitted from increased operating income supported by a writeback of Credit Impairment Losses, while UCL’s profitability was affected by one-off restructuring expenses. Will FCGFH continue to grow earnings? Can UCL return to more stable performance, after making significant changes to its business? We discuss below.

First Citizens Group Financial Holdings Limited (FCGFH)

First Citizens Group Financial Holdings Limited (FCGFH) recorded Earnings per Share (EPS) of $1.45 for the six months ended 31st March 2023 (HY2023), up 9.8%, relative to $1.32 reported in the prior comparable period (HY2022).

Net Interest Income advanced 19.9%, moving from $723.7M in HY2022 to $867.4M in the current period. Other income fell 10.4%, amounting to $302.6M. Overall, Total Net Income was 10.2% higher, standing at $1.17B in HY2023, relative to $1.06B in the previous period. The Bank benefited from a small writeback in Impairment Expenses net Recoveries of $1.0M relative to a prior impairment expense of $6.3M. Expenses amounted to $671.2M, $74.8M or 12.6% higher year-on-year. Consequently, Operating Profit increased 8.9%, moving from $458.8M to $499.8M in HY2023. Share of Profit from Associates and Joint Ventures fell 1.4% to $10.3M in the period under review. Profit Before Taxation climbed 8.7% to $510.2M from a prior $469.3M. Taxation expense stood at $145.9M in HY2023, 8.8% higher than $134.1M in HY2022. Overall, Profit After Taxation advanced 8.7% from $335.2M in the prior period to $364.3M. According to the Group, the overall improvement in profitability is a positive demonstration of the Group’s drive towards pre-Covid performance.

Credit Impairment Writeback

FCGFH remained focused on achieving loan growth resulting in its Loans to Customers, increasing 8.0% year-on-year from $18.1B to $19.5B in HY2023. The Group recorded a reversal in its Credit Impairment Losses in the amount of $1.0M, signalling improving credit conditions and more resilient loan performance. Increased economic activity both locally and regionally could sustain the performance in the Group’s credit quality of its loan portfolio, which could be partially offset by lingering inflationary pressures and any adverse impacts on borrowers’ loan servicing capacity.

Major Segments Improve

FCGFH grew its Profit Before Tax (PBT) by 8.7% YoY. Retail & Corporate Banking continued to be the dominant contributor to PBT, accounting for 53.5% before eliminations. The segment increased 11.0% from $436M in HY2022 to $484M in HY2023, supported by loan growth. Treasury & Investment Banking, the second largest contributor to PBT (43.8% before eliminations) advanced 40.6% YoY. Trustee & Asset Management (2.7% of PBT before eliminations) fell 10.0%.

The Bourse View

FCGFH is currently priced at $50.00 trades at a P/E ratio of 16.5 times, higher than the Banking Sector average of 13.6 times. Historically, FCGFH would have traded at a ‘pre-COVID’ earnings multiple of around 12.6 times (during 2017-2019).

The Group declared an interim dividend payment of $0.38 per share, to be paid on 31st May 2023.The stock offers a dividend yield of 3.3%, relatively in line with the sector average of 3.0%. FCGFH’s policy of paying consistent quarterly dividends should prove attractive to income-oriented investors, though comparably rewarding fixed income opportunities currently exist within the domestic financial landscape. The dividend yield could, however, be an added incentive for investors focused on FCGFH primarily as a stock with the potential to deliver measured medium-term growth. On the basis of improving performance, elevated valuations, Bourse maintains a MARKETWEIGHT rating on FCGFH.

Unilever Caribbean Limited (UCL)

Unilever Caribbean Limited (UCL) reported Earnings Per Share (EPS) of $0.37 for the financial year ended December 31st,2022(FY2022), a 94.9% decrease from $7.19 reported in the prior comparable period. EPS from Continuing Operations declined 43.1% from $0.65 to $0.37 while EPS from Discontinued Operations stood at $0.00.

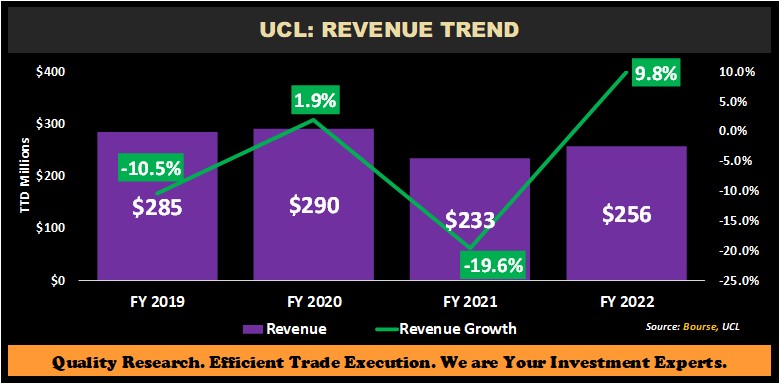

Revenue from Continuing Operations advanced 9.8% to $256.1M from $233.2M in the prior period. Cost of Sales came in at $150.9M, $23.7M (18.6%) higher than $127.2M reported in FY 2021. Gross Profit marginally contracted 0.7% to stand at $105.2M. Selling and Distribution Costs and Administrative Expenses both fell 3.8% and 7.7% respectively. Resultantly, Operating Profit advanced 24.3% from $25.4M in FY2021 to $28.8M in FY2022.

Restructuring Costs expanded 448.7% over the period from $5.6M to $30.6M, resulting in operating Loss after restructuring costs of $1.8M. Finance income gained $0.1M as opposed to finance expense in FY2021 of $0.6M, while Other Income increased 30.3% to $7.0M (FY2021: $5.4M). Profit Before Taxation stood at $5.4M, a 78.2% decrease from a prior $24.6M. A taxation credit was observed in FY2022 of $4.4M, from a taxation expense of $7.7M in the prior comparable period. Overall, Profit for the Period from Continuing Operations stood at $9.8M, 42.3% lower than $16.9M reported in the prior period.

Revenue Higher

One positive indicator was UCL’s revenue generation, expanding 9.8% to $256M in FY2022. According to UCL, The Home Care Category led revenue growth in FY2022 with a 19.8% ($21.2M) increase, contributing 65.1% of total revenue. The company’s Beauty and Personal Care Segment by revenue fell 1.5% in FY2022. The Foods & Refreshments business segment grew 14.8% YoY and was strengthened by the launch of two new products in pre-existing brands: Ramen Noodles in Knorr and Ketchup for Hellmann’s.

Margins Lower

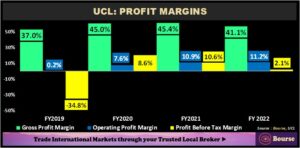

UCL experienced a dip in its margins for FY2022 due to higher cost of sales, larger expense costs and a significant increase in restructuring costs from the retrenchment exercise enacted on the expiration of its major manufacturing supply agreement. With major changes and one-off costs obfuscating overall performance in prior periods, investors would be focusing on Gross Profit and Operating Profit Margins as indicators under ‘normalized’ conditions. Gross Profit Margin decreased from 45.4% in FY2021 to 41.1% in FY2022, with higher input costs in a high-inflation environment likely compressing margins. Operating Profit Margin, however, moved from 10.9% to 11.2%, benefitting from lower Selling & Distribution Costs and Administrative Expenses. Profit Before Tax Margin saw a considerable decrease from 10.6% in FY 2021 to 2.1% in FY 2022, with restructuring costs taking a heavy toll on overall profitability.

The Bourse View

At a current price of $15.75, UCL trades at a trailing P/E of 42.6 times, above the Manufacturing Sector average of average of 27.7 times. On March 29th, 2023, the Board of Directors declared a final dividend of $2.80 to be paid to shareholders on June 26th, 2023. This exceptionally large dividend resulted from the Group’s sale of assets, which were one-off in nature. The stock offers investors a trailing dividend yield of 17.8%, above the sector average of 5.4%.

Despite higher revenues during the period, profitability for the period was down due to one- off restructuring costs due to major changes to UCL’s business model. Looking forward, UCL should now have a better platform on which to generate improved (and possible more predictable) performance. The streamlining of its operations should put the Company in a better position to focus on distribution of its fast-moving consumer goods (FMCG) and improve operating efficiency and overall performance. These positive drivers could be offset in the near-term by high input costs in the current inflationary environment. UCL’s Q12023 results could be pivotal in forming investor expectations and influencing sentiment around the stock. On the basis of attractive dividends, but tempered by elevated valuations, Bourse assigns a MARKETWEIGHT rating on UCL.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”